Stock Market Outlook entering the Week of December 15th = Uptrend

- ADX Directional Indicators: Uptrend

- On Balance Volume Indicator: Uptrend

- Institutional Activity (Price & Volume): Uptrend

ANALYSIS

The stock market outlook remains in an uptrend, even though the “Santa Claus rally” too a bit a of a breather last week.

The S&P500 ( $SPX ) fell 0.6%. The index sits ~2.5% above the 50-day moving average and ~10% above the 200-day moving average.

SPX Price & Volume Chart for Dec 15 2024

The ADX ( Average Directional Index ), Institutional Activity and OBV ( On-Balance Volume ) are all in bullish territory.

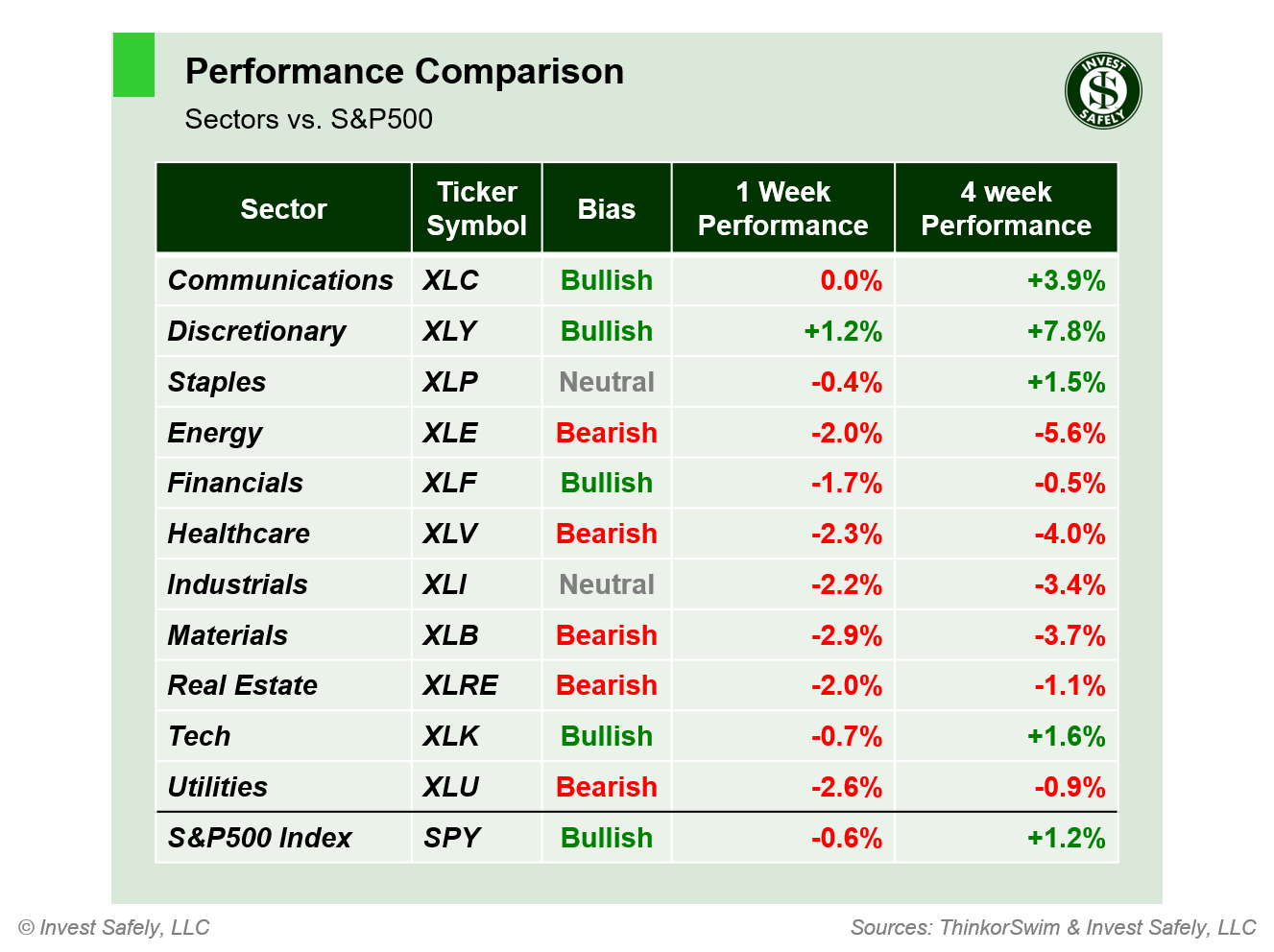

S&P Sector Performance for Week 50 of 2024

Another tough week for the sectors, despite relative strength in the overall index. Consumer Discretionary ( $XLY ) led to the upside for the third week, while Materials ( $XLB ) led to the downside. Consumer Staples and Industrials are at a Neutral trend, Healthcare ( $XLV ), Materials ( $XLB ), Real Estate ($XLRE ) , and Utilities ( $XLU ) are back to bearish trends.

Sector Style Performance for Week 50 of 2024

Large Cap Growth ( $IWF ) was again the best performing sector style…the only positive return last week. Small Cap Growth ( $IWO ) was the worst. Low Beta ( $SPLV ), High Dividend ( $SPHD ) and Large Cap Value ( $IWX ) dropped into bearish trends.

Asset Class Performance for Week 50 2024

Oil ( $USO ) put in a big rally last week and led assets higher. Bonds ( $IEF ) were the worst performer again thanks to rates rising into the CPI/PPI prints. Bonds also dropped back to bearish trend.

COMMENTARY

Last week was a good example of macroeconomic trends (higher interest rates and commodity prices) filtering through to equity sectors (materials, real estate and utilities down). Energy is lagging, since it’s usually correlated with movements in oil-based commodities, but hasn’t regained a bullish bias.

November inflation data was higher than expected for the second month in a row; still not enough to take the next rate cut off the table. The consumer price index (CPI) rose again in November, while Core CPI was unchanged.

| CPI (y/y) | Actual | Prior |

Expected |

| Headline | +2.7% | +2.6% | +2.7% |

| Core | +3.3% | +3.3% | +3.3% |

Producer prices (PPI) rose in November, and that’s on top of a 20 basis point increase to Octobers data. Core PPI was flat, but only because October’s reading was revised 30 basis points higher (up from 2.6%).

| PPI (y/y) | Actual | Prior |

Expected |

| Headline | +3.0% | +2.6% | +2.6% |

| Core | +3.4% | +3.4%* | +3.2% |

This week we get retail sales on Tuesday, the FOMC interest rate decision on Wednesday, the final Q3 GDP figure on Thursday, and November PCE on Friday.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.