This article may contain affiliate links, meaning we may receive a commission if you make a purchase through one of our links, at no cost to you. The Ambitious Dollar is reader-supported and only recommends products and services that we believe in. Read our full disclaimer here.

Short on time? Here’s what you need to know:

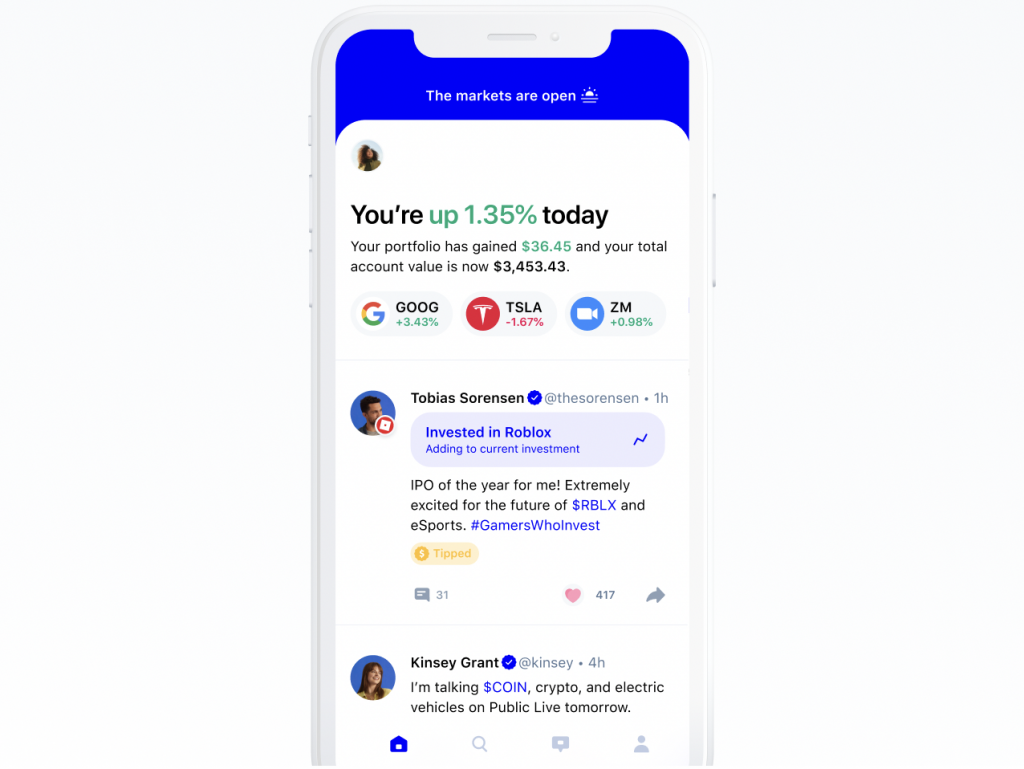

Public is a free trading platform which makes it easy for newbies and passive investors to increase their confidence in investing, purchase fractional shares, and invest with even very small amounts of money. Public is limited in what it can offer in terms of complex investment opportunities, and only offers taxable account options (i.e. no retirement accounts), but it is difficult to find any real faults in the simple and easy-to-use options it does provide.

What is Public?

Public, formerly known as Matador, is one of the newest apps on the scene offering commission free investing for over 5000 different stocks and ETFs. Their motto is Everyone’s an

Investor. The company was founded in 2017 and is a wholly-owned subsidiary of a broker-dealer called T3 Securities Inc.

What makes Public unique? Public incorporates social media into its platform to make yours and every other users’ portfolio publicly visible, hence the name.

How does Public work?

1. Download the app

Public makes it very simple to get started. The first thing to do is simply download the app (for either iOS or Android) and input your phone number.

Keep in mind that there are a few requirements for investors to meet in order to trade on the Public app:

- Be 18 years of age

- Have a valid Social Security Number

- Have a legal U.S. residential address

- Be a U.S. citizen, U.S. permanent resident or have a valid visa

Fun fact #1:

Most brokerages require investors to be at least 18 years of age to open an account. Why? Because in most states, individuals must be 18 years old to legally enter into a contract. There are a few states which have higher age requirements for investing. At the time of this writing, Alabama and Nebraska require investors to be 19 years of age; and Mississippi requires investors to be at least 21 years old.

Fun fact #2:

Public allows those under the age of 18 to download and use an inactive version of the app. This is a great way to allow for early exposure and education in the investment world.

2. Finalize your application

At this stage, Public will ask you a series of questions in order to finalize your application. You’ll be required to provide information including your age, social security number, bank account, address, etc.

The application approval process with Public is usually pretty quick. However, since this step requires individual review, it can take up to 10 business days.

3. Link a funding source to your account

Your next step is to fund your Public account. Here you have some flexibility in linking either a bank account or a debit card. Once your deposited funds have settled, you’re ready to roll.

4. Build your portfolio

Once your account has been created and approved, and you’ve funded your account, you’re ready to start investing!

Public currently hosts over 5000 stocks and ETFs. You’ll notice these listed in 40+ themes on the app. These themes are set up to help you find stocks of interest in particular categories. Just to name a few, some of their themes are:

- Public Top 20 – the most popular investments in the Public community, updated monthly

- Crypto Revolution – companies and funds that support the cryptocurrency movement*

- The SPACK Pack – companies that exist to take other companies public

- American Made – taking “Buy American” to a whole new level

- Dividend Stocks – cash-rich companies that pay out regular dividends to investors

- Reuse & Reduce – companies converting waste materials into new materials and objects

Public investment app features

| Trading Fees | $0 (trade commission-free) |

| Other Fees* (there are no trade fees for buying and selling securities) | Broker-manned phone trades – $30 Domestic wire transfer – $30 Domestic overnight checks – $35 Returned checks or stop payments – $30 ACAT outgoing – $75 Paper statements – $35 |

| Account Minimum | $0 |

| Investment Options | Stocks, ETFs & closed-end funds |

| Accounts Supported | Taxable Accounts (no retirement accounts) |

| Automatic Dividend Reinvestment (DRIP) | Yes |

| Crypto | *No – however Public has mentioned that it’s something they’re working on as of August 2021 |

| Marijuana Investing | Yes |

| Environmentally & Socially Conscious Investing | Yes |

| Fractional Shares | Yes |

| Customer Service | Live In-App Chat M-F 9am-5pm EST: Email: hello@public.com |

Is Public a good investment app?

If you’re trying to determine if Public is a worthwhile investment app, here’s a list of important pros and cons to consider:

Pros

No minimum deposit

While this isn’t unique to just Public, it is incredibly helpful to new and small-budget investors by reducing barriers to the investment scene.

Commission free investing

Public certainly isn’t the only brokerage offering commission-free trading. But, they are unique in the fact that they don’t charge a subscription fee nor do they take Payment for Order Flow (more on that below).

Fractional shares

More and more brokerages are offering investors the ability to purchase fractional shares – that way you can invest in companies even when you might not be able to afford an entire share.

In-app chat

A great customer service avenue at your fingertips.

Investor forum

- One of the most unique aspects of Public, and what prompted their name, is the investor forum. This is the social aspect of the investment platform where investors can:

- View the portfolios of other Public investors

- Ask questions and comment about all things investment-related

- Support one another in a curated investment community

Educational content

Public provides lots of educational content on their blog and in their FAQ section all with the aim of breaking down complicated financial lingo, increasing investor confidence, and giving investors the tools they need to reach their goals.

Cons

Limited account types

By far, the largest drawback to Public is the limited account types they support. They do not offer investors the ability to invest in retirement accounts. For new investors – this is key in order to help prepare for your financial future.

No phone-based customer service

While Public offers in-app chat, a thorough FAQ page, and email customer service, they do not list a phone number. This can be a drawback to new investors who may find it helpful to talk through more complicated questions and topics. But, to be fair, there are always concessions to be made when utilizing a commission-free brokerage platform. Many other commission-free trading platforms don’t offer phone-based customer service either.

The investor forum

While this isn’t a true pitfall, it should be acknowledged that the social element of Public may not be a positive for all investors. It is meant to foster a community for veteran and newbie investors alike, helping them to feel they’re not alone. But for some people, it’s possible that it could lead to a degree of ‘peer pressure’ which could ultimately alter your investment decisions.

All advice and commentary, whether professional or amateur, should be taken with a grain of salt. Only you can decide how to handle important and individual investment decisions like risk tolerance, portfolio weighting, etc.

Can you day trade on Public?

Given that Public has been primarily geared towards novice and beginner investors, day trading is not possible on the platform. This is one of the ways in which Public tries to help reduce risk for these types of investors. They prohibit day trading by limiting the activities of accounts that attempt to buy and sell securities within the same day (i.e. day trade).

Who is Public best suited for?

Taking into account all of this information, Public is ideally suited for beginner investors who are looking to invest in taxable (non-retirement) accounts in a supportive, educational environment. They aren’t at a stage where they want to make any complex investment choices nor do they want personalized, professional advice.

How does Public make money?

So, if Public offers commission-free investing, how does it make money? A unique feature of Public is that they do not use Payment for Order Flow. What is Payment for Order Flow? It’s a somewhat under the radar and controversial practice utilized by many commission-free brokerage firms. In a nutshell, it’s the process of selling investors’ trades to a middleman in instances where a small profit could be made by rerouting the trade.

As an investor, this process would likely be completely invisible to you. The cost to the investor could also be miniscule, but it is important to note that what’s advertised as ‘free’ may not actually be completely free.

Instead, Public has opted for a business model which incorporates 3 avenues for profit. First, Public lends money to short sellers. Secondly, they make interest on uninvested cash balances. And finally, Public allows investors to tip when they make a trade. It’s also been mentioned that Public may introduce paid-for premium features in the future as a subscription service.

Is Public safe?

Public takes you and your money’s safety and security seriously. They are registered with FINRA and SIPC. FINRA ensure that brokerages like Public are responsible and act with integrity and transparency. SIPC, on the other hand, protects investors’ losses of up to $500K in securities and up to $250K in cash. Additionally, Public also uses AES 128-bit encryption and TLS 1.2 secure data in transit.

Is Public really free?

Yes, Public is really free. They offer commission-free trading. There are a very short list of fees they do charge (see above) for things like paper statements and wire transfers.

Can you get free stocks with Public?

At the time of this writing, Public is offering one free randomly chosen stock worth up to $20 per person. In order to qualify, you must have an open and active account. However, in Public’s own words, there is a limited supply of said free stock, though they haven’t disclosed just how limited. They are also currently offering referral rewards for inviting your friends and associates to the platform.

Are there good alternatives to consider instead of Public?

There are a few good alternatives to consider that offer commission-free trading, low minimum balances, fractional shares, and low or zero fees.

M1 Finance

M1 Finance is a fantastic alternative to Public. While it is a great platform for beginners, it also serves the needs of more advanced investors who want self-directed trading. Investors will find slightly less informative content on M1 Finance, and it may take a bit of time to get used to the pie and slice methodology, but it’s a user-friendly platform worth exploring for beginners and non-beginners alike. You can read the full write up of why M1 Finance is a great platform for beginner investors here.

Pros of M1 Finance

- Free to set up an account

- Zero commissions and trading fees

- Low minimum balance

- Fractional shares

- Robo-advising that allows customization

- User-friendly interface

- Supports a much larger variety of account types including

- Brokerage accounts (individual and joint)

- Retirement accounts: Traditional, Roth, SEP, IRAs

- Trusts

Cons of M1 Finance

- Need to be comfortable with self-directed trading

- Does not offer custodial or 529 accounts

- Does not currently support crypto

- Invest with M1 Finance

Acorns

Acorns offers many of the same benefits, features, and fees that Public does (minus the social aspect). Additionally, while Acorns typically has a subscription fee, they offer a great benefit to college students wherein you get 4 free years of investing when you sign up with a .edu email address. You can read the full review of Acorns here.

Pros of Acorns

- No minimum investment

- Informative content

- Easy, hands-off way to invest

- User friendly app & website

- Free account management for college students

- Those with .edu email address will get 4 years of Acorns for free

Cons of Acorns

- Flat fee structure is detrimental to small portfolios

- Users need to actively invest beyond just savings round ups

- No self-directed trading

- The 5 portfolio’s available are limiting

The bottom line

Public is a reputable brokerage firm offering simple investment options for new investors. They offer this alongside free educational content, a supportive investor forum, and charge zero commission fees. Since they don’t support any retirement accounts, it likely won’t be the only platform an investor will need. However that shouldn’t stop investors from exploring and growing their expertise in all that Public has to offer.

Like what you read? Subscribe to our email list below!