All year, you and I have tracked takeover offers…mergers…capital raisings…alliances…contracts. They just keep coming. This is exactly what you and I want to see from corporate Australia. This is how value gets created.

Just last week we were chatting about oil and gas play Carnarvon Energy ($CVN).

We tabled the idea it might get a takeover offer.

Stone the crows today…

It’s the reverse!

CVN is announcing that it’s now the major shareholder in Strike Energy ($STX) after buying a 19.9% stake.

Strike is a gas company based out of WA.

Again, we find more wheeling and dealing when it comes to the ASX, especially in the small cap sector.

All year, you and I have tracked takeover offers…mergers…capital raisings…alliances…contracts.

They just keep coming.

This is exactly what you and I want to see from corporate Australia. This is how value gets created.

Strike has a portfolio of gas assets.

It’s angling to become a “vertically integrated” gas company where it supplies gas to its own power station.

What it needs is more cash, which CVN can help supply.

This is a whole lot like the move Mt Gibson Iron ($MGX) just pulled too. We chatted about that last week as well.

You can see that a lot of risk money is coming out of its hidey-hole. It’s been hiding since 2022.

In 2025 gold explorers are raising cash. Commodity firms are diversifying into other resources and projects.

They are only doing this because they see opportunity.

In the case of gas projects, the next ten years could be a humdinger.

I’ve been writing on the ASX for a long time.

Let me tell you something…

Warnings about Australia’s gas shortfall have been going out since 2015.

Let me repeat that…

For ten years gas users and gas producers have fretted and floated the looming shortfall.

What was done about it?

Nothing – at least, as far as I can tell.

Back in 2015, 2026 seemed so far away. It was no concern to voters at the time.

Fossil fuels are a dirty business anyway, or so went the thinking. The electorate wanted change on climate policies – not more gas investment.

We might find those convictions tested in the next five to ten years.

Advertisement:

REVEALED:

Australia’s 60-Cent

‘Secret Weapon’

It’s a tiny ASX stock that could hand the United States, NATO, and its allies a key advantage in case another major conflict breaks out.

That could make this stock very valuable and potentially profitable for investors over the coming months.

Get the full story here.

It’s one thing to take a stand when your energy bill is modest and based off investment made years, even decades ago.

What about when demand rockets…blackouts become a risk…and supply isn’t there to meet it?

I’m not saying this is going to happen, only tabling a potential scenario.

However, it does make Carnarvon’s buy in on Strike look shrewd.

They’re putting their cash into a “hard” commodity with high future use value.

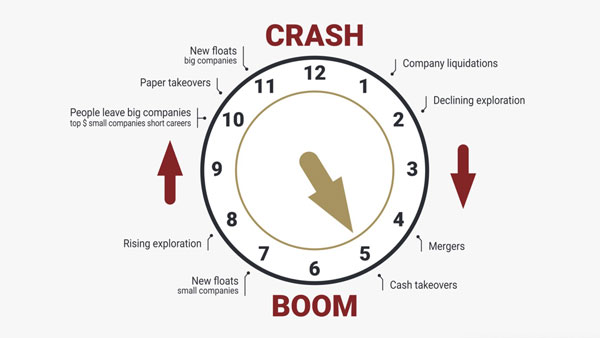

This is all perfectly in accord with the Lion Investment Clock too. I’ve shared this many times.

Here it is again…

|

|

|

Source: Lion Selection Group |

This tracks the typical mining cycle. You can see we’re moving into the ‘boom phase’.

Now is the time to be scooping up promising projects while they’re still trading at multiyear lows.

It looks like we’re seeing that in the lithium sector right now, as Murray and I chatted about last Friday on the Closing Bell.

My one bit of advice on this is not to get too cute with the timing.

Decide if you want to own some of these names or sectors (gas, lithium, gold). Take a position – then hang on for dear life.

Commodity stocks swing around like a 1950’s sock hop.

Everything I see says it will be a wild ride…but potentially a very profitable one.

We’ve seen it in gold already. Now lithium and gas look to be rumbling too.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

PS. Your best bet is to tune in to my colleague James Cooper over at Diggers and Drillers. He does all the work for you.

|

|

|

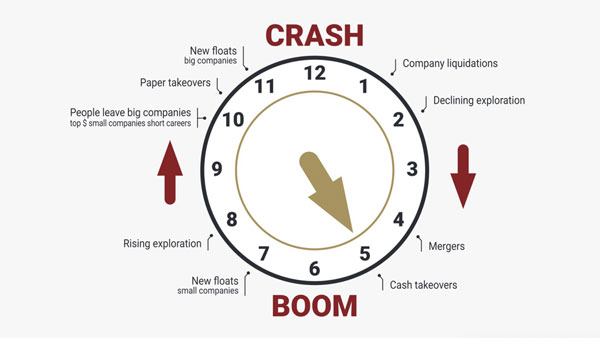

Source: Tradingview |

Gold has spent three months treading water after the immense rally from January to April.

The correction that occurred in the last few months has been very shallow considering the size of the rally.

That can be a sign of strength.

The highest price traded in April, May, and June has been between US$3,450-$3,500.

Another attempt at that level could see a breakout and there is blue sky above there.

The monthly chart is looking strong as an ox with no signs of weakness with key bars marching steadily higher.

Until we see the gold price below the 10-month moving average, which is well below current levels, traders should cheer the rally on and not assume they can pick when it has run out of puff.

Another impulsive rally could be on the cards if resistance at US$3,450-3,500 gives way.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Advertisement:

WATCH NOW: Australia’s ‘abandoned gold’

A revolution is taking place in Australia’s mining sector.

A new type of miner is bringing old gold and critical minerals back to life…and already sending some stocks soaring.

Our in-house mining expert — a former industry geologist — has tapped his industry contacts to uncover four of these stocks that could be next…

Click here to watch now.

All advice is general advice and has not taken into account your personal circumstances.

Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.