Once a niche hobby stereotyped as the domain of young people in headphones, gaming has grown into a near-US$300 billion1 industry – and with it, creating a slew of investment ideas with long-term potential.

Companies like Nintendo, Sega and Take Two have been joined by newer players like Roblox, Tencent and Applovin in a highly competitive sector that now boasts 2.7 billion players in every corner of the world2.

Specific games like League of Legends (owned by Riot Games, a subsidiary of Tencent) and Overwatch (developed by Blizzard Entertainment, now owned by Microsoft) now have tournaments with million-dollar prizes which draw huge crowds.

So how did video game companies and the wider eSports thematic grow so quickly – and is there scope for its growth to continue?

Adoption and monetisation take flight

As the above statistics demonstrate, gaming is far from the niche that it once used to be. During the COVID-19 pandemic, the global games market was larger than industries such as movies and North American sports combined3.

More than that, gaming has become a foundational pillar of the digital economy with games evolving to represent social platforms, fitness, educational and productivity tools, creator-driven economies as well as sources of high-quality advertising and data collection.

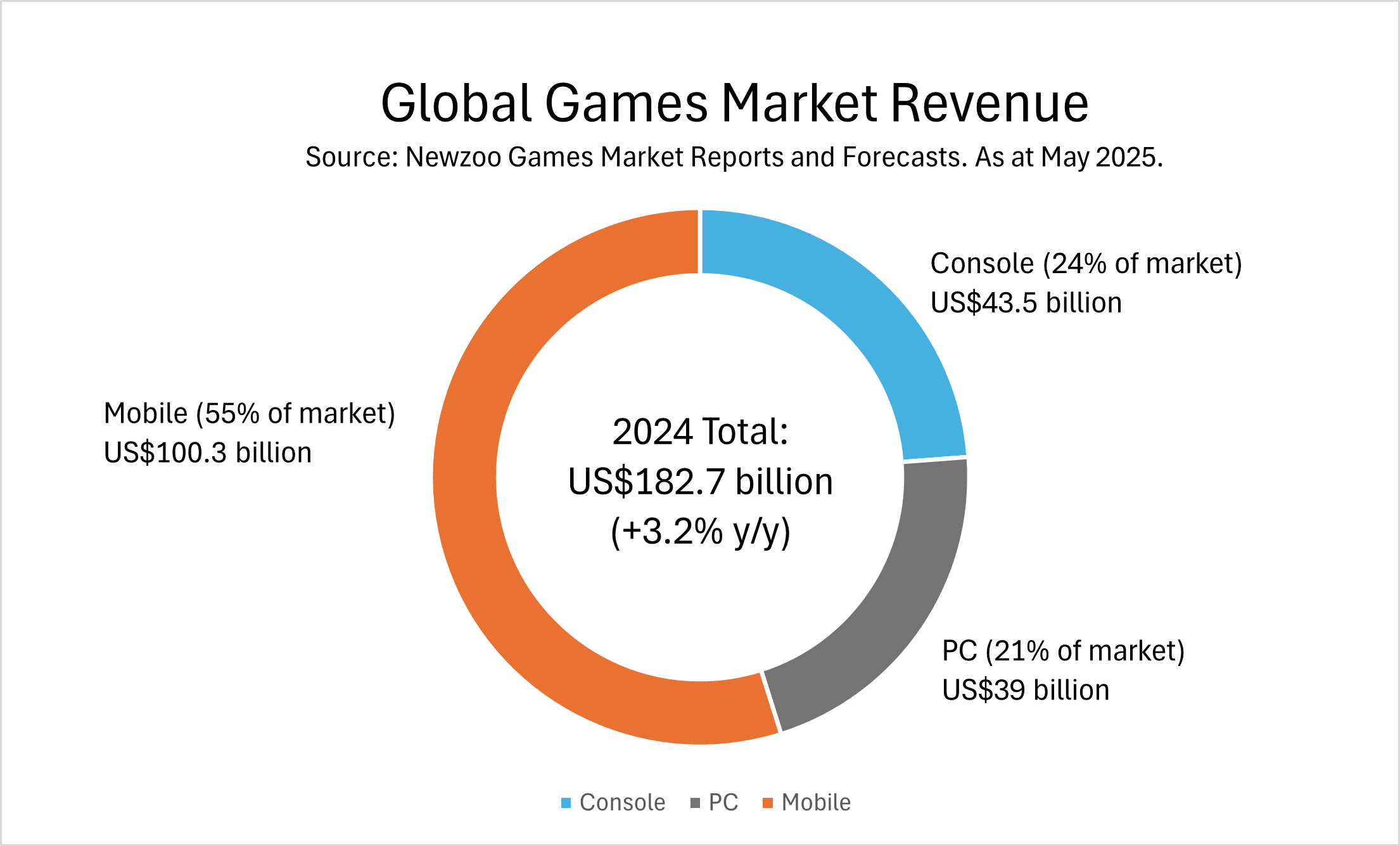

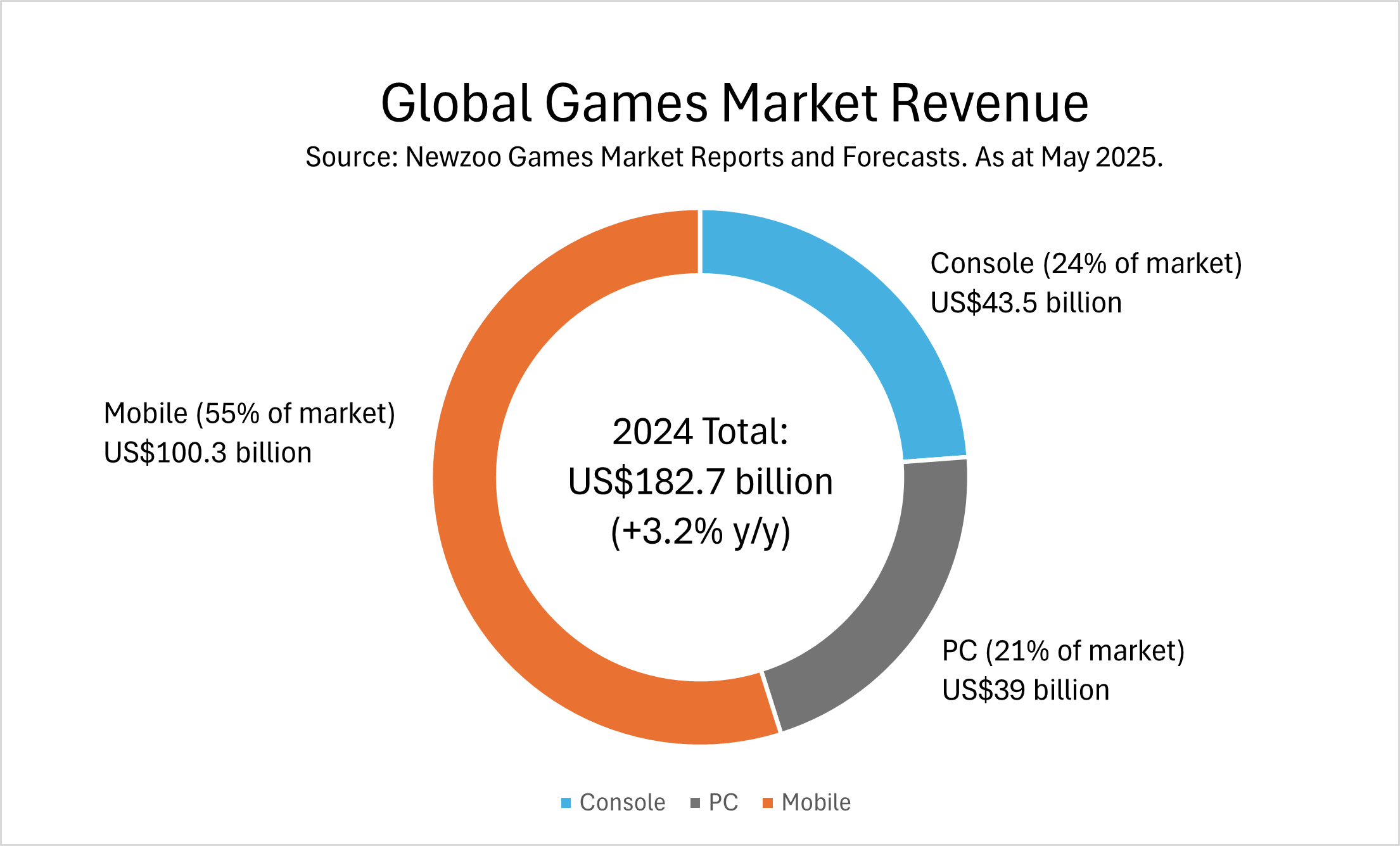

Last year, the global games market brought in revenues of US$182.7 billion – more than half of that coming from mobile games. By 2027, this figure could top US$200 billion4.

Source: Newzoo Games Market Reports and Forecasts. As at May 2025. Provided for illustrative purposes only.

The games market has continued to grow as adoption continues to soar and monetisation, particularly through in-game purchases and targeted advertising, continues to pick up.

How the digital world brings gamers together

The next stage for gaming will likely involve the continued rise of digital distribution as well as the fall in physical distribution. While both of these avenues generate huge margins for their owners, digital-native games can generate anywhere between 70-85% gross margins and even create whole new mini-economies within games.

eSports events are another symbol of the industry’s massive growth. July 2025 sees the second eSports World Cup taking place in Riyadh, with the event involving 2000 players from 200 clubs and 100 countries competing for a US$70 million prize pot5.

These events have the potential to generate significant revenues and margins for their owners – further emphasising the investment potential available in this field.

Could the video game industry be recession-resilient?

Digitisation has also brought about an interesting side effect – video game industry revenues can remain resilient even in the event of a recession6.

Many games are now free-to-play or available through an app store at a low cost. Additionally, gaming subscription services may see increased adoption during recessions given they offer access to a library of games for a fixed fee.

This provides high value for money compared to other leisure activities. In times of recession, this combination of accessibility, low entry cost and high engagement makes gaming a counter-cyclical investment theme – resilient in the bad times and strong in the good times7.

The hard data backs this up. During the 2008 Global Financial Crisis, video game sales increased by 19% year-over-year8.

In that same year, Activision and Vivendi Games merged to form the then-third largest video game publisher in the world, Activision Blizzard. The merger made the combined company more financially stable. In just over a decade, Activision Blizzard doubled annual revenues9 and created a business model that was so successful that it was eventually bought by Microsoft for US$68.7 billion in 202210.

Locally, and in more recent times, the Australian digital games industry actually recorded a 22% revenue increase on 2020 levels11. During 2021–22, digital game development businesses produced 299 digital games, a 68% increase from 178 games in 2015–1612. Since then, a federal Digital Games Tax Offset and state-based programs of a similar nature have been introduced in Australia to support the costs of creating video games13.

Who’s in the game?

Three of the biggest names in the space are Nintendo, Roblox and Applovin.

Nintendo (TYO: 7974) needs no introduction to many of you. In case you do need one, the Japanese video game giant is famed for its gaming consoles (Nintendo 64, GameCube, Wii and the DS to name a few) as well as its games – the most famous of which is the Super Mario series. Since it was created in September 1985, the Super Mario series has seen 24 games hit the market14.

But its newest innovation might be its biggest success to date. The Nintendo Switch 2, which was released in June 2025, sold 3.5 million units in four days15. It’s now Nintendo’s fastest-selling console ever and when it’s reflected in its next financial results, may cause quite the stir for investors.

Roblox (NYSE: RBLX) is an American video game developer where the games are created by the players themselves (as opposed to a single developer or company). Roblox’s platform also has a heavy social element and hosts its own virtual economy called Robux.

In 2024, daily active users (DAUs) on the platform increased by 21% to nearly 83 million. Hours engaged increased by 23% in the same time period. This growth continued into the first quarter of 2025, with DAUs climbing 26% to 98 million and revenue increasing by 29% to US$1.03 billion16.

Finally, Applovin (NASDAQ: APP) is an ad platform which allows game publishers to optimise ads and in game content. The introduction of AppLovin’s AI-driven ad engine, Axon 2, has been pivotal. This platform has enhanced ad targeting efficiency, leading to a 71% surge in year-over-year advertising revenue. In its Q1 2025 earnings report, net income surged 144% year-over-year17.

Is it time to get in the game?

These companies were also three of the largest contributors to the total return performance of

GAME

Video Games and Esports ETF

. GAME was the top-performing Betashares ETF of the last 12 months (to 30 June 2025), and since its inception on 7 February 2022, GAME has recorded a total return of 14.85% per annum (remembering that past performance is not a reliable indicator of future performance).

Most importantly, each of these examples highlight the incredible growth and influence the gaming industry is having in shaping today’s digital economy. You can access ASX: GAME through Betashares Direct.

Sources:

1. https://www.grandviewresearch.com/industry-analysis/video-game-market ↑

2. https://www.statista.com/topics/1680/gaming/ and https://www.statista.com/forecasts/748044/number-video-gamers-world. As at June 2025. ↑

3. https://www.marketwatch.com/story/videogames-are-a-bigger-industry-than-sports-and-movies-combined-thanks-to-the-pandemic-11608654990 ↑

4. https://newzoo.com/resources/blog/global-games-market-update-q2-2025 ↑

5. https://www.euronews.com/2025/07/13/grand-prizes-big-names-2nd-esports-world-cup-starts-in-riyadh ↑

6. Mauree, Y. (2022) “Is the Video Games Industry Recession Proof?” ↑

7. https://www.konvoy.vc/newsletters/gaming-is-it-recession-proof ↑

8. https://whye.org/how-does-the-gaming-industry-react-to-economic-recessions and https://www.gamedeveloper.com/business/npd-behind-the-numbers-december-2008 ↑

9. https://investor.activision.com/static-files/d7b4f08d-213b-4bd5-a41b-7497baa9c106 (2021 figures) and https://www.activision.com/cdn/activisionblizzard/investors/annual-reports/Activision_Blizzard_2010_ARS_Final_PDF.pdf (2011 figures) ↑

10. https://www.wsj.com/tech/microsoft-to-buy-activision-blizzard-games-11642512435 ↑

11. https://www.dfat.gov.au/about-us/publications/trade-investment/business-envoy/business-envoy-february-2022/booming-australian-digital-games-industry ↑

12. https://www.abs.gov.au/statistics/industry/technology-and-innovation/film-television-and-digital-games-australia/latest-release ↑

13. https://www.rsm.global/australia/insights/tax-insights/digital-games-tax-offset-australian-gaming-industry ↑

14. https://www.forbes.com/sites/technology/article/mario-games-in-order/ ↑

15. https://www.nintendo.com/au/news-and-articles/nintendo-switch-2-sets-record-selling-over-3-5-million-units-globally-in-first-four-days/?srsltid=AfmBOop3nWB_ff8Cv3rGSC71zR-elARDc_vN6UABAzW3g1dxsPmugrrK ↑

16. https://ir.roblox.com/news/news-details/2025/Roblox-Reports-First-Quarter-2025-Financial-Results/default.aspx ↑

17. https://investors.applovin.com/news/news-details/2025/AppLovin-Announces-First-Quarter-2025-Financial-Results/default.aspx ↑