Investors and traders will always dump a stock like this, so fast you can barely blink in time. And it’s not something to “buy the dip on”, at least in my opinion.

Every now and again our compliance officer here at Fat Tail makes doubly sure that an appropriate risk warning goes into our material like Fat Tail Daily.

Why?

It doesn’t matter how pumped you are for an idea, occasionally the market serves up a – to put it bluntly – shit sandwich.

In fact, my 5 year old and I are playing a version of the card game Uno right now called “No Mercy”. That’s another way to think about it.

Consider fund manager Chris Judd.

Yesterday he was front page of the Australian Financial Review.

He was rightly being celebrated for a humdinging 20% return for his investors last financial year.

One idea he liked, according to the report, was uranium firm Boss Energy.

The very same day Boss Energy put out their latest update – and sank 43%.

It’s no criticism of Chris to say this. Pretty much the same thing happened to me 2 months ago.

It’s certainly not pleasant.

It’s almost guaranteed, if you stick around the markets long enough, that you’ll cop a hiding like this at some point.

The world…the market…companies…all of them contain so many variables and hidden unknowns that it’s impossible to be right all the time.

Why the negative reaction to Boss?

This all looks a bit messy.

It’s an Aussie mine in its first year of production. The results so far aren’t squaring with the projections put down in their feasibility study.

This raises concerns about the viability of the operation.

It also makes it difficult for the market to project earnings going forward.

Investors and traders will always dump a stock like this, so fast you can barely blink in time. And it’s not something to “buy the dip on”, at least in my opinion.

Uranium has been a “hot” theme over the last couple of years.

That said, it’s not something I’ve gone for.

I understand the argument – more power needed, long bear market, constrained supply, etc – however it’s easy to forget how complicated mining operations can be.

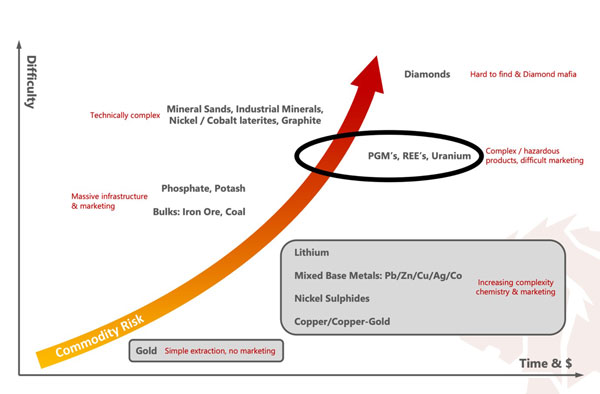

My friend Hedley Widdup over at mining resource fund Lion Selection Group ($LSX) also likes to show the following chart…

|

|

|

Source: Lion Selection Group |

It shows the degree of difficulty around different commodities.

I’ve circled uranium to show that it’s right up there in terms of complications.

We’re seeing that right now with Boss.

You can see what’s at the bottom too: good old gold!

It’s another reason why, over the years, I’ve traded and discussed iron ore shares more than most too.

They may not be flash, but they’re not that complicated either.

This is not to say you shouldn’t trade or invest in uranium. Plenty of people have made good coin backing this idea over the last few years.

I bring it to your attention today to show that you do need to think about both a “thematic” around any commodity and the nitty gritty of the operation you’re backing.

My rough assessment is that a lot of us can grasp the thematic easily enough…but the technical side of mining is where we can all go wrong easily.

That’s also why I urge you to subscribe to my colleague James Cooper if you’re interested in mining shares.

I believe there is a huge opportunity in resources now, and where they could be in 3-5 years.

I just made the case for lithium in my latest issue too.

But I only recommend resource stocks occasionally, and very selectively.

As above, I’ve never recommended a uranium stock in my newsletter because it’s not a market I understand to any depth.

It’s the kind of thing I’m going to leave to James.

He’s a trained geologist, and has worked within the mining industry.

Generally, I try to stick to the basics: gold and copper…and now lithium.

But mining does present so much more, especially in niche metals.

Don’t let the Boss move put you off resource stocks completely.

Just make sure you have a guy liked James in your corner to try and avoid this type of situation, as much as it’s ever possible.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

|

|

|

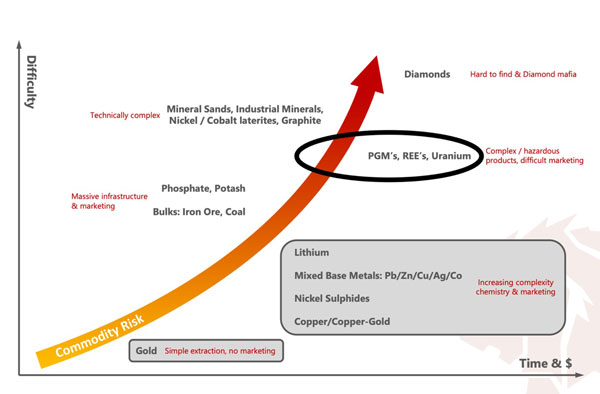

Source: Tradingview |

Last week I had a look at gold when it was trading near the top of the range and said it would look bullish if it could breakout above resistance at US$3,450-3,500.

Fast forward a week and gold hit a high of US$3,439 before plummeting over US$100 to the current price of US$3,318.

So despite the fact we didn’t see prices heading above resistance, I think it is a good case study in the need to create hurdles for the market to overcome before placing trades.

If a pre-empted the breakout I would have bought gold at exactly the wrong moment.

The chart above shows you a range based on the correction in gold that we saw from the recent all-time high hit in April this year.

You can see that the sell zone of that range is where gold struggled to get through last week.

If the selling pressure in the sell zone overwhelms buyers the next target is the point of control or middle of the range.

You can see in the chart above that gold fell straight to the point of control of the range over the past four trading sessions.

It is this type of price action that constantly wrongfoots amateur traders because they are usually thinking in terms of prices going up or down rather than oscillating around a central point.

This mean-reversion as its called is the major cause of losses for traders and also a major opportunity for those who know how it works and can use it to their advantage.

Regards,

|

Murray Dawes,

Editor, Retirement Trader