The ASX managed to find a bright spot amongst the gloom, finishing an overall negative session in the green after lifting late in trade. Pic: Getty Images.

- Energy stocks climb as oil ticks up 2pc

- ASX rallies late to climb 0.08pc

- Gold stocks slide despite recovering gold price

ASX lifts as clouds part for energy sector

The ASX was in a decidedly bad mood today, hanging out in negative territory for the majority of the trading session before recovering in the last half hour.

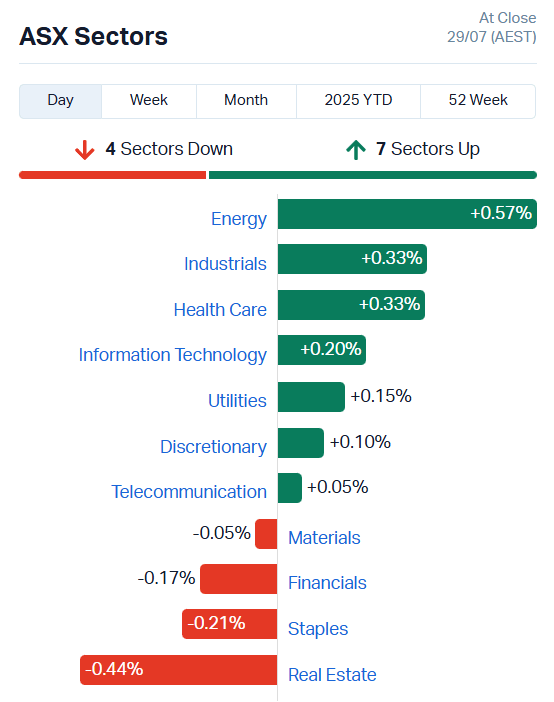

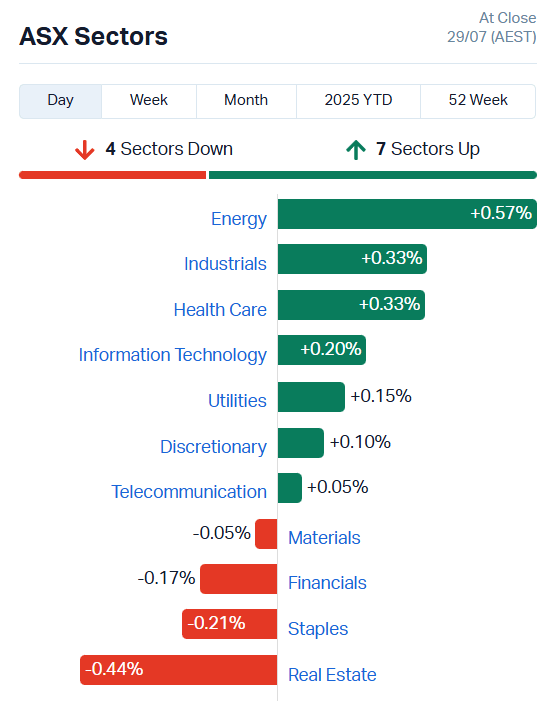

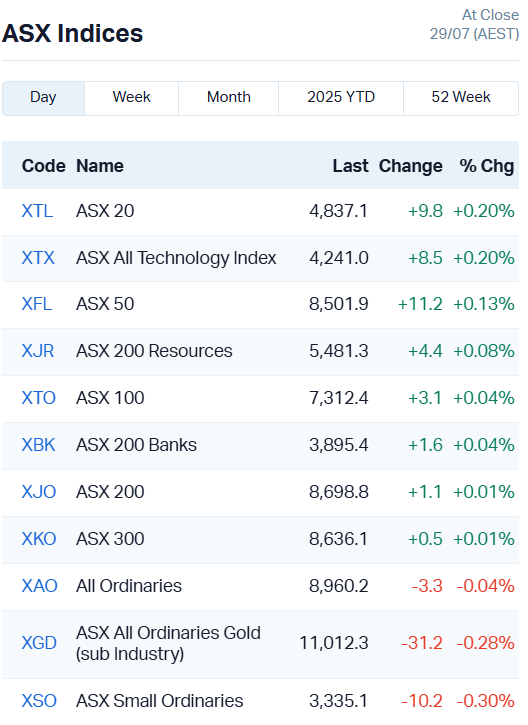

The market closed up 0.08%, crossing into positive territory on a last-minute rally in energy stocks.

A 2% uptick in oil prices had the sector yoyo-ing through the day before finally settling in the green to provide some much-needed support for the broader market.

Woodside Energy (ASX:WDS) lifted 1.57% and Santos (ASX:STO) added 2%. A little further down the pecking order, alternative energy companies were also moving higher.

Green hydrogen firm Provaris Energy (ASX:PV1) climbed 4.55%, and natural hydrogen plays HyTerra (ASX:HYT) and Gold Hydrogen (ASX:GHY) added 5.56% and 1.79% each.

The real estate sector was the biggest drag, shedding 0.44% with lesser losses in consumer staples, financials and materials.

The EU-US trade deal also applied pressure to the gold price overnight, sliding 0.8% to US$3310 an ounce before recovering most of that in today’s session.

The ASX All Ords Gold index still fell 0.28%, mirroring the larger materials sector despite a small uptick in resource stocks.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BEO | Beonic Ltd | 0.32 | 49% | 219661 | $15,235,117 |

| HLX | Helix Resources | 0.002 | 33% | 2745339 | $5,046,291 |

| NAE | New Age Exploration | 0.004 | 33% | 6000000 | $8,117,734 |

| B4P | Beforepay Group | 2.18 | 33% | 204334 | $79,383,074 |

| NOX | Noxopharm Limited | 0.125 | 29% | 2317923 | $28,347,081 |

| SCP | Scalare Partners | 0.16 | 28% | 293110 | $5,229,378 |

| EVG | Evion Group NL | 0.038 | 27% | 3075443 | $13,047,599 |

| HFR | Highfield Res Ltd | 0.195 | 26% | 625545 | $73,481,942 |

| D3E | D3 Energy Limited | 0.335 | 24% | 565977 | $21,458,252 |

| BSA | BSA Limited | 0.09 | 23% | 15510313 | $5,496,919 |

| HCT | Holista CollTech Ltd | 0.089 | 22% | 1138344 | $24,458,551 |

| BDG | Black Dragon Gold | 0.06 | 20% | 722759 | $15,898,303 |

| EE1 | Earths Energy Ltd | 0.006 | 20% | 100000 | $2,649,821 |

| FBR | FBR Ltd | 0.006 | 20% | 7267046 | $28,447,261 |

| SKK | Stakk Limited | 0.006 | 20% | 83333 | $10,375,398 |

| 1TT | Thrive Tribe Tech | 0.0095 | 19% | 791210 | $812,691 |

| BM8 | Battery Age Minerals | 0.07 | 19% | 6584846 | $8,956,308 |

| CHM | Chimeric Therapeutic | 0.0035 | 17% | 4244892 | $9,747,370 |

| ENV | Enova Mining Limited | 0.007 | 17% | 407721 | $8,745,600 |

| TON | Triton Min Ltd | 0.007 | 17% | 607569 | $9,410,332 |

| TSL | Titanium Sands Ltd | 0.007 | 17% | 228039 | $14,068,483 |

| GRV | Greenvale Energy Ltd | 0.051 | 16% | 371924 | $23,952,427 |

| AUZ | Australian Mines Ltd | 0.008 | 14% | 1314681 | $11,977,085 |

| AX8 | Accelerate Resources | 0.008 | 14% | 506793 | $5,720,321 |

| BLU | Blue Energy Limited | 0.008 | 14% | 125000 | $12,956,815 |

WordPress Table

In the news…

LiDAR-based logistics company Beonic (ASX:BEO) has secured a contract to deploy its passenger flow management technology across seven major international airports in north Africa.

BEO reckons the contract is worth about $10.6m over its 2.5-year term, with an option to extend for another three years. The company is already operating in the London Heathrow, JFK Terminal 4, Narita and Abu Dhabi airport hubs.

Evion Group’s (ASX:EVG) Maniry graphite project has joined an exclusive group of 13 non-EU projects acknowledged by the European Commission’s Strategic Projects initiative under the Critical Raw Materials Act.

It’s a big nod to the project’s chops, confirming it as a strategic source of natural graphite at a time when China – the world’s number one producer – is throttling international supply.

Technical services company BSA (ASX:BSA) delivered $286.8m in revenue for FY2025, a 7% uptick compared to last year. While that’s a solid performance by anyone’s standards, the company is warning of some serious headwinds on the horizon.

BSA was unsuccessful in a new bid on a contract with the NBN, and its smart metering contracts with Intellihub and Bluecurrent are winding down to just about nothing by next year.

As those contracts represented 92% of BSA’s yearly revenue, the company is aggressively restructuring in an effort to keep the ship afloat, but it’s not going to be an easy road.

Direct-to-consumer lending firm Beforepay (ASX:B4P) has grown in leaps and bounds this quarter, achieving a 113% increase in quarterly net profit after pulling in $2.4m.

Year-on-year revenue is also up 15% to $10.4m and active users have increased 12% to just under 270,000. CEO Jamie Twiss said he “couldn’t be happier with this result; it’s the perfect way to end a strong financial year.”

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ECT | Env Clean Tech Ltd. | 0.2 | -3333% | 70167018 | $12,046,306 |

| DTM | Dart Mining NL | 0.3 | -2500% | 9197764 | $4,792,222 |

| EDE | Eden Inv Ltd | 0.15 | -2500% | 1100500 | $8,219,762 |

| SFG | Seafarms Group Ltd | 0.15 | -2500% | 400001 | $9,673,198 |

| LM1 | Leeuwin Metals Ltd | 11 | -2414% | 1202325 | $14,616,926 |

| ANR | Anatara Ls Ltd | 0.7 | -2222% | 5143866 | $1,920,454 |

| GLA | Gladiator Resources | 0.7 | -2222% | 1100000 | $6,824,671 |

| PRX | Prodigy Gold NL | 0.2 | -2000% | 1421349 | $15,875,278 |

| QXR | Qx Resources Limited | 0.4 | -2000% | 936755 | $6,551,644 |

| RDN | Raiden Resources Ltd | 0.4 | -2000% | 3275000 | $17,254,457 |

| VRC | Volt Resources Ltd | 0.4 | -2000% | 1716667 | $23,424,247 |

| KZR | Kalamazoo Resources | 9.1 | -1727% | 7641683 | $24,133,287 |

| 1AI | Algorae Pharma | 0.5 | -1667% | 2991398 | $10,124,368 |

| BYH | Bryah Resources Ltd | 0.5 | -1667% | 139990 | $6,171,195 |

| TMX | Terrain Minerals | 0.25 | -1667% | 3666666 | $7,595,443 |

| IFG | Infocusgroup Hldltd | 1.6 | -1579% | 3441552 | $5,546,844 |

| GRL | Godolphin Resources | 1.1 | -1538% | 100000 | $5,835,353 |

| RPG | Raptis Group Limited | 20.5 | -1458% | 271844 | $84,164,365 |

| KOB | Kobaresourceslimited | 3.6 | -1429% | 181858 | $8,344,207 |

| AKN | Auking Mining Ltd | 0.6 | -1429% | 1379280 | $4,816,814 |

| ATV | Activeportgroupltd | 1.2 | -1429% | 1621803 | $9,617,679 |

| FCT | Firstwave Cloud Tech | 1.5 | -1429% | 105900 | $29,986,577 |

| NES | Nelson Resources. | 0.3 | -1429% | 300000 | $7,601,747 |

| RKT | Rocketdna Ltd. | 1.2 | -1429% | 1189554 | $12,817,325 |

| SP3 | Specturltd | 1.2 | -1429% | 205778 | $4,436,602 |

WordPress Table

IN CASE YOU MISSED IT

St George Mining (ASX:SGQ) has delivered a 30kg bulk sample from its Araxá project to a Brazilian government-backed supply chain program.

CuFe (ASX:CUF) has unveiled a scoping study highlighting the strong economics of the Orlando open pit cutback within its 55%-owned Tennant Creek copper-gold project in the Northern Territory.

Aroa Biosurgery (ASX:ARX) recorded its third consecutive quarter of positive net cash flow since listing on the ASX in July 2020 and has reaffirmed FY26 revenue guidance.

DY6 Metals (ASX:DY6) has kicked off a soil sampling program to guide maiden auger drilling at its Central rutile project in Cameroon.

Pancontinental Energy (ASX:PCL) has increased both the potential scale and geological chance of successfully finding oil at its PEL 87 project in the Orange Basin offshore Namibia.

Loyal Metals (ASX:LLM) is using modern exploration including a high-tech geophysics drone survey to identify new copper-gold targets.

Victory Metals (ASX:VTM) has produced a high-value, mixed rare earth oxide at its North Stanmore project in Western Australia.

Resolution Minerals (ASX:RML) has enlisted two Trump-affiliated firms to back its Horse Heaven antimony-tungsten project in proposed Nasdaq listing.

Trading Halts

Astute Metals (ASX:ASE) – cap raise

Catalina Resources (ASX:CTN) – exploration results

IRIS Metals (ASX:IR1) – cap raise

Noviqtech (ASX:NVQ) – quantum computing deal and cap raise

Prescient Therapeutics (ASX:PTX) – cap raise

Sequoia Financial Group (ASX:SEQ) – price query response

Strategic Energy Resources (ASX:SER) – cap raise

TechGen Metals (ASX:TG1) – cap raise

At Stockhead, we tell it like it is. While HyTerra is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.