In H1 2025, the European fintech sector demonstrated continued strength and resilience, attracting US$4.4 billion across 653 deals, according to a new report by Innovate Finance, the UK’s fintech industry body.

The figure represents a 17% increase in funding volume from H2 2024, while the deal count held steady on a rolling 12-month basis, underscoring a maturing market marked by larger deal sizes, sustained investor interest, and increased demand for digital financial solutions.

The report, based on data from PitchBook, supplemented by Beauhurst and Innovate Finance’s own data analysis, reveals that Switzerland ranked 7th in fintech funding in Europe, attracting US$200 million across 52 deals in the H1 2025. This gives Switzerland a 4.5% share of Europe’s total fintech funding and 8% of all deals on the continent.

Notable deals in H1 2025 included rounds secured by Sygnum Bank, Unique, and Amnis Treasury Services to expand overseas and enhance their offerings.

Sygnum Bank, a regulated digital asset bank, raised a US$58 million strategic growth round in January. This financing round gave in Sygnum Bank a US$1 billion, thus reaching unicorn status. A key driver of the growth round was Sygnum Bank’s multi-year core business growth, and the proceeds will be used to drive its expanded market entry into the European Union (EU) and to launch its regulated presence in Hong Kong.

Unique, a Zurich-based specialist in agentic AI solutions for asset and wealth management, closed its Series A funding round in February, raising US$30 million. The round, which brought the company’s total capital raised to US$53 million, will be used to boost Unique’s global expansion efforts and enhance its ability to deploy agentic solutions for its clients. Unique’s technology is already in use by leading institutions managing a combined US$2.3 trillion in assets under management (AUM), including Pictet Group, UBP, LGT Private Banking, and SIX.

Amnis, a provider of international banking services for small and medium-sized enterprises (SMEs), completed its Series B investment round in February, raising CHF 10 million (US$12.3 million) to accelerate its growth. Currently, Amnis serves more than 3,000 companies from over 35 countries. The company plans to start business operations in additional European countries and to enhance its services, including e-commerce solutions, additional accounting integrations, and embedded card solutions.

UK, France, Germany continue to lead

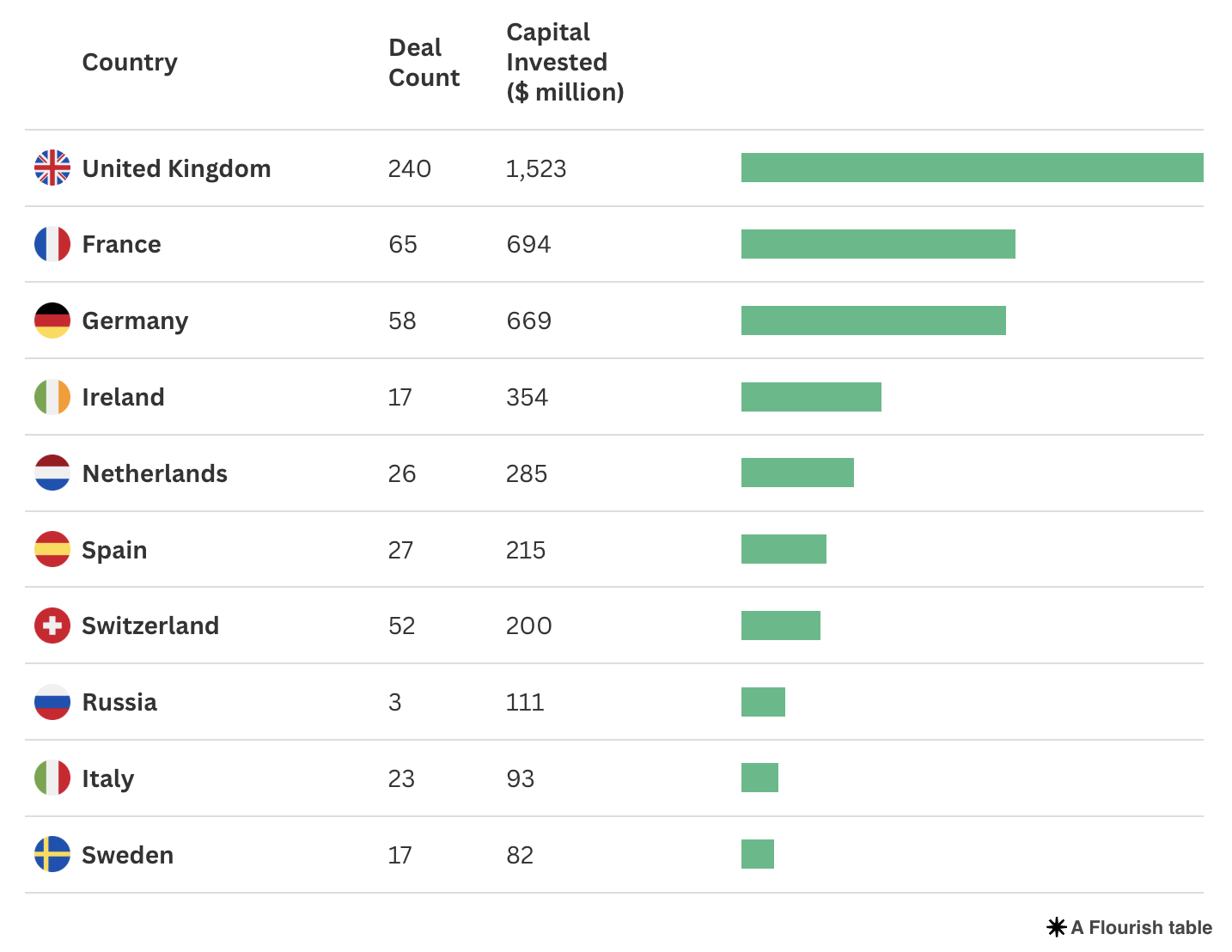

Across Europe, the UK, France, and Germany maintained their positions as fintech leaders in the region. The UK remained at the forefront, raising US$1.5 billion across 240 deals and accounting for 34% of European fintech funding volume, and 36.8% of deal count.

Fintech funding activity in the UK was led by several high-profile transactions across payments, artificial intelligence (AI), and digital assets. In March, Rapyd, a fintech-as-a-service company, secured a US$300 million Series E to support its growth through a combination of organic growth, acquisitions, and strategic investments. The funding followed Rapyd’s acquisition of Valitor, a European payments and card issuing company, and the launch of Rapyd Ventures, the company’s venture arm.

Quantexa, an AI, data and analytics software company, completed a US$175 million Series F in March to bolster its platform innovation efforts, create new partnerships and alliances, deepen its presence in North America, and pursue selected mergers and acquisitions (M&A) opportunities. The transaction brought Quantexa’s valuation to US$2.6 billion.

In January, Komainu, a regulated digital asset services provider and custodian, raised US$75 million in strategic investment to accelerate its international strategic growth plans, integrate class-leading technologies, and enhance client services in collateral management and tokenization. Komainu offers multi-asset support, bank-grade governance and multi-jurisdictional regulatory solutions.

The UK is followed by France with US$694 million and 65 deals, and Germany closely behind with US$669 million from 58 deals. Together, these three countries accounted for 65.9% of fintech funding in Europe (US$2.9 billion) and 55.6% of deals in the region in H1 2025 (363 deals).

Beyond these top tier markets, Ireland attracted US$354 million through 17 transactions, followed by the Netherlands with US$285 million and 26 transactions, and Spain with US$215 million and 27 deals.

Global fintech funding

In H1 2025, global fintech investment reached US$24 billion across 2,597 deals, marking a 6% increase from US$22.4 billion in H2 2024.

The US continued to dominate the landscape, securing US$11.5 billion through 1,082 deals, representing 47.9% of global funding and 41.7% of total deals. The United Arab Emirates (UAE) ranked second by funding volume, attracting nearly US$2.2 billion across just 58 transactions, followed by the UK, India, which raised US$1.4 billion across 109 deals, and Singapore, which raised US$797 million across 100 deals.

Featured image: Edited by Fintech News Switzerland, based on image by freepik via Freepik