Bitcoin failed to exceed US$120,000 in value and ended up falling along with the broader crypto market over the last seven days. Multiple factors pushed the crypto market down over the weekend, including a dismal US jobs report, rising geopolitical risks and US recession worries.

Bitcoin and Ethereum were down -3.77% and -8.38% respectively over the seven days to 3 August 2025. Bitcoin’s market capitalisation dropped to US$2.26 trillion while the global crypto market fell to US$3.68 trillion. Bitcoin’s market dominance rose slightly to 61.5%.

|

Price |

High |

Low |

Change from previous week |

|

|

BTC (in US$) |

$113,704 |

$119,788 |

$112,272 |

-3.77% |

|

ETH (in US$) |

$3,455 |

$3,936 |

$3,372 |

-8.38% |

Source: CoinMarketCap. As at 3 August 2025. Performance is shown in US dollars and does not consider any USD/AUD currency movements.

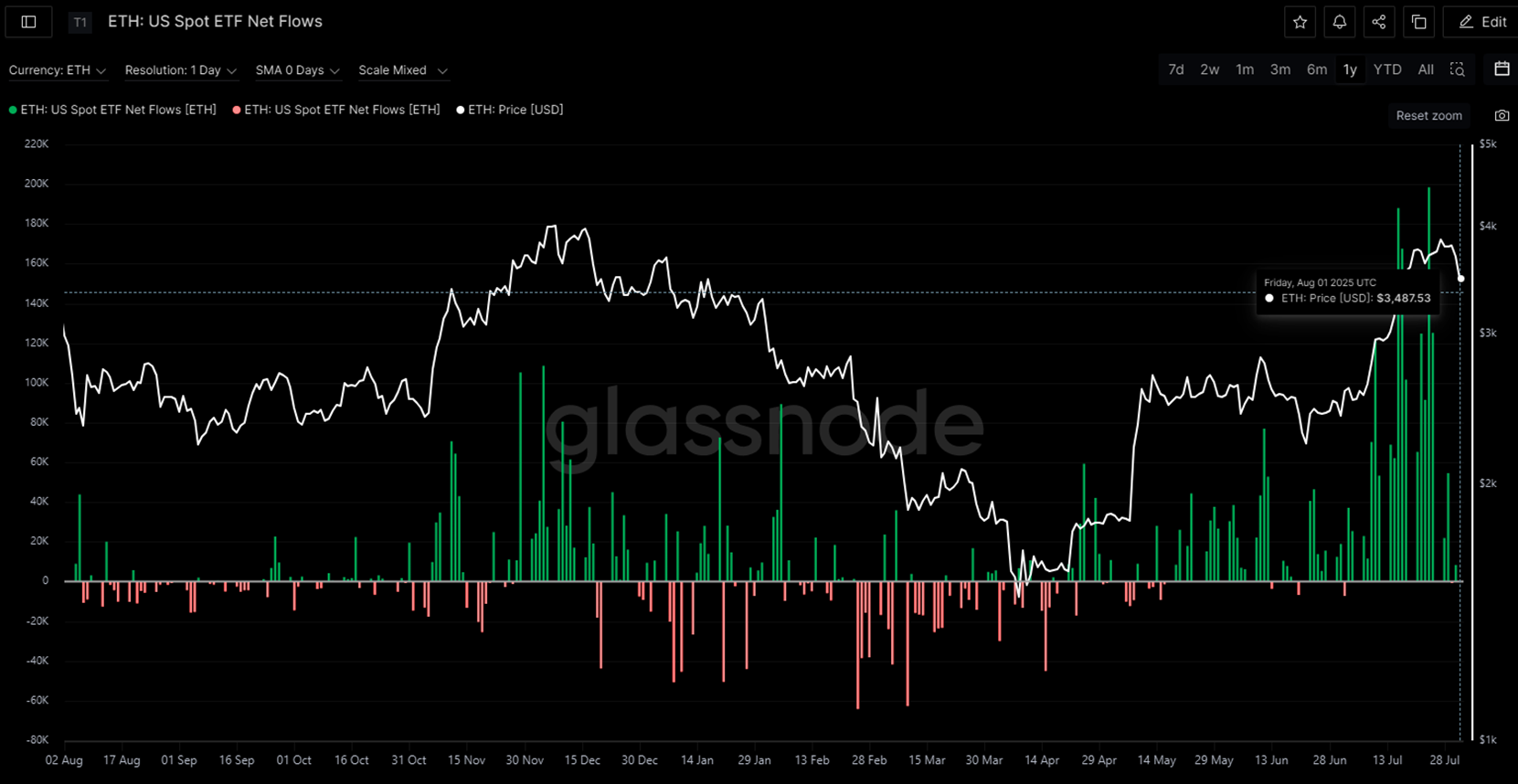

Source: Glassnode, as at 3 August 2025. Past performance is not indicative of future performance.

Crypto news we’re watching

Ethereum records a stellar July

Although Ethereum’s (ETH) performance has drastically lagged Bitcoin (BTC) over the past year (19% vs 88% respectively as at 1 August 2025), things may be turning around for the second largest cryptocurrency. Over the last month, ETH has returned 54% against BTC’s 10%. ETH spot ETFs have also recorded 20 consecutive trading days of positive inflows including $17 million of net inflows on 31 July 2025 versus $115 million of net outflows for Bitcoin1.

Positive factors for ETH over the last month:

- Benefits from the US stablecoin bill (also known as the Genius Act) – the largest stablecoins such as Tether and USD Coin are issued on the Ethereum network. If more stablecoin issuers are launched, these may also be built on the Ethereum network.

- ETF inflows – strong price performance for ETH has led to consecutive net inflow days and a turnaround in sentiment for the cryptocurrency.

- Corporate buying – Crypto treasury strategies have been popular in 2025 and some of these are now adding ETH to their treasury holdings1.

Largest ever crypto transaction

Over 80,000 Bitcoin (worth over US$9.3 billion at the time of transaction) was sold by Galaxy Digital (NASDAQ: GLXY) on 27 July 2025, making it one of the largest crypto transactions ever2. The coins were held for over a decade by a Satoshi-era (2009 to 2011) investor.

According to Galaxy, the trade was part of an estate-planning strategy with Galaxy acting as the intermediary.

The markets briefly dipped -1% from ~$118K to ~$116K, but the price swiftly rebounded back above ~$119K within a day. The execution ran smoothly, highlighting Bitcoin’s growing maturity, institutional grade liquidity and the crypto market’s broader resilience. The seller remains unidentified.

CRYP company spotlight

Metaplanet plans US$3.7 billion stock issuance to buy additional bitcoin

Bitcoin focused firm, Metaplanet announced that it has filed for a shelf registration to raise up to JPY¥555 billion (US$3.7 billion) so it can continue to purchase Bitcoin for its treasury. The firm aims to accumulate 210,000 BTC between the start of the shelf registration (planned for 9 August 2025) and 8 August 2027. The company clarified the issuance is still tentative and subject to a vote at the company’s Extraordinary General Meeting on 1 September3.

Metaplanet is held in the Betashares Crypto Innovators ETF (ASX: CRYP)4. CRYP provides exposure to global companies at the forefront of the crypto economy5.

Ethereum (ETH): US Spot ETF Net Flows

This metric shows the total net flow of funds of the leading Ethereum ETFs traded in the US, reflecting the day-to-day changes in the ETFs’ holdings. It is calculated as the difference between today’s balance data point and the previously available balance data point in native units. Each day’s native net flow is then converted into USD, leveraging the closing USD exchange rate at 16:00 New York time.

As of 1 August 2025, ETH has had only three net outflow days since 19 May 2025.

Source: Glassnode, as at 1 August 2025. Past performance is not indicative of future performance.

Ethereum (ETH): Realised Price and MVRV Pricing Bands

This chart presents two of the most widely recognised on-chain metrics: the Realised Price (the average price at which all Bitcoins were last bought or shuffled around) and its derivative, the MVRV Ratio. An on-chain metric helps analysts determine the timing of buying or selling a cryptocurrency asset.

- Realised Price is the average price of the Ether supply, valued at the day each coin last transacted on-chain. This is often considered the ‘on-chain cost basis’ of the market.

- MVRV Ratio is the ratio between the market value (MV, spot price) and the Realised Value (the profit or loss an investor received following their crypto investment), allowing for a visualisation of Ethereum market cycles and profitability.

As of 2 August 2025, the MVRV is now at 0.58 and has been positive since Thursday 8 May when the price of ETH is above its realised price of US$1974 per unit.

Source: Glassnode, as at 2 August 2025. Past performance is not indicative of future performance.

Altcoin news

The top 20 altcoins were down in the last seven days to 3 August 2025. However, Binance Coin (BNB), the third largest altcoin, recently hit new all-time highs of US$850 on 28 July and is up over 33% over the last year. BNB is one of only five cryptocurrencies that have a market cap greater than US$100 billion.

BNB is the native token for the cryptocurrency exchange Binance which was launched in 2017. BNB has a limited supply of 200 million and has a regularly scheduled “burn” which is intended to limit and halve its supply. By holding the token, investors have a way to share in some of the crypto exchange’s profit6.

Binance Coin (BNB) over the last 12 months

Source: Coinmarketcap, as at 3 August 2025.

References:

- https://www.theblock.co/post/365184/spot-ether-etf-20-day-inflow-streak

- https://investor.galaxy.com/news/news-details/2025/Galaxy-Executes-One-of-the-Largest-Notional-Bitcoin-Transactions-Ever/

- https://www.businessinsider.com/ethereum-vs-bitcoin-eth-btc-price-crypto-rally-spot-etfs-2025-7

- https://www.dlnews.com/articles/markets/xrp-price-nears-all-time-high-as-traders-eye-further-gains/

- https://www.theblock.co/post/365210/japans-metaplanet-3-7-billion-raise

- https://cryptopotato.com/here-are-some-binance-coin-bnb-eye-poppers-for-you/