Delta doubles down on lithium projects amid market lull. Pic: Getty Images

- Delta Lithium is betting on long-term upside with new drilling at Yinnetharra

- Acquisitions have significantly grown Delta’s Yinnetharra landholding, paving the way for more drilling opportunities

- The company is keen to use its strong balance for potential M&A down the track

Fresh from the demerger of its gold assets into ASX-newcomer Ballard Mining (ASX:BM1), Delta Lithium (ASX:DLI) has come to the fore with ambitious growth plans for its Yinnetharra project, timing an upcoming drilling campaign for what analysts suggest could be the cyclical bottom of the lithium sector.

For strategic players like Delta, acting counter-cyclically means taking a long-term view, especially when it comes to exploration and acquiring high-quality assets at a discount.

It may seem risky but downturns offer unique opportunities for companies looking to de-risk and position themselves ahead of the next boom.

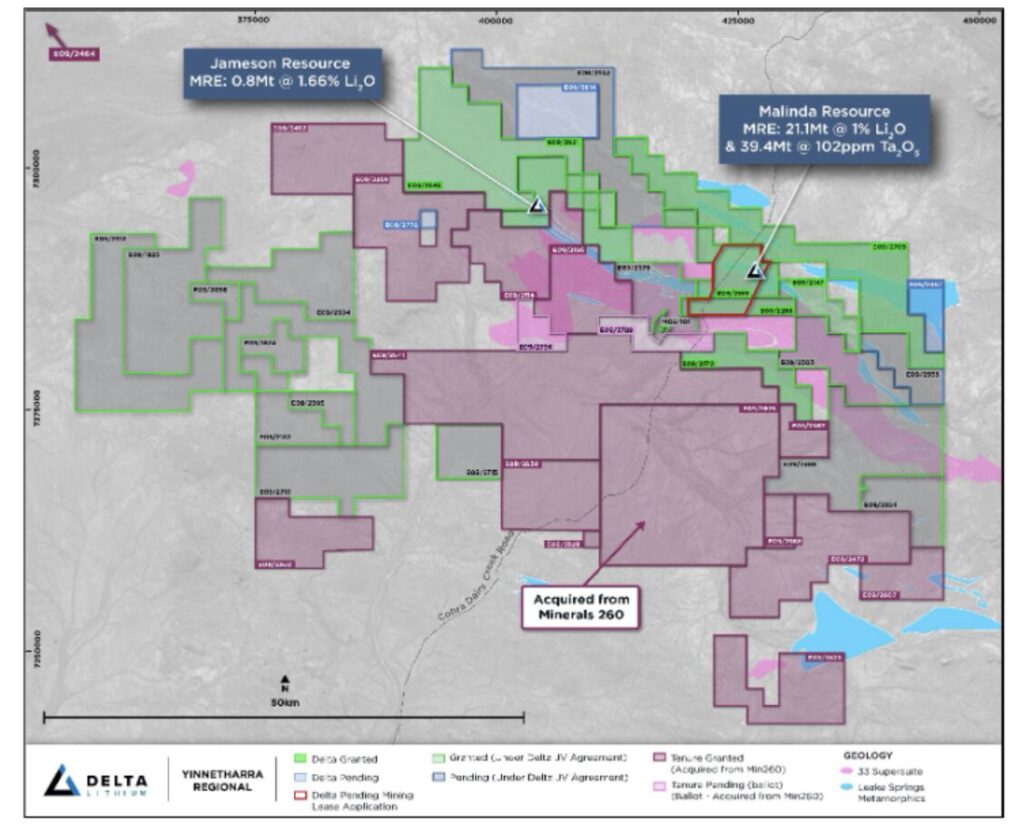

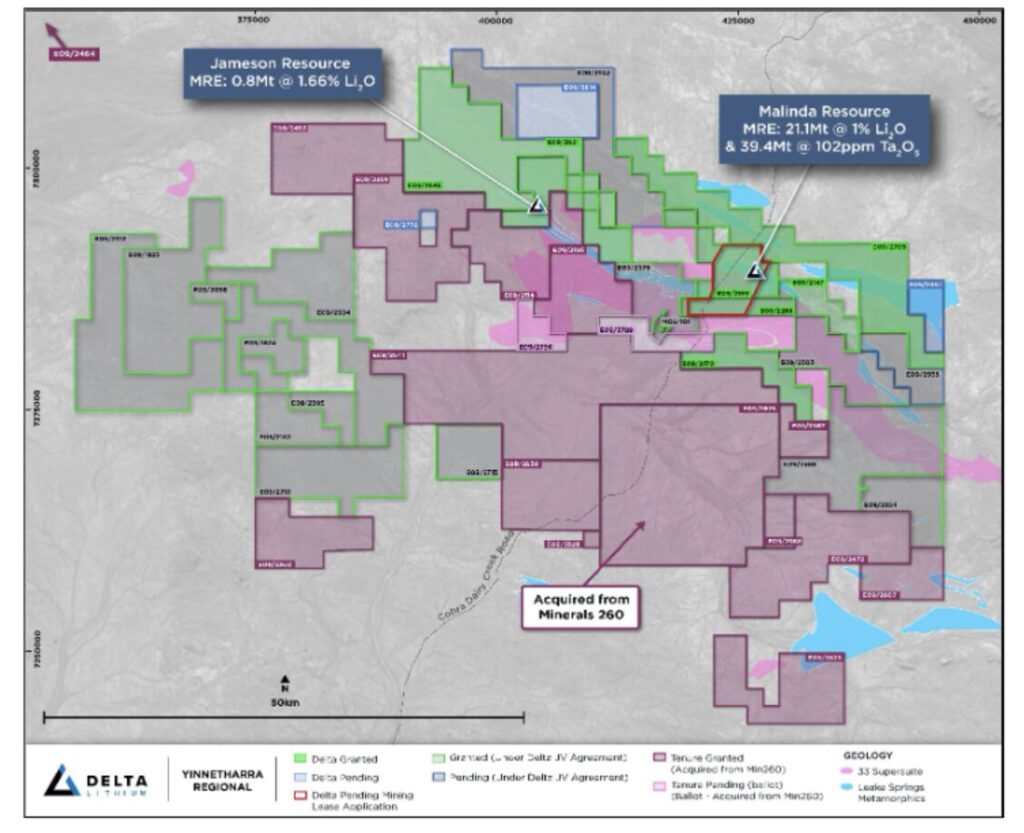

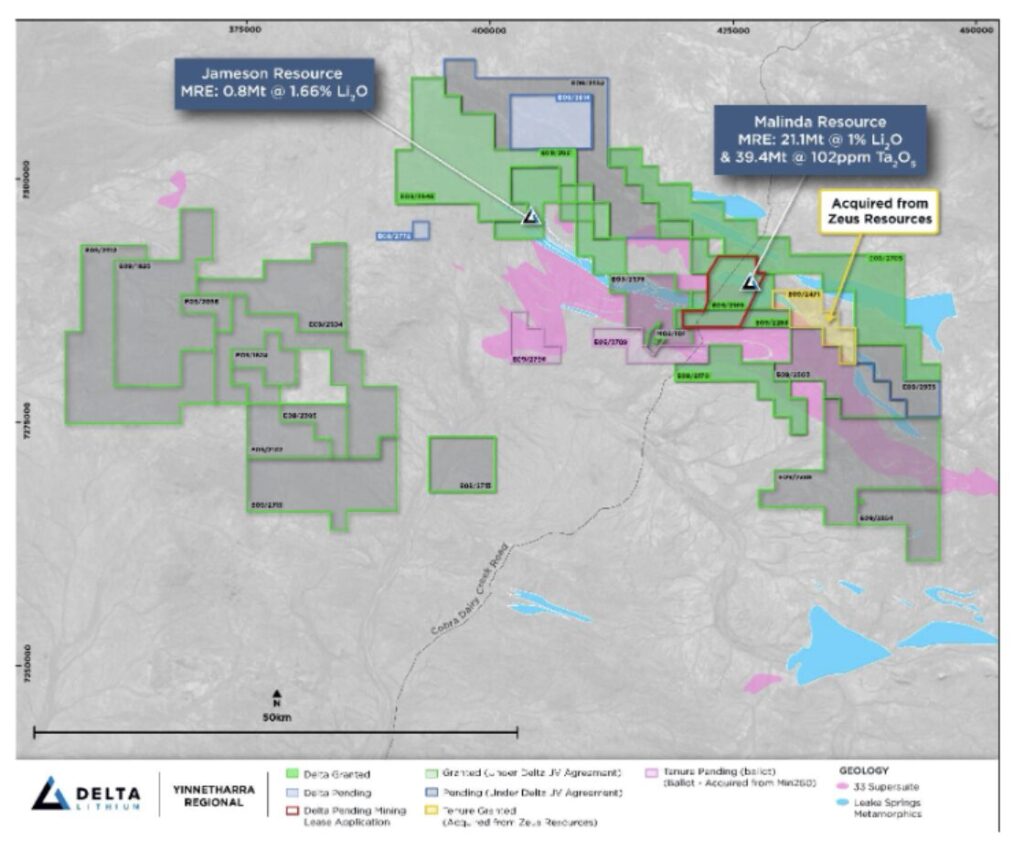

That’s been Delta Lithium’s strategy with the expansion of its project footprint at Yinnetharra earlier this year after its purchase of Minerals 260 (ASX:MI6) Aston project and Zeus Resources (ASX:ZEU) Mortimer Hills landholding.

Both acquisitions took Delta’s total footprint in WA’s Gascoyne from 1769km2 to more than 3100km2, opening immediate exploration opportunities along strike of the company’s existing deposits at Malinda and Jameson.

Near total control of Leake Springs lithium hub

Mortimer Hills is just 5km southeast of Malinda while Aston is ~20km from Malinda and another 2km along strike from the 800,000t at 1.66% Li2O Jameson prospect.

The company now controls almost all of the Leake Springs meta-sediment unit, which hosts the Malinda and Jameson resources for a combined 21.9Mt of lithium.

Mortimer Hills presents enormous prospectivity owing to its location near Malinda, where Yinnetharra’s M1 and M36 pegmatites contain a combined 14.6Mt of the indicated resource, providing enough confidence to begin mining studies.

Aston features multiple lithium, tantalum and rubidium soil anomalies, including a 5km-long lithium trend at Pyramid Hill – with no drilling previously undertaken.

Many of these tenements adjoin Delta’s existing holdings and JV areas, streamlining exploration and potential development.

Final piece of the lithium puzzle

DLI managing director James Crosser told Stockhead Aston filled the last crucial piece of the puzzle for the company as it looked to utilise the knowledge gained over the last few years and apply it over that ground.

“It filled the last keystone in the Leake Springs meta-sediment unit to the southeast of Jameson – and we knew that the anomalism in the surface geochemistry trended that way,” he said.

“Minerals 260 had done some fairly extensive work across the six or seven kilometres of strike that we were most interested in and being able to acquire that ground for the deal we did was too compelling to ignore.

“It was a good pick up.”

With an extensive heritage survey all wrapped up, Crosser said the $107.7m market cap explorer was eager to drill more holes into the Jameson prospect to expand the resource the company defined there.

“We’ll then progress out to the southeast along the Leake Springs metaseds across the Aston project and drill some holes into that and then some other prospects on our tenure like Yamazaki back towards Melinda, and we’re really hopeful that we’ll hit some more lithium pegmatites on the way,” he said.

“There’s a fair bit of drilling to be done to keep us busy for the rest of the year but the work we’ll be doing isn’t the high intensity, multiple drill rig work we were doing when we were delineating Malinda.

“We’re being a lot more judicious with the amount of capital we’re spending until the lithium market looks like it has turned, and we’re starting to maybe see that now,” Crosser added.

“Until we’re a bit more confident, we’re being a little restrained, keeping the geology teams on that relatively cheaper field work with some modest drilling on high priority targets rather than drill everything.”

Delta keeps eyes on lithium at Mt Ida

Despite a busy start to the year with Yinnietharra acquisitions, Delta continues to prioritise lithium development at Mt Ida, adjacent to the gold resources at the site.

In 2023, the company revealed combined inferred and indicated resources at Mt Ida of 14.6Mt at 1.2% Li2O and 191ppm tantalum pentoxide, with the indicated resource (7.8Mt at 1.3% Li2O) representing a 136% increase on the previous estimate.

Given the scale of the Mt Ida Gold MRE and a potential future standalone mining operation, Delta’s board decided to demerge the asset into Ballard to drive value for both Delta and new Ballard shareholders.

The demerger received strong institutional and retail support, raising $30m through an IPO to drive a 130,000m drilling campaign and tap into 26km of under explored greenstones along gold-rich structures known for major finds.

Crosser said Delta was quite proud of getting Mt Ida into its own little home, with the demerger taking up most of the company’s time.

“The most prudent thing for us to do now is wait and see how the Ballard feasibility on the gold proceeds,” Crosser said.

“When Ballard is able to put some real infrastructure and mining shapes around the gold – particularly at the Baldock deposit where Delta’s lithium is – we’ll be able to collaborate on optimising that outcome to suit Ballard as much as suit Delta.

“We’re really waiting to see that come together so we can leverage off Ballard’s investment to get a cheaper outcome and to exploit our lithium there.”

Potential M&A on the cards

Now, with Delta’s 46% equity position in Ballard and its cash balance of nearly $59m, Crosser said the company was set on using its strong balance sheet to have a look around and see if they put that towards some good M&A.

“We’re particularly interested in projects that support our current strategy, which is to bolster the scale and scope of our existing projects and also perhaps open a third front,” he said.

At Stockhead, we tell it like it is. While Delta Lithium is a Stockhead advertiser, it did not sponsor this article.