Stock Market Outlook entering the Week of December 8th = Uptrend

- ADX Directional Indicators: Uptrend

- On Balance Volume Indicator: Uptrend

- Institutional Activity (Price & Volume): Uptrend

ANALYSIS

The stock market outlook remains in an uptrend as investors look forward to the annual “Santa Claus rally”.

The S&P500 ( $SPX ) rose 1.5%. The index sits ~4% above the 50-day moving average and ~11% above the 200-day moving average.

SPX Price & Volume Chart for Dec 08 2024

The ADX ( Average Directional Index ), Institutional Activity and OBV ( On-Balance Volume ) are all in bullish territory.

S&P Sector Performance for Week 49 of 2024

A tough week for several sectors, but oddly enough it’s the same best and worst performers: Consumer Discretionary ( $XLY ) led to the upside, Energy ( $XLE ) to the downside. Rate sensitive sectors have struggled to find their footing, flipping back and forth between bullish and bearish trends: Energy ( $XLE ), Real Estate ( $XLRE ) , and Utilities ( $XLU ) are back to neutral trends. Materials ( $XLB ) dropped from bullish to bearish.

Sector Style Performance for Week 49 of 2024

Large Cap Growth ( $IWF ) was the best performer last week, while High Dividend ( $SPHD ) was the worst All the Value plays also struggled. High Dividend and Large Cap Value also slipped from bullish to neutral trend.; no surprise since they have the lowest returns over the past 4 weeks.

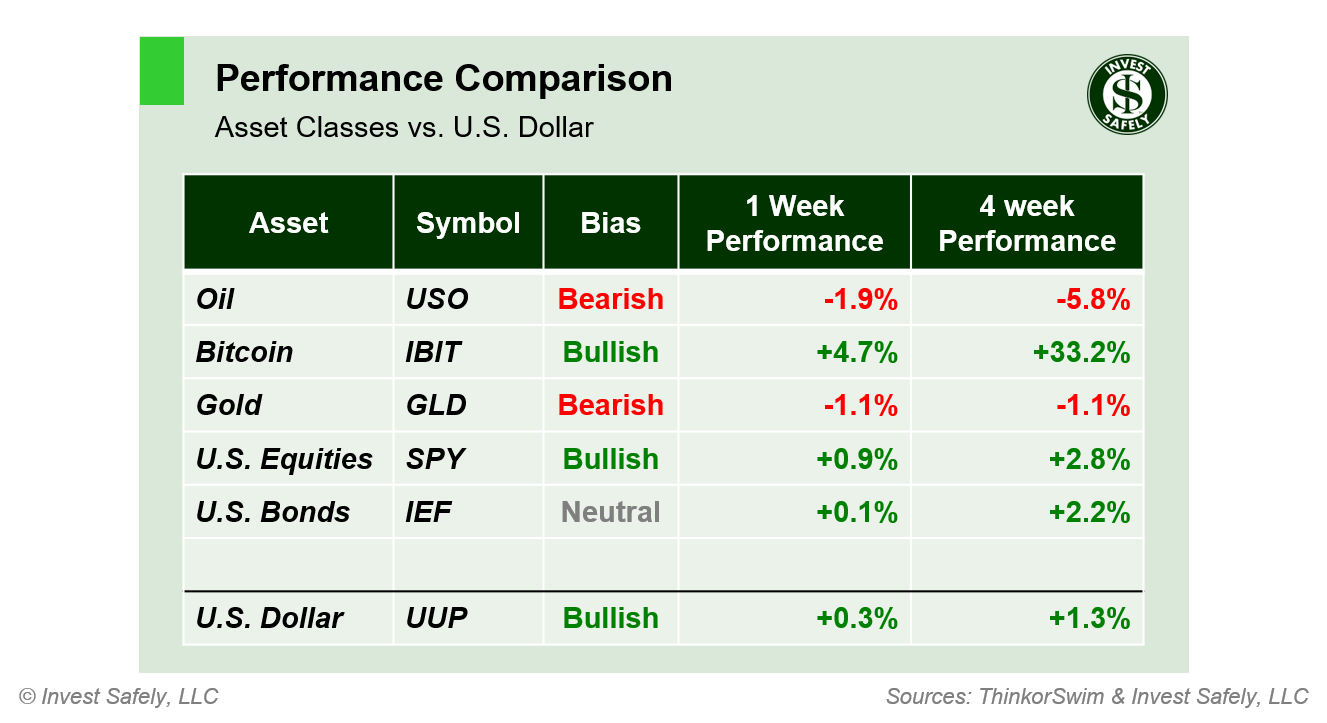

Asset Class Performance for Week 49 2024

Bitcoin ( $IBIT ) was the best performing asset last week, after briefly dipping back below 100,000. Oil ( $USO ) was the worst performer again. Gold continues to struggle, dropping from neutral to bearish trend with other commodities. Bonds slipped back from bullish to neutral.

COMMENTARY

With the general market content to grind higher since mid-November, investors should be content with riding their winners into the new year, while trimming any names showing weakness (high volume selling, lower lows and lower highs over the past few weeks).

ISM Manufacturing PMI rose in November, but still showed a contraction in place (reading < 50). The Services version fell more than expected, but still showed an expansion in place (reading > 50).

Labor data showed more job openings (JOLTs) and higher payrolls (NFP) than expected. That said, unemployment ticked 10 basis points higher to 4.2%

This week, we’ll get CPI and PPI data for November.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.