If you’d like to listen to this week’s Bass Bites, click on the player below:

Global week in review

Global equities pushed higher last week, helped by solid US earnings reports and the completion of more major US trade deals.

Trump causes Japan and Europe to blink

Say what you like about US President Donald Trump but he does appear to have secured some fairly good trade deals with both Japan and the European Union – at least from his perspective. Both major US trading partners have agreed to a 15% tariff on most of their goods imported into the US, along with a commitment to invest billions into the US economy – and without trade retaliation!

While this still amounts to a tax on US corporations and/or households, markets will likely construe these deals as a win for Trump – major economies are rolling over just to get a deal done so we can all move on with our lives. As I noted last week, to the extent that most trading partners will face similarly stiff tariffs, they should not lose much competitiveness (at least against each other) with regard to selling into the US market.

Reports suggest an updated deal with China is also in the wings.

Is this good news?

From a markets perspective, all this is great news – there are good grounds to think that tariff uncertainty will soon be behind us and the overall level of tariffs won’t be enough to tip the US economy into recession.

That said, we do likely face a few months of higher-than-usual US monthly inflation gains (as some of the tariffs are passed through to prices) but markets seem well prepared for this. Provided this remains a one-off hit to the price level – and is not entrenched into higher inflation through a wage-price spiral – it’s an acceptable outcome for markets.

There will also likely be some hit to US profits and household real incomes, which could temporarily slow economic growth. But the tariff hit is coming at a time of still-resilient US economic growth and easing underlying inflation pressures. Offsetting the tariff hit (to an extent) will be reduced trade uncertainty and the Fed waiting in the wings to cut interest rates further as required.

My base case is the still high – but less than feared – level of tariffs opens the door for the Fed to cut interest rates, albeit not this week but in September.

Meanwhile, the Q2 US earnings reporting season continues to be encouraging. According to FactSet, of the 34% of S&P 500 companies that have reported so far, 80% have beaten earnings estimates – which is a little above the 5-year average of 78%. Last week, there was some relief Tesla’s result was not a lot worse than expected. And while Alphabet had yet another earnings beat, there remains lingering market concerns about the billions in capital spending that management is forking out to keep up in the AI race.

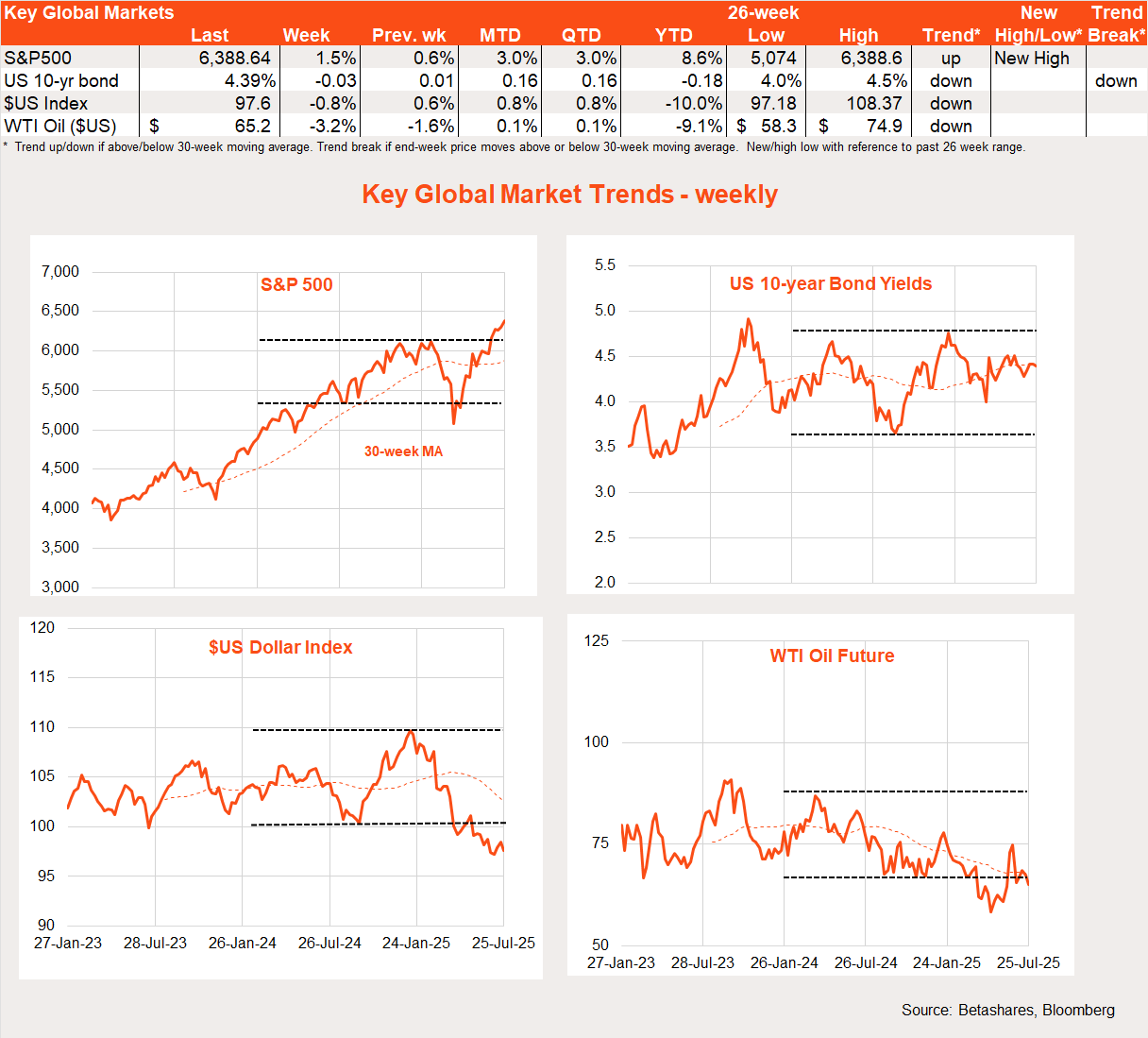

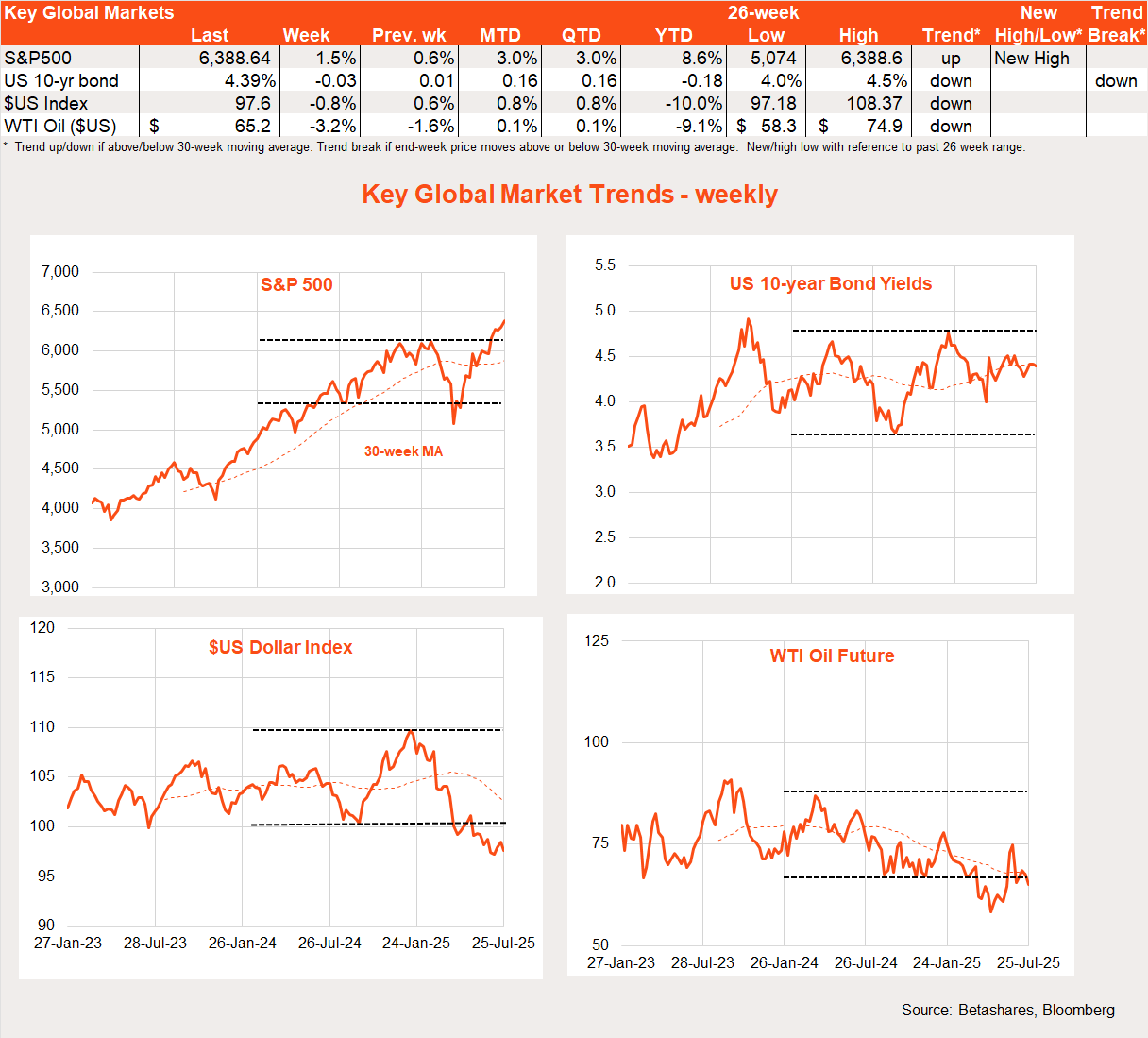

Global market trends

Helped by completion of the US trade deal, Japanese stocks had a particularly good week with the Nikkei 225 up 4.1%. Value sectors also generally beat growth.

That said, the main trend of note over recent months remains the rebound in US/growth/technology relative performance, in line with the market bounce back since early April. Despite the risk-on tone over this period, small caps have refused to outperform so far.

Global week ahead: FOMC & payrolls

Despite Trump’s cajoling, the Fed is widely expected to leave rates on hold when it meets this week – with interest centred on the degree to which it signals a potential rate cut in September. With trade deals being completed, I think there’s some chance we could see a “dovish hold” this week, with the Fed exciting markets about a potential rate cut at the September meeting.

The US payrolls report on Friday is expected to show the labour market remains firm but its strength is gradually easing – with a gain of around 100k jobs expected although the unemployment rate is forecast to lift from 4.1% to 4.2%.

The US earnings season also rolls on this week with four Mag-7 stocks – Microsoft, Meta, Apple and Amazon – reporting.

Australian week in review

Local stocks pulled back last week after a strong prior week – but are likely to enjoy a good start this morning on reports of a US-Europe trade deal.

The major local highlight last week were the minutes to the recent RBA Board meeting. A key takeaway was the apparent desire of the Board to lower rates in a “cautious and predictable” manner, which is consistent with my view that it will likely only cut rates on a quarterly basis following confirmation of good inflation results in the quarterly CPI reports – unless a serious local/global growth scare suddenly erupts. That suggests further rate cuts in August, November and February – which would take rates from modestly restrictive to a more neutral level.

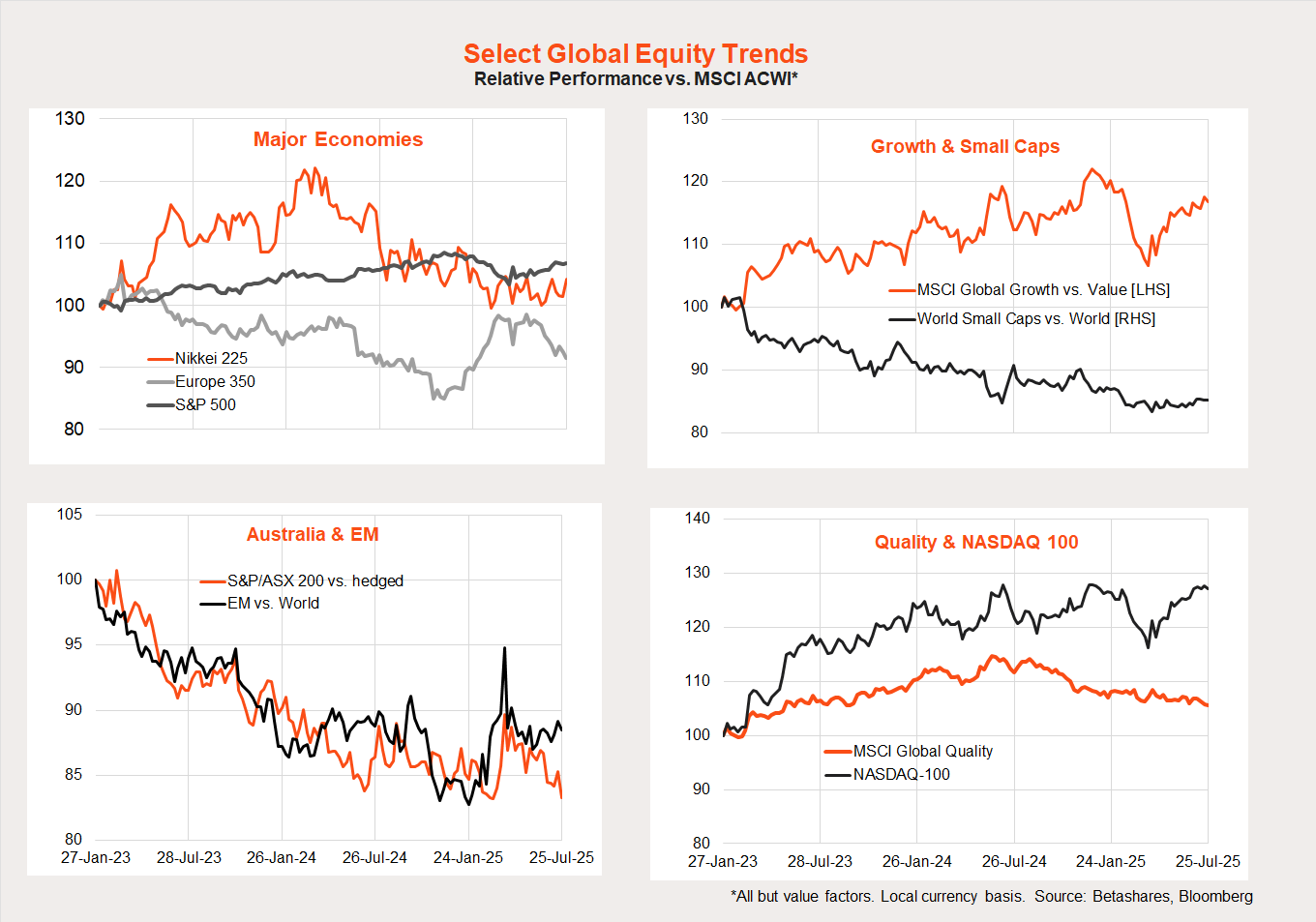

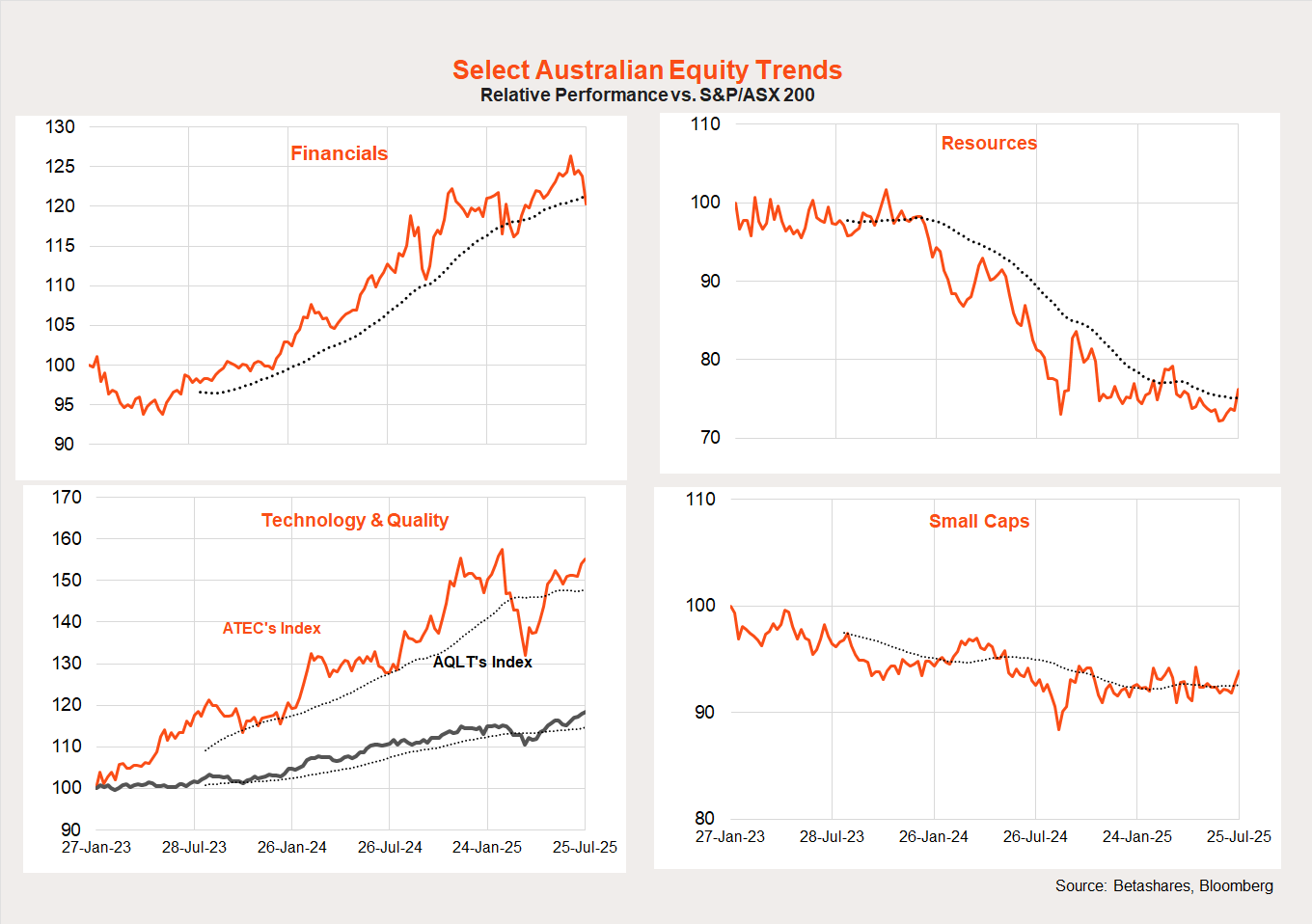

Also of note last week was the Chinese announcement of a major hydro-energy project, which has led to excitement around a potential increase in demand for iron ore. This saw some rotation from financial to material stocks, with the former sector down 3.9% last week and the latter up 2.0%.

As evident in the charts below, financials have beaten resources since early 2023, while technology and quality have also done well. As is the case globally, small caps have so far refused to outperform in this upswing. I’ll keep posting the chart below from now on so as to track shifts within the Australian equity market.

Australian week ahead

It’s a big week in Australia with the long-awaited Q2 CPI report due on Wednesday.

Based on details within the May monthly CPI report, the market anticipates a slightly higher than RBA predicted trimmed mean inflation outcome: a quarterly/annual gain of 0.7%/2.7% respectively. This compares to the RBA’s forecast in the May Statement of Monetary Policy of 0.6%/2.6% respectively. The risk of an untoward upside surprise was one of the reasons the RBA held off cutting rates this month.

That said, a 2.7% annual trimmed mean inflation result should still be good enough to see the RBA cutting rates next month – a 2.8% gain or more will make the decision more difficult.