BlackRock’s bitcoin exchange-traded fund (ETF) is becoming a major revenue generator for the asset manager.

According to Bloomberg, the roughly US$75 billion iShares Bitcoin Trust ETF (IBIT) earns an estimated US$187.2 million in annual fees at a 0.25% expense ratio, surpassing the US$187.1 million from the firm’s core iShares S&P 500 ETF (IVV). IBIT is now the third highest revenue-generating ETF for BlackRock across nearly 1,200 funds, says Eric Balchunas, a senior ETF analyst for Bloomberg.

BlackRock is the world’s largest asset manager with US$11.5 trillion in assets under management (AUM) as of 2024. Its long-established IVV fund, launched in 2000 and based on the S&P 500 index, is one of its cornerstone offering, managing around US$624 billion in assets and charging an ultra-low expense ratio of just 0.03%.

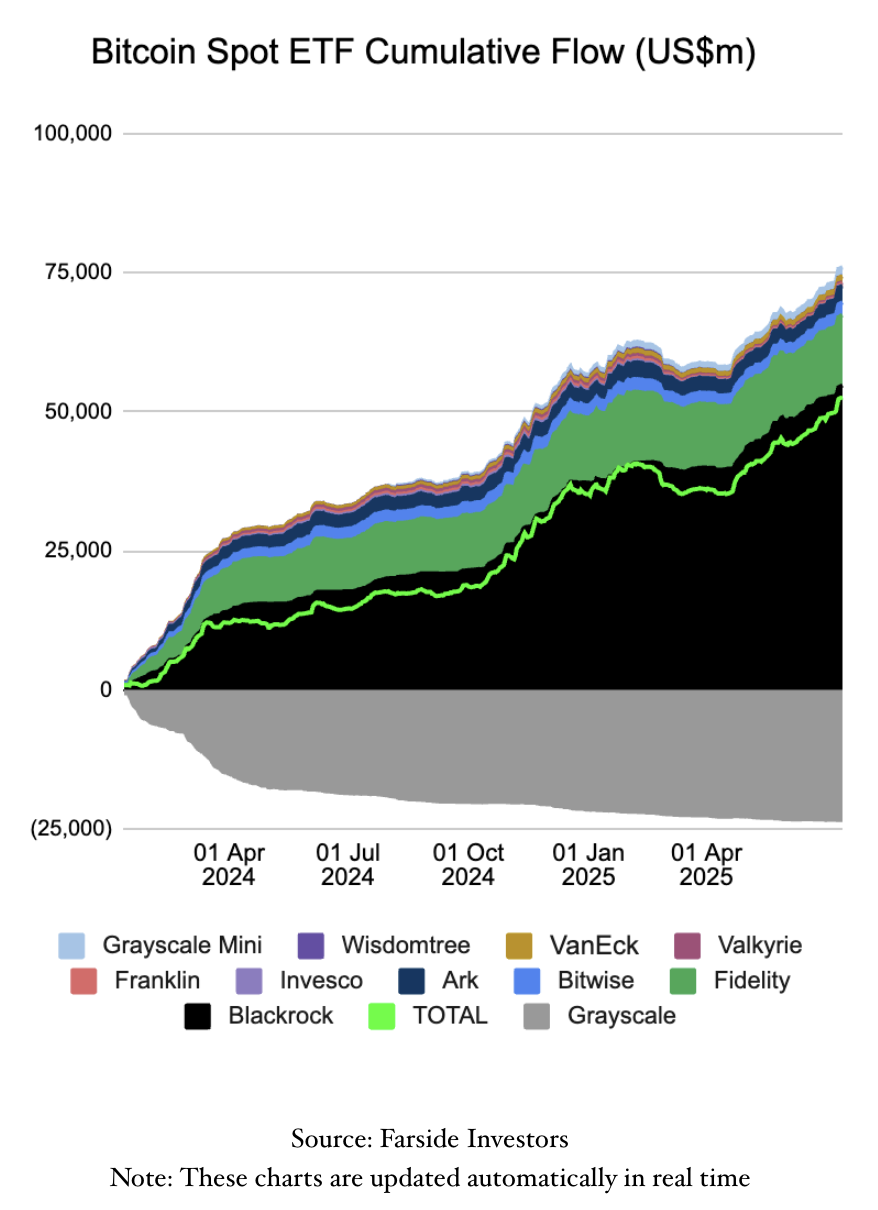

IBIT is BlackRock’s spot bitcoin ETF that allows investors to gain direct exposure to the cryptocurrency. Launched in January 2024, the fund has attracted massive inflows from institutional and retail investors alike at more than US$50 billion, posting a positive net flow for all 18 months except one.

Today, IBIT is the largest bitcoin spot ETF in the world, with over 700,000 bitcoins in AUM, according to Farside data, and now accounts for about 3.52% of total bitcoin share.

“IBIT overtaking IVV in annual fee revenue is reflective of both the surging investor demand for Bitcoin and the significant fee compression in core equity exposure,” Nate Geraci, President at NovaDius Wealth Management, told Bloomberg.

“Although spot bitcoin ETFs are priced very competitively, IBIT is proof that investors are willing to pay up for exposures they view as truly additive to their portfolios.”

IBIT’s fee is in line with other Bitcoin ETFs, which range from 0.15% for Grayscale’s Mini Bitcoin ETF (BTC) to as high as 1.5% for its flagship Bitcoin Trust ETF (GBTC).

Crypto ETF inflows skyrocket

Investor demand for crypto ETFs has surged this year amid a sharp rise in the price of cryptocurrencies. On July 10 and 11, 2025, bitcoin ETFs saw two consecutive days of over US$1 billion in inflows, with a record US$1.18 billion on Thursday alone.

This surge coincided with bitcoin hitting an all-time high of US$119,000 on July 14, 2025, up 57% since April, according to CoinMarketCap data.

Ether ETFs are also seeing record inflows. On July 10, US spot ether ETFs attracted a total of US$383.1 million in net inflows. BlackRock’s iShares Ethereum Trust (ETHA) led with a record of US$300.9 million in net daily inflows, according to data from The Block. Fidelity’s FETH, Grayscale’s ETH and ETHE, Bitwise’s ETHW, and VanEck’s ETHV, registered US$37.3 million, US$20.7 million, US$18.9 million, US$3.2 million, and US$2.1 million in net daily inflows, respectively.

The capital flood has helped fuel the rebound of ether to US$3,000, its highest price in nearly five months.

Favorable regulatory developments

Investors have been anticipating cryptocurrencies to hit fresh records this year as corporate treasuries accelerate their bitcoin buying sprees and the US Congress nears the passing of new crypto legislation.

The US House of Representatives began deliberations on a series of crypto bills this week in what has been dubbed “Crypto Week.” The potential laws are aimed at providing a clearer regulatory framework for the digital asset industry.

Meanwhile, the US Securities and Exchange Commission (SEC) recently released guidance clarifying how issuers of crypto asset exchange traded products (ETPs) such as bitcoin and ether ETFs should comply with US federal securities disclosure laws.

This clarity could lead to an influx of applications for crypto ETFs for assets such as Solana, and Ripple’s XRP, experts told Fortune.

“The floodgates are basically completely open right now as to what can be introduced,” Andy Martinez, CEO of Crypto Insights Group, a digital asset data provider, told the media outlet.

“It’s quite a long process, and with guidance like this, part of the initiative is to reduce that time to launch significantly […] We anticipate seeing much more capital coming into the crypto investment products.”

Crypto ETFs first emerged in the US in early 2024, with the SEC approving 11 spot bitcoin ETFs that saw US$4.7 billion in trading volume on day one. Ethereum ETFs followed in July 2024.

These products have gained traction by making it easier for investors to gain exposure to cryptocurrencies through traditional stock exchanges and familiar brokerage accounts. With crypto ETFs, investors no longer need to buy, store, or manage cryptocurrencies directly, benefiting instead from familiar trading processes.

As of July 07, there were 76 ETFs listed in the US that track crypto spot and future prices. Bitcoin and ether products made up the overwhelming majority of crypto ETFs, according to Fortune.

Featured image: Edited by Fintech News Switzerland, based on image by thanyakij-12 via Freepik