EU & US Strike 15% Tariff...

Trump’s latest EU trade deal may have dodged disaster, but it slaps a costly 15% price tag on Europe—and risks turning allies into adversaries. In a high-stakes meeting on July 27, 2025, at President Trump’s Turnberry golf resort in Scotland, U.S. President Donald Trump and European Commission President Ursula von der Leyen unveiled a landmark trade framework according to BBC News. The…

Read More

Filtronic: a UK success story cashing...

London’s Aim small-cap market is down 40% since mid 2021, but within that there has been a wide disparity of outcomes. Many 2021-vintage initial public offerings (IPOs) are down 80% or more. Yet one Aim-listed stock looks to have achieved escape velocity, having rocketed 28-fold since May 2021. Interestingly, Filtronic (Aim: FTC) is not a start-up or even a recent…

Read More

How to use SAYE and SIP...

Are you looking for new ways to save for the medium to long term beyond obvious options such as individual savings accounts (ISAs) and private pensions? If you work for one of the 1,000-plus employers in the UK that offers an employee share scheme, joining it could make sense. These schemes, which must be aimed at all employees (not just…

Read More

8 of the best houses for...

Image 1 of 1 (Image credit: Savills) Belgrave Crescent, West End, Edinburgh. A renovated B-listed Victorian townhouse near Murrayfield, Scotland’s national rugby stadium. It has period fireplaces, wood floors and a state-of-the-art kitchen overlooking the walled garden. 3 bedrooms, study/bedroom, 4 bathrooms, 2 receptions, wine cellar, courtyard. Price: £1.6m+ Savills 0131-247 3770. Image 1 of 1 (Image credit: Antony Roberts)…

Read More

Profiting from private markets has become...

Global financial markets have undergone a seismic change in the last 30 years. The number of public companies has slumped from a peak of 7,300 in 1996 to 4,300 today. Companies are delisting and initial public offerings (IPOs) have slowed to a crawl, with many firms choosing to stay private for longer, or never list at all. This shift has…

Read More

Sizzling sales at Sysco – should you...

Sometimes the best opportunities don’t come from firms in glamorous, fast-growing industries, but from well-run companies that have carved out a niche for themselves in lower-profile, but no less profitable, sectors. An example of this is food distribution, which involves making sure that food from producers, both ingredients and prepared meals, reaches wholesale customers such as restaurants, and large institutional…

Read More

Mira Murati: a trailblazer in AI...

When all hell broke loose at OpenAI in November 2023 – during the bitter boardroom fight over the company’s future that saw Sam Altman briefly ousted – chief technology officer Mira Murati stepped in to hold up the tent. Now she has a gig of her own. Having “fled” OpenAI with a group of its top researchers, the Albanian-born whizz…

Read More

Looming debt crisis could blow up...

“Sire… worse than a crime, you have committed an error,” said Charles Maurice de Talleyrand-Périgord. A crime is whatever the feds say it is. Often not what you think it ought to be. But an error is different. It is a left turn when you should have turned right. It is forgetting your wife’s birthday. It is a budget deficit,…

Read More

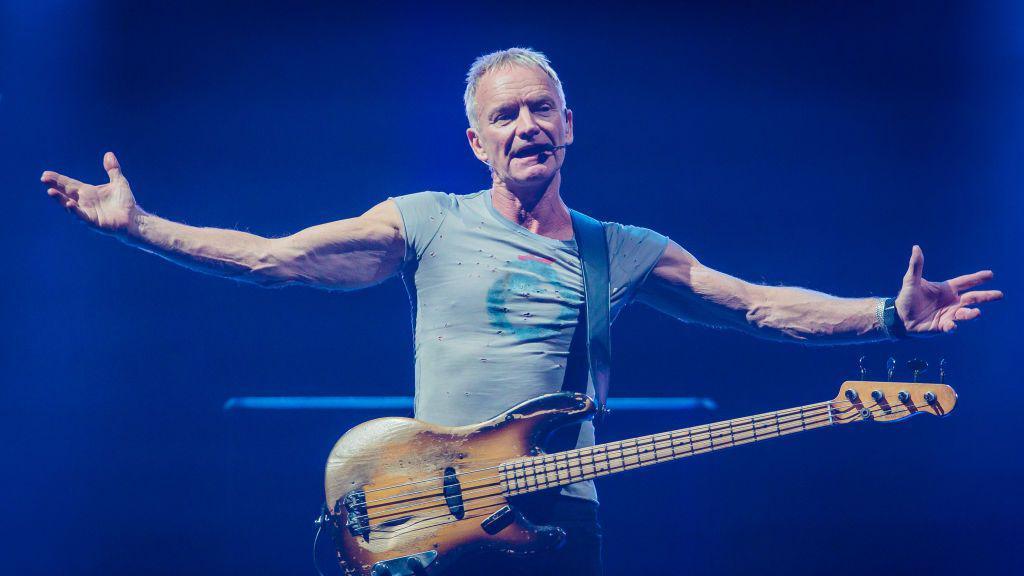

How The Police Legend Built His...

From The Police to Tuscany: Inside The Real Story Behind Sting’s $550 Million Fortune. What is Sting’s Net Worth? As of 2025, Sting, is estimated to be worth $550 million (£410 million). This figure is supported by multiple reports, including Yahoo Finance, and aligns with Finance Monthly’s own analysis based on catalog sales, touring income, and real estate holdings. Best…

Read More

How to balance income and growth...

Income has historically been one of the best-performing investment strategies. The average annualised return of dividend-paying stocks in the S&P 500 between 1973 and 2024 was 9.2%, compared with 4.3% for non-dividend-paying stocks, according to a study by Ned Davis Research. What’s more, dividend payers were less volatile and offered more protection during market downturns. In 2022, when the S&P…

Read More