Financial advice for families: Overcoming challenges!

If you have children, you are suddenly responsible for more than just yourself. The financial decisions become more complex, the effects more long-term. Optimizing family finances means much more than just drawing up a budget – it’s about a well thought-out strategy for the next 20 years. The most important things at a glance Loss of income after the birth…

Read More

Preserve Your Purchasing Power: Is the...

Due to the concerns about the stability and purchasing power of the US dollar over the past few years, an increasing number of Americans have diversified their investment portfolio internationally, with a strong preference for investing using Swiss francs. As a Swiss wealth management firm that serves US-based investors, we are frequently asked questions like: How can I hedge my…

Read More

Portfolio Strategy: Market Capitalization vs. Equal...

When building an equity portfolio, sooner or later a fundamental question arises: how much weight should be given to each individual position in the portfolio? This question is by no means trivial, as the weighting influences not only the risk structure of a portfolio, but also its rebalancing logic, performance and robustness across different market phases. Two strategies are particularly…

Read More

Financial consulting Team leadership: Development &...

The appointment calendar is overflowing, the waiting list for new customers is getting longer and longer. What initially sounds like a luxury problem quickly turns into a strategic challenge. Sooner or later, successful financial advisors are faced with the decision: should I continue to operate as a lone wolf or take the plunge and become a team-based company? This transformation…

Read More

FINANCIAL MARKETS DEEP DIVE – LFA

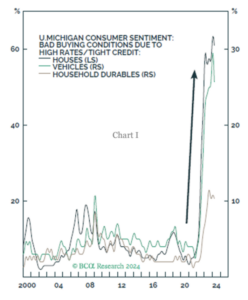

“The Fool in the Shower” – Milton Friedman, Nobel Laureate ECONOMY: RECESSION PROBABILITIES RECEDING, BUT NOT ZERO Imagine yourself taking a shower. The water is too cold thus, you turn on the hot water. After a few seconds (and a few shivers), the water is still cold. Irritated and chilled to the bone, you boost the hot water even more.…

Read More

The Swiss View

First and foremost we hope that you and your loved ones are healthy and safe. We currently find ourselves in unprecedented and historic times. In addition to being stressed by the plummet of the stock market, we are all going through personal struggles and the fear of the unknown related to COVID-19. We are worried about the health of our…

Read More

Financial Markets DEEP DIVE – LFA

“We really can’t forecast all that well, and yet we pretend that we can, but we really can’t.” – Alan Greenspan, ex-chairman of the Federal Reserve ECONOMY: The illusion of control versus the wisdom of crowds. Overconfidence, or the illusion of control, is one of the many pitfalls in behavioural finance that describes the tendency of people to overestimate their…

Read More

The investor vs. entrepreneur mindset. Key...

In the dynamic world of finance, understanding the ‘Investor vs. Entrepreneur’ dichotomy is crucial for anyone looking to make their mark in investments. There are fundamental differences in the way investors and entrepreneurs think about the world of investment. This exploration into the entrepreneurial mindset will not only reveal these distinct approaches but also equip you with valuable insights and…

Read More

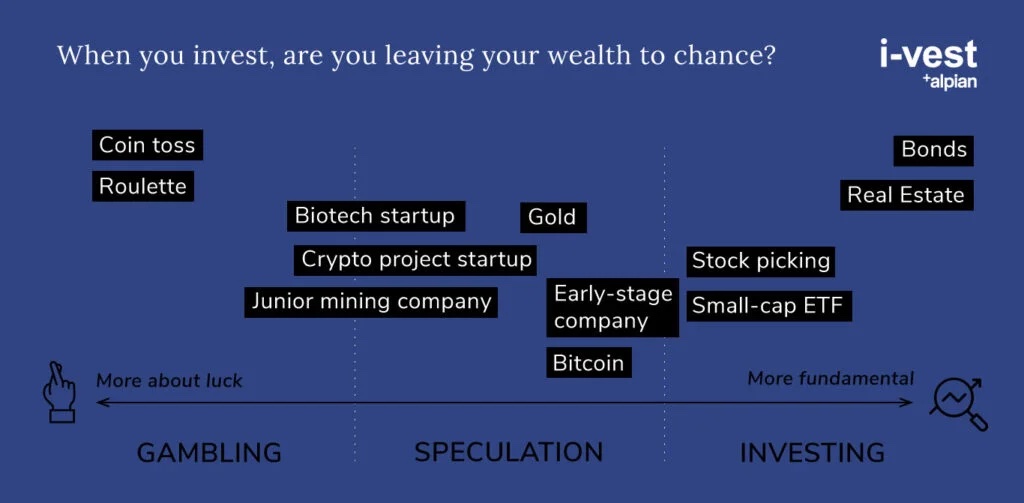

Gambling, investing & speculation – we...

When you invest, are you leaving your wealth to chance? Let’s take a closer look at investing, gambling and speculation to understand the fundamental differences between the three. And the common thread that ties them together. To an outsider, the stock market may look a lot like gambling. In fact, that view may be the default for anyone who grew…

Read More

Financial Markets DEEP DIVE – LFA

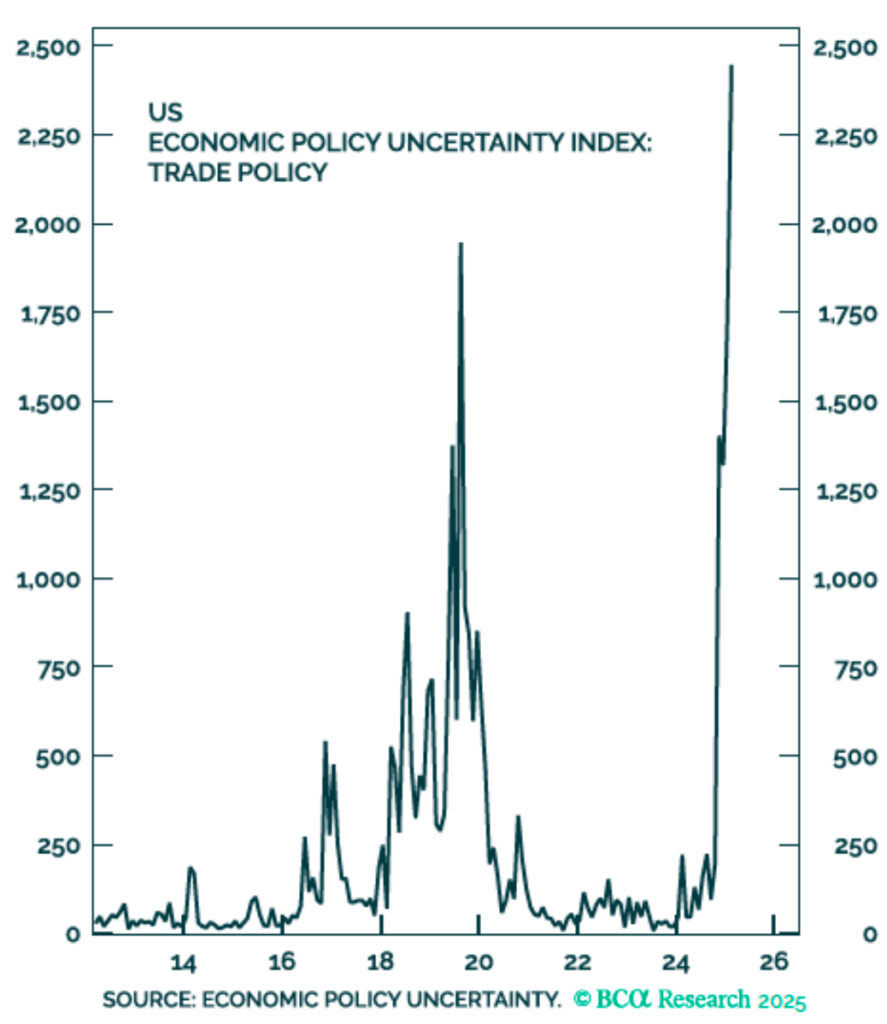

“It takes 20 years to build a reputation and five minutes to ruin it.” – Warren Buffett, Investor ECONOMY: THE SPECTRE BACK IN THE CLOSET? What a week! I must be honest; at one point I was skeptical about even writing our usual quarterly update. If Goldman Sachs changes its economic view within an hour, moving from recession to no…

Read More