Saving vs. investing: 9 tips to...

9 Tips for saving and investing Most of us are aware that investing your money means ending up with more than what your piggy bank can store. But it can be surprising to see the difference between saving and putting your money to work – by which we mean investing even in low-risk, low-return products. Let us dive into a…

Read More

Financial advice for companies: The biggest...

The Swiss economic landscape is characterized by dynamism and change. In this environment, companies of all sizes are faced with the task of optimally managing and deploying their financial resources. However, the demands placed on professional financial management have increased significantly in recent years. Regulatory requirements are becoming more complex, digital technologies are changing business processes and international competition is…

Read More

The Worldwide Inflation Dilemma – Miller...

Inflation is increasing prices and a fall in the purchasing value of money. Banks and governments make inflation sound complicated as it serves their interest. It’s a hidden tax. Government-created inflation weakens the value of the currency, our money buys less. Anyone shopping goods, services, airline tickets, an automobile, clothing, and particularly medical care is seeing significant price increases. While…

Read More

Investing in ETFs: Understanding the basics

What you should know about ETFs It is always great to start on a lighter note, that note being that the advantages of investing in ETFs are their affordability, transparency and that they are liquid. There are now many providers who include ETFs (Exchange Trade Funds) in their portfolio and demand is constantly growing. If you are someone who prefers…

Read More

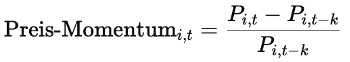

Momentum as a Return Factor: Significance...

Systematic investing using quantitative factors has become established in modern portfolio theory. One of the best documented and most widely used factors is the momentum factor. It describes the tendency of investment instruments such as shares to continue price trends: Shares with strong relative performance over a defined period of time are more likely to achieve above-average returns in the…

Read More

Cleantech in 2025: Seizing the Investment...

Published on 20 December 2024 Cleantech is at a pivotal point. On the one hand, we’ve seen the political agendas seemingly turning their back on cleantech companies. The future US government explicitly favours geopolitical and economic topics and at times even overtly backs dirty technologies. Fuelled by a world wrapped up in global conflict, cleantech stocks have been under pressure…

Read More

What Does Really Matter? – Miller...

Recently our friends at WHVP published an eye-opening article, The Swiss View: “It doesn’t really matter that much” discussing Fitch downgrading the US credit rating: “Fitch announced that they downgraded the credit rating from the U.S. from AAA to AA+. ….(citing) the suspended debt ceiling and the high debt-to-GDP ratio. …. While the announcement itself is already worrying, it is…

Read More

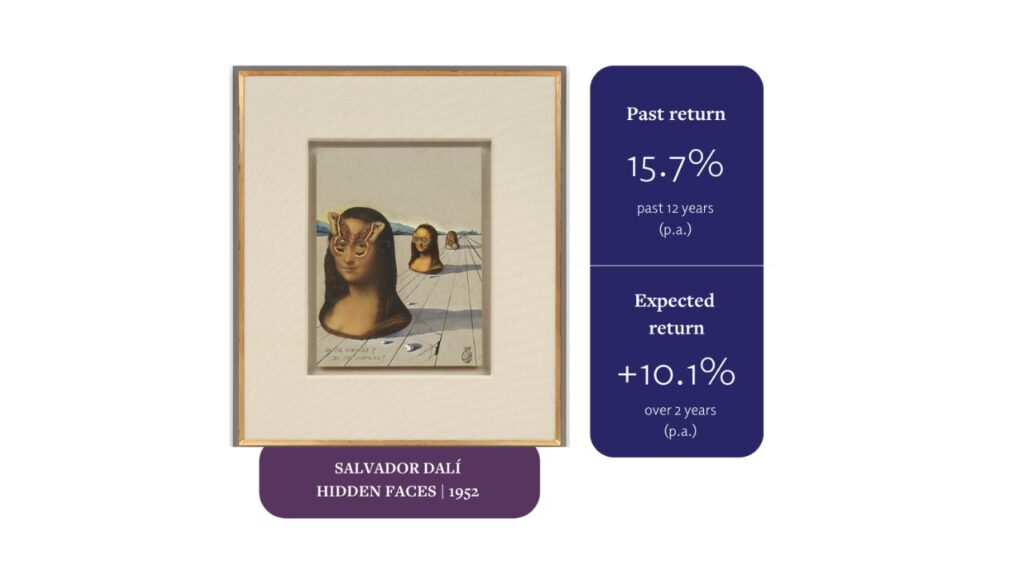

Alternative investments to diversify your portfolio:...

Alternative investments have long been the stronghold of the ultra-wealthy. Wealthy individuals have up to 50% of their assets in alternative investments, but they are now becoming accessible to a broader range of investors, including those traditionally not involved in these markets. As the landscape of investing evolves, understanding the nuances and benefits of alternative investments can significantly diversify and…

Read More

Swiss Banking for US Citizens: 4...

As more wealthy Americans consider moving a portion or all of their assets overseas, Switzerland has re-emerged as a preferred destination for its long-standing reputation as a global banking and asset protection hub. Yet for U.S. citizens who want to invest in Switzerland, opening and maintaining a Swiss bank account isn’t as straightforward as it once was. According to Henley…

Read More

Financial consulting target groups: Specialization for...

Most financial advisors make a crucial mistake: they try to win over every customer. But if you try to appeal to everyone, you end up reaching no one properly. Clever specialization in certain target groups, on the other hand, brings measurably more success – and makes the work more efficient. The most important things at a glance Focus pays off:…

Read More