How to maximise your retirement and...

Get directly to When it comes to retirement planning, it’s easy to focus on the here and now and put off thinking about the future. But the lifestyle you want in your retirement starts with the choices you make today. Whether you’re self-employed without a pension fund or simply looking to strengthen your financial future, pillar 3a is the way…

Read More

We Can No Longer Afford To...

The world is in turmoil. Governments worldwide are ruling against the will of the majority and things are coming to a head. Richard Maybury tells us: “There is simply no end in sight to the big Ukraine and Israeli bloodbaths, plus a high likelihood that the power junkies in DC and Beijing will slug it out in order to frighten…

Read More

FINANCIAL MARKETS DEEP DIVE – LFA

Turning to credit, our stance remains unchanged compared to our Q1 update. On the one hand, the prospects of continued economic growth (which we deem possible, but not certain) justify an exposure to lower credit (and higher yielding) companies. On the other hand, the valuations of the latter are very unattractive – the risk/reward profile is poor – and the…

Read More

AMC types compared: the most important...

Actively managed certificates (AMCs) are experiencing double-digit annual growth in the Swiss financial market. The diversity of these products is considerable. Each type of AMC offers specific advantages for different investment strategies. With cost advantages of up to 30-50% compared to traditional fund structures and a time to market of only 2-3 weeks, AMCs are becoming increasingly important. The most…

Read More

Top 11 tips for investing money...

Do you want to know how you can invest money so it will grow and multiply in the future? No matter your age, the amount you hope to earn, or how long you plan to invest, you’ve already made an important first step by deciding to invest. Well done! Now, you might be wondering: Where do I start? What are…

Read More

How do I need to tax...

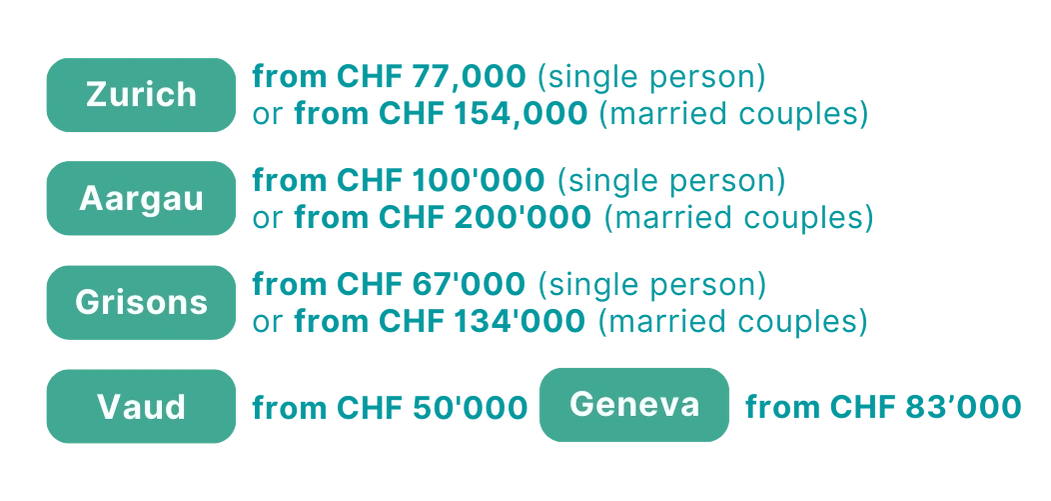

Wealth Tax The total value of your findependent investment solution is subject to wealth tax, just like all other movable assets (e.g., jewelry, cars, bank balances) and immovable assets (e.g., real estate). Exempt from wealth tax are pension fund assets, vested benefits accounts, and pillar 3a accounts. In most cantons, there is a tax-free allowance or similar exemption for wealth…

Read More