Top 10 at 11: ASX smacked,...

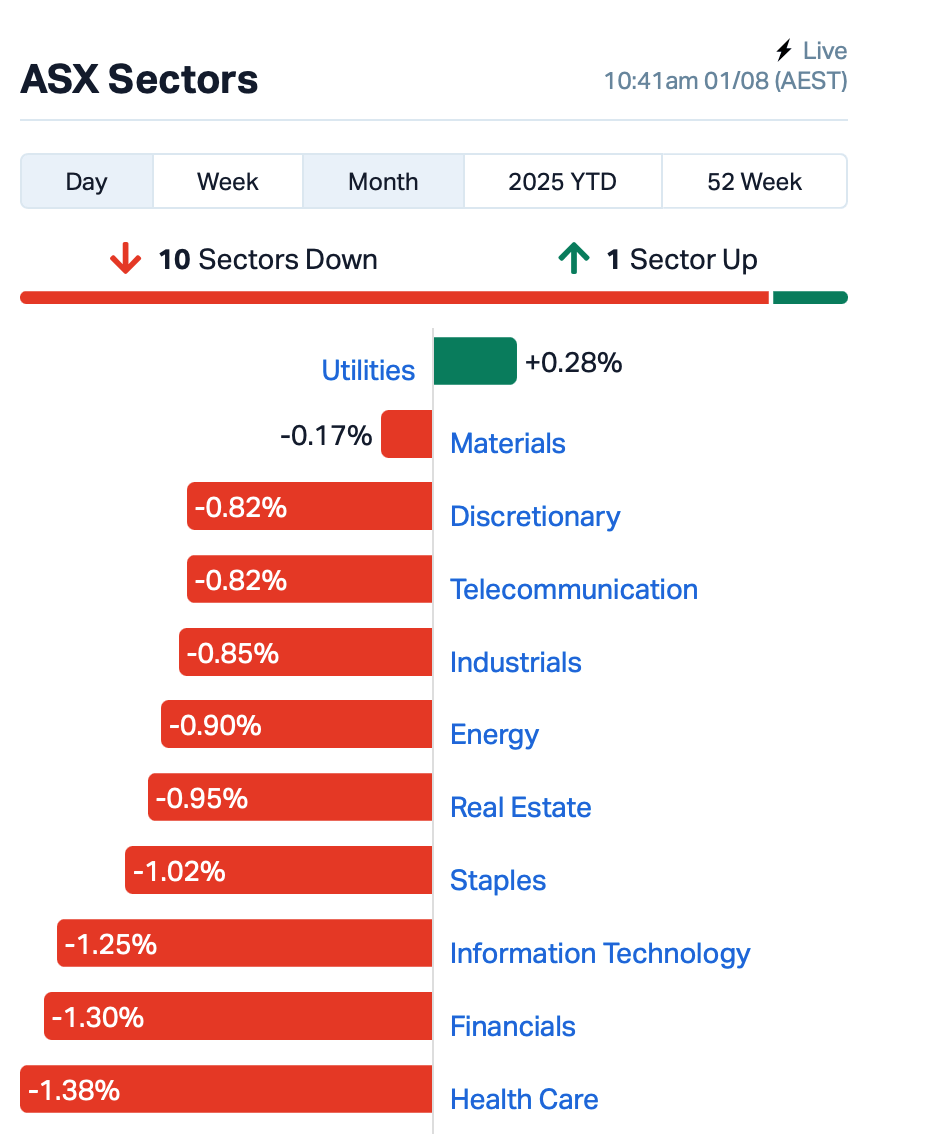

ASX Smacked, But We Dodged the Trump Bullet. Picture via Getty Images Morning, and welcome to Stockhead’s Top 10 (at 11… ish), highlighting the movers and shakers on the ASX in early-doors trading. With the market opening at 10am sharp eastern time, the data is taken at 10.15am in the east, once trading kicks off in earnest. In brief, this…

Read More

Everything you need to know about...

Adoption of battery storage is rising greatly. Pic: Getty Images Battery storage adoption growing in Australia as federal government rebates go live Lithium-ion batteries of different specific chemistries continue to dominate New technologies promising to increase energy capacity, power and safety Battery storage has been in the limelight with increasing frequency due in no small part to the Australian…

Read More

Disorder to go: Tackling the deadliest...

With incidences of eating disorders almost doubling among kids aged 10-19, treatment options beyond psychotherapy are sorely needed. Pic: Getty Images. Eating disorders are among the deadliest mental health disorders Prevalence among kids 10-19 has almost doubled in last decade Eating disorders cost Australia $67 billion every year in economic and wellbeing losses We’ve all had those thoughts. Maybe…

Read More

Rise and Shine: Everything you need...

Everything you need to know before the ASX opens. Pic: Getty Images. Good morning everyone and welcome to Rise and Shine on Friday, August 1, 2025. Here’s what you should know before the ASX opens today… At 7am AEST, ASX futures were down 0.7%, pointing to a wobbly end to the week for Aussie investors. Here’s what went down while…

Read More

Pure Hydrogen signals a name change...

Pure Hydrogen looks to its future, proposing a sleeker new name and rebrand. Pic: Getty Images Pure Hydrogen proposes name change to Pure One, as it focuses on commercial transport solutions Company’s operations set on supply of BEV and HFC vehicles along with hydrogen equipment Introduction of new hybrid coach and rigid truck to provide customers with more options to…

Read More

The Fed didn’t move – but...

This is not a time for investors to be passive, believes Nigel Green. Pic via Getty Images The Federal Reserve did exactly what markets expected midweek: it held rates steady. No surprises, no fireworks. But investors looking only at the surface risk missing what really matters, writes Nigel Green. Beneath the calm lies a shift that’s already underway, and the…

Read More

Health Check: Today’s flood of last-minute...

Today’s last-minute quarterly reporters give paws for thought. but there’s no ‘dog ate my homwork’ excuses. Pic via Getty Plenty of biotechs are lodging late in the piece, but without too many ‘dog ate my homework’ excuses Telehealth group looks to post-pandemic recovery Botanix, Amplia and Vitrafy pass muster with the brokers Some students hand in their homework with…

Read More

Lunch Wrap: ASX struggles as copper...

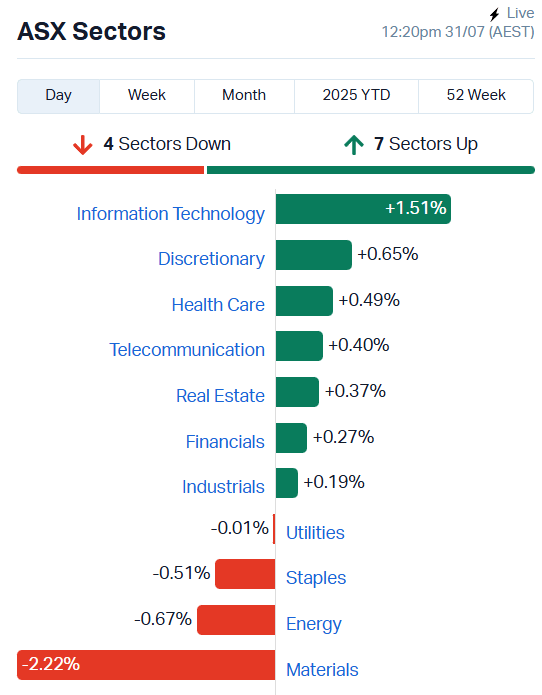

The ASX is reeling from a sharp slap down in copper prices, which plummeted 20pc after the US signalled the metal wouldn’t be subject to high tariffs. Pic: Getty Images Resources lead losses, down more than 2pc Copper tariff exemption slams prices down 20pc Info tech offers resistance, up 1.58pc By Thursday lunchtime in the east, the ASX had…

Read More

Geopacific’s Woodlark gold project set for...

Geopacific Resources has kicked off a 30,000m drill program at the 1.67Moz Woodlark Gold Project in PNG while its DFS remains on track for Q4 2025 Surface auger results confirm the high-grade potential of Woodlark and an independent study has identified possibly game-changing copper-gold porphyry targets Geopacific is in a strong position with $32.3M cash in hand and mid-tier miner…

Read More

ASX Health Quarterly Wrap: PainChek grows...

PainChek is scaling its presence in the global aged care market. Pic via Getty Images It’s 31 July, marking the official close of the June quarterly reporting period under ASX Listing Rules. For healthcare companies, these filings set the stage for full-year financial results following the end of the Australian financial year. Investors have been watching closely for signs of…

Read More