Why Australian dividend investors are turning...

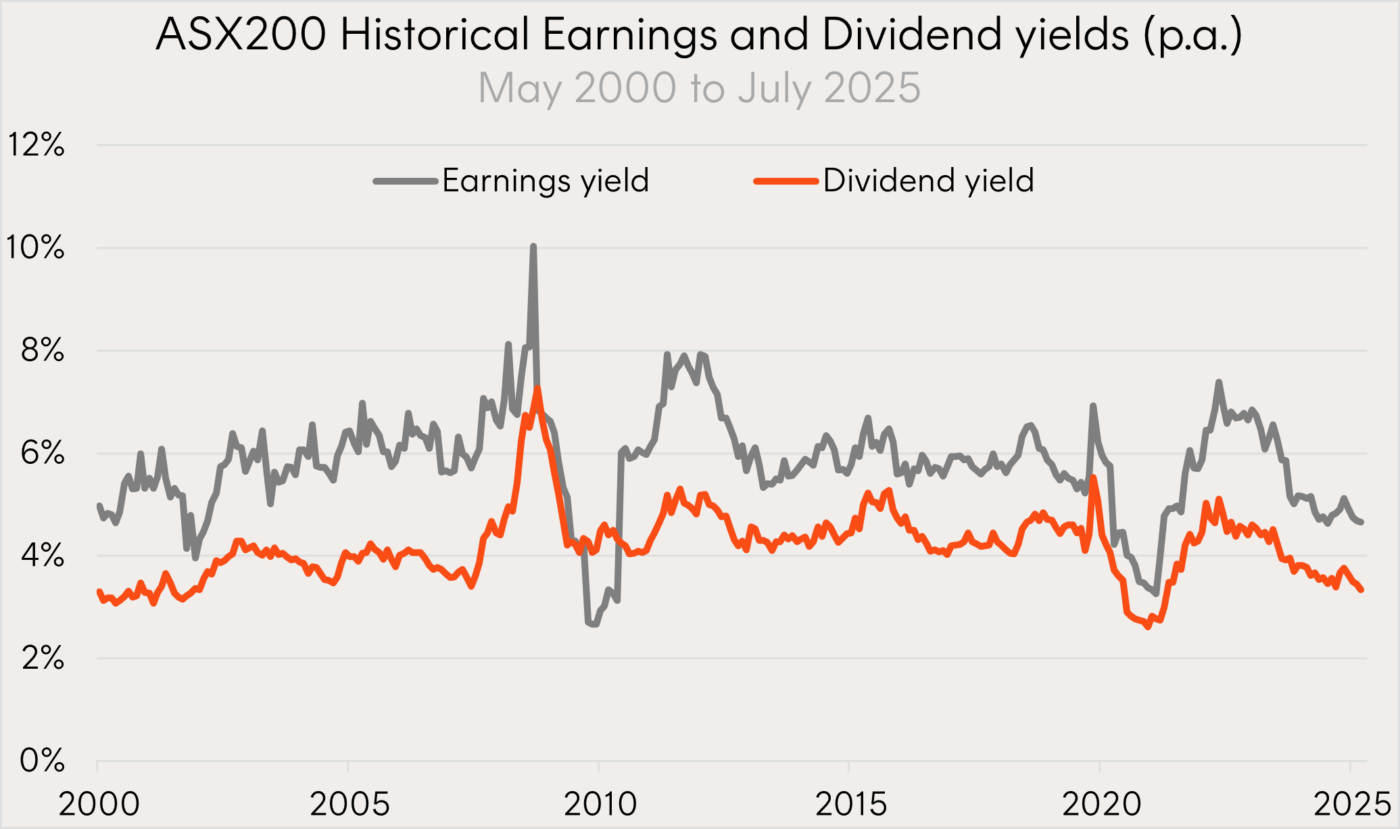

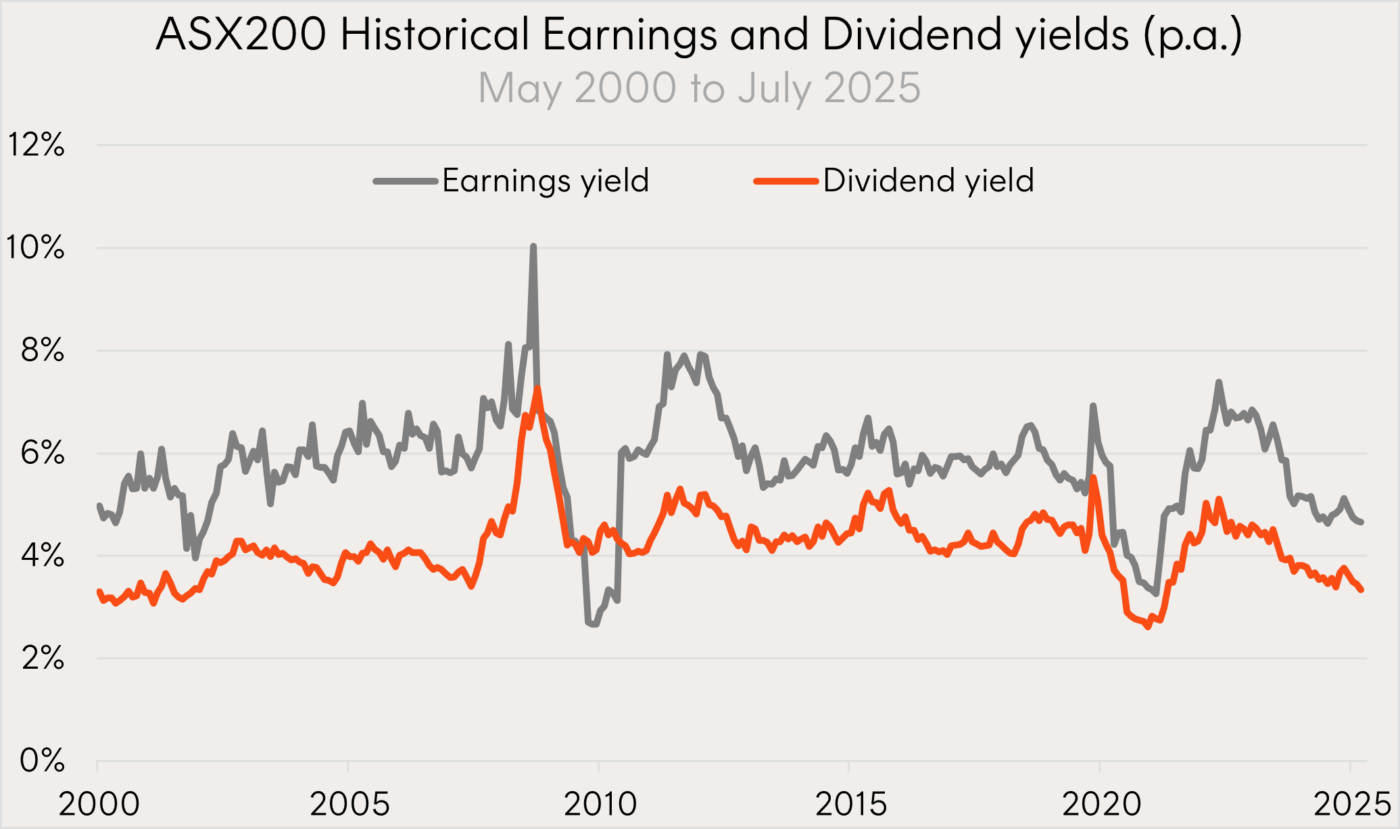

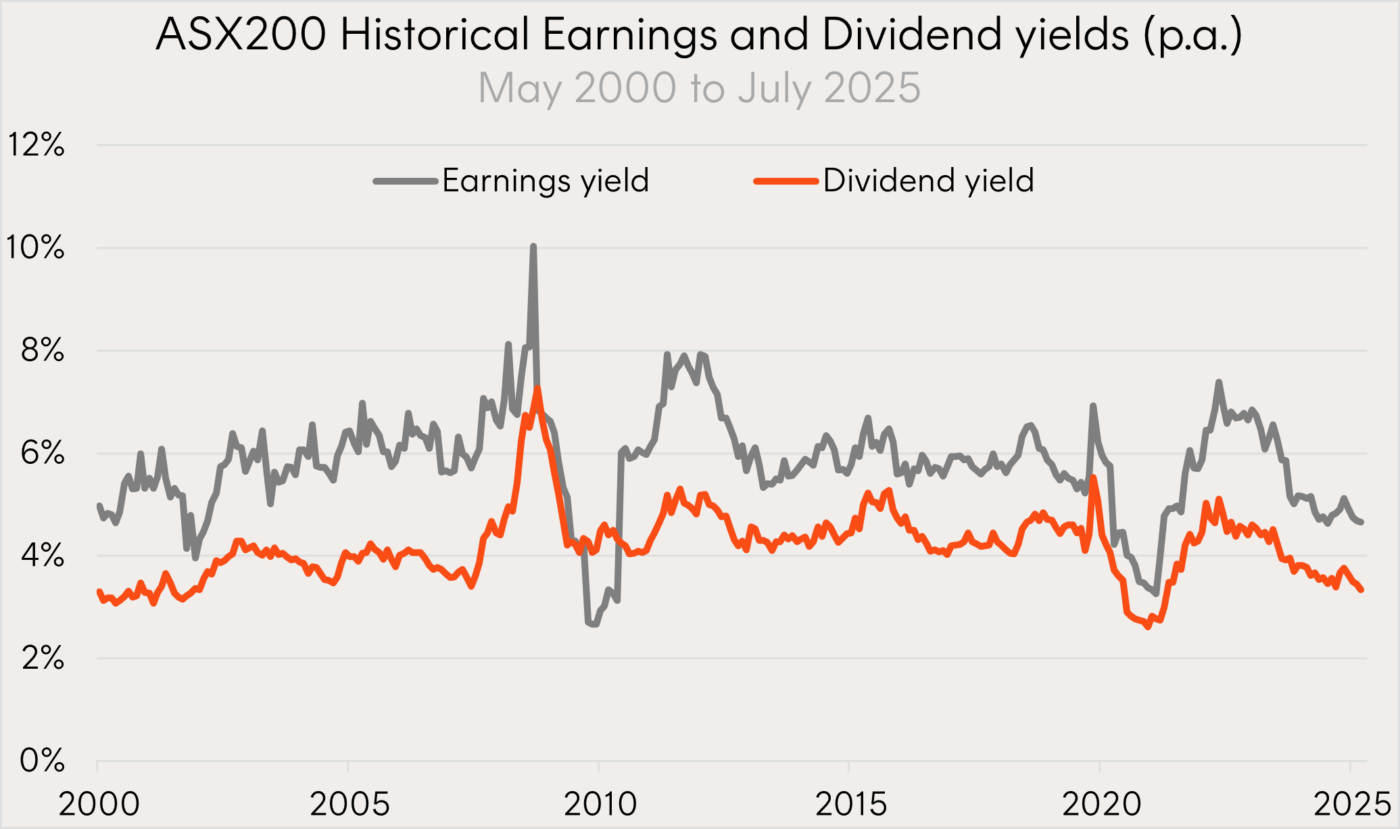

Australia boasts one of the highest yielding share markets in the world, but the dividend yield on the ASX200 has fallen significantly and is now below 3.5% p.a. Aside from the Covid dip, we haven’t had another time in the last 50 years where both the ASX dividend yield and RBA cash rate were below 4% at the same time.…

Read More

Bank of mum and dad: Reverse...

Reverse mortgages “for the win”? That depends on cashed-up Boomers. Pic via Getty Images The bank of mum and dad is going to new extremes to help their adult children get ahead. No longer is it enough to dip into their own pocket to cobble together a deposit or go guarantor on a home loan; retirees are increasingly locking themselves…

Read More

A more intelligent approach to Aussie...

Australia boasts one of the highest yielding share markets in the world, but the dividend yield on the ASX200 has fallen significantly and is now below 3.5% p.a. Aside from the Covid dip, we haven’t had another time in the last 50 years where both the ASX dividend yield and RBA cash rate were below 4% at the same time.…

Read More

Stocktake: Power looks to expand niobium-REE...

Stockhead’s Tylah Tully unpacks Power Minerals (ASX:PNN), who have kicked off a 1000 metre drilling program at the Santa Anna project in Brazil, hunting for broad zones of niobium and rare earths. The second-phase auger program will allow Power to rapidly drill new untested target areas and provide additional data as part of the company’s due diligence process for the…

Read More

Too Much of a Big Nothing

So much investment has gone into AI that anything less than spectacular results will look like failure. One estimate is that the Mag 7 would have to make $600 billion in revenue to make sense. Two companies — Nvidia and Microsoft — each are worth more than $4 trillion. Together, that’s more than India’s and Japan’s combined annual output. Price…

Read More

Why Australian dividend investors are turning...

Australia boasts one of the highest yielding share markets in the world, but the dividend yield on the ASX200 has fallen significantly and is now below 3.5% p.a. Aside from the Covid dip, we haven’t had another time in the last 50 years where both the ASX dividend yield and RBA cash rate were below 4% at the same time.…

Read More

Tuned in together: Audeara and ESIA...

The two entities aim to enhance access to hearing support for children in classroom settings. Pic via Getty. Audeara partners with Ear Science Institute Australia to advance bone-conduction hearing solutions for high-need Australian communities Solutions send vibrations through the skull to bypass eardrum, enabling users to hear audio while staying aware of ambient sounds The project starts this month and…

Read More

The hidden gems of the investing...

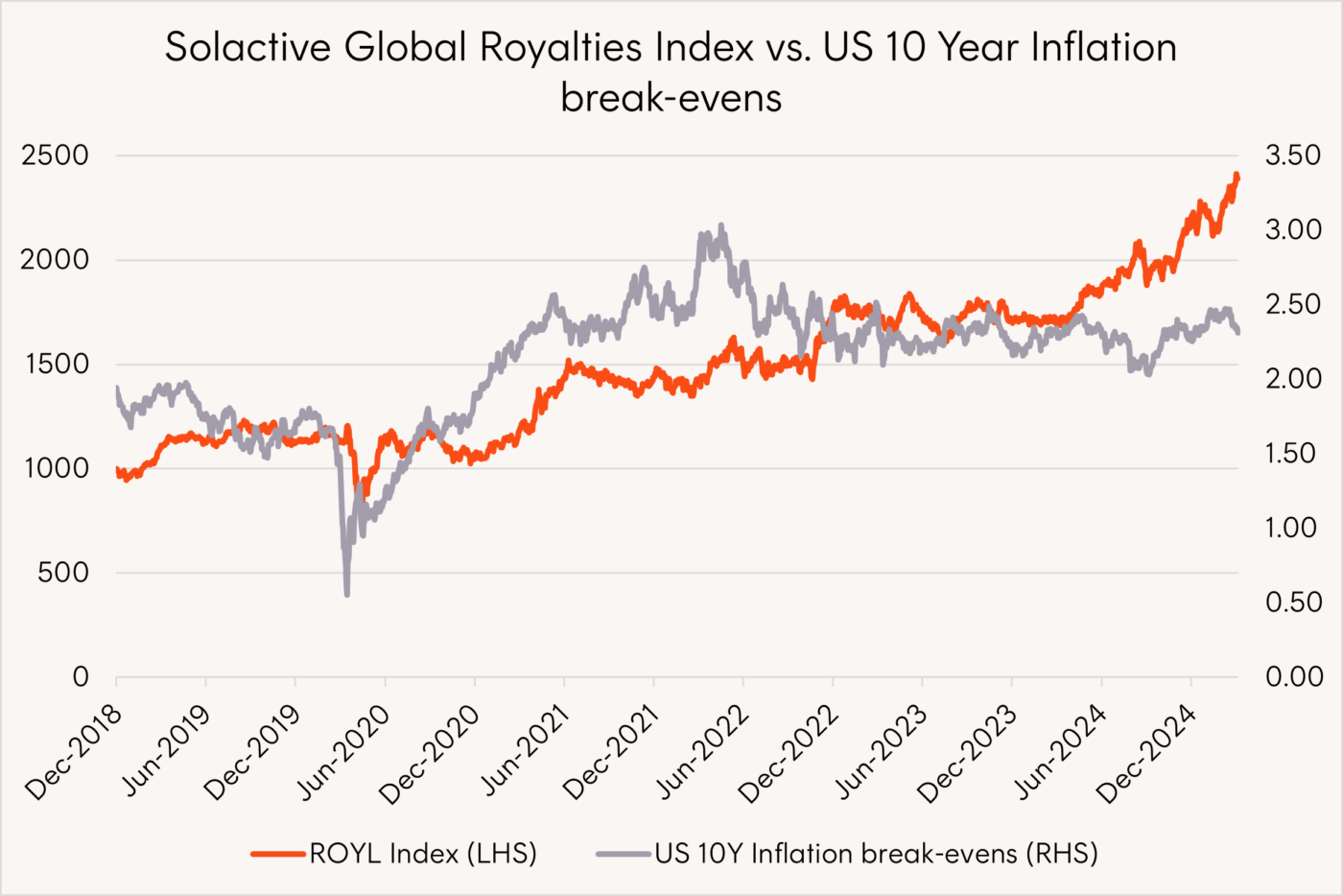

In part two of this series, we delve into the unique investment characteristics of royalty companies, how they can fit into investor portfolios, and their potential to increase income and improve overall risk adjusted returns for investors. Why include royalty companies in your portfolio? As we discussed in part one, royalty companies are often considered resilient, capital efficient business. Since…

Read More

EBR gains key US reimbursement for...

EBR achieves key reimbursement for its WiSE CRT System in the US. Pic via Getty images. US Centers for Medicare & Medicaid Services approves EBR’s WiSE CRT System for Medicare inpatients under new technology add-on payment Payments will be provided in addition to standard Diagnosis Related Groups payments for the procedure Reimbursement to start on October 1, coinciding with EBR’s…

Read More

‘Rage bait’ is burning you out...

It’s far too easy to fall for the bait. Pic: Getty Images. Rage bait content is everywhere, and no matter how ridiculous the take, it still manages to anger or upset us. Here’s how to stop it from damaging your mental health. Words by Sarah Mitchell for Body and Soul No matter how often we scroll social media, the speed…

Read More