Kalgoorlie’s Super Pit is two years into a three-year expansion planned to set it up for decades. Pic: Josh Chiat

- Diggers and Dealers has begun in Kalgoorlie, with a key question. Is the boom real for gold miners?

- While gold prices and margins are at record highs, guidance misses and rising costs could eat into cash flow

- Northern Star Resources remains confident its expansion of the Super Pit and build of the Hemi gold mine will leads to decades of riches

Gold’s run to an all time high – actually a succession of them – has thrust investor eyes squarely on the gold capital of Kalgoorlie today, where thousands of investors, contractors, fund managers, stockbrokers and media will circle for the start of the Diggers and Dealers Conference.

An annual temperature check of the mining industry’s undeniably fickle trends, the composition and mood of the crowd and presenters provides a xerox of the shape of the industry’s key commodities, favouring battery metals one year, precious metals the next.

The most common refrain in the lead-in has been that gold miners remain undervalued.

But there are concerns rippling through the investment sector that while times are good and cash is piling up in the balance sheets of gold miners enjoying ripping prices today of US$3350/oz ($5200/oz Aussie), that the good times could be squandered.

Margins have been sharply increasing in the past year, tripling across 2024 and gaining further ground in 2025 as war, trade disputes and gold’s status as a safe haven asset sent prices roughly 30% higher across the first six months of the year.

Yet costs have begun to creep and a string of capex increases and negative guidance updates has spooked investors over the June reporting season. Since hitting an all time high on June 13 of 13,222, the All Ords gold sub-index is down close to 20%.

The head of Australia’s biggest gold miner, Northern Star Resources (ASX:NST), noted the concerns as MD Stuart Tonkin led dozens of Australia’s top brokers, fund managers and investors around its flagship Kalgoorlie Consolidated Gold Mines operation on Sunday.

Colloquially known as the Super Pit, the legacy of the Golden Mile – now in its 132nd year of operations – is being continued by a $1.5bn mill expansion and underground development which will make the long-running mines consolidated by Alan Bond in the 1980s a 900,000ozpa producer from FY29, up from 419,000oz in FY25.

But the $22bn ASX gold giant has added hundreds of millions of dollars in capital onto the project, with the early expansion of tailings dams, a new state of the art thermal power plant, accelerating development and camp to lift costs – at least temporarily – over the next couple years, tailing off in 2027.

As mines age and producers seek to expand, will earnings be left behind?

Super expansion

After clearing a major wall slip that cut off access to Golden Pike, the best part of the famous Super Pit, developing seven underground portals to establish a new underground in historical areas of the Golden Mile beneath it, Northern Star plans to expand KCGM to 550-600,000oz this year.

After tens of millions of dollars of exploration drilling, it’s taken an orebody slated to run short of gold some time this decade and turned it into a long-term proposition.

All up KCGM, which also includes the Mt Charlotte underground mine which has been running continuously since 1962, has 14Moz in reserves and 39Moz in resources.

It also boasts low-grade stockpiles built up over generations of mining – 144Mt at 0.6g/t Tonkin says represents $10bn in undiscounted cash flow at spot prices and backs the case for the expansion of the mill to 27Mtpa by 2029. A ramp up should see NST jump from 12Mtpa in FY26 to 23Mtpa and 25Mtpa in FY27 and FY28.

While additional capital costs spooked market watchers when NST released them last month, Tonkin insists the behemoth is getting the balance right to set up the mine for multiple decades at the forefront of the global gold market.

“These are multi-year projects we’ve been working on, and it’s not about today’s gold price,” he told media after Sunday’s site visit.

“The returns on something like the Fimiston Mill expansion, it was a three-year build, but with a decades outlook.

“So we’re not looking at the spot price and and worrying about that. It’s affordable for our business, our strength, our balance sheet.

“So our confidence for those investments for long term returns is there. But we do hear those concerns around what’s where’s the cash going.

“How does it come back to shareholders? So we’re very conscious around balance … between dividends between reinvestment and organic growth and retained earnings.”

The other major development on the horizon is the Hemi gold mine, the 11.2Moz monster NST picked up in its $6bn scrip takeover of De Grey Mining.

The project will not be without its challenges, with Northern Star tasked with running through an environmental approvals process and discussions with stakeholders including traditional owners left unfinished when the deal was sealed in May.

It is hoping to have approvals completed towards the end of the year and review numbers from the De Grey DFS Tonkin admitted were now “stale” ahead of a potential FID in 2026. The idea is that by the time Northern Star are in the thick of things on the – currently – $1.3bn, 530,000ozpa development, the spend on KCGM will have tailed off.

Cost control

At the same time, costs are rising.

At $2300-2700/oz this year, NST’s AISC numbers will come in well ahead of this year’s $2163/oz.

While it may not have the drama of the Covid years, NST is factoring in 5% cost inflation in the year ahead.

Tonkin also says the pressure valve has yet to be released entirely on labour, despite job losses at WA’s struggling nickel and lithium mines.

“Primarily in labour, internally in our own teams we’re seeing sort of 3-4% increases across a lot of the workforce,” Tonkin said.

“And then on the service providers we’re seeing more than that because they have … stale contracts that might be … formed a few years ago and there’s been that build-up.

“So resetting that pricing is how we’ve got at that average 5%. There’s also some cost escalation in the US related to the tariffs.

“We’re unsure but we’ve factored in some some increases there. And once we realise those things we’ll be able to guide better.

“Unfortunately we’re not seeing costs plateau and that pressure still remains, and you’re seeing that across the sector.”

Free cash generation on a sector wide basis continues to grow.

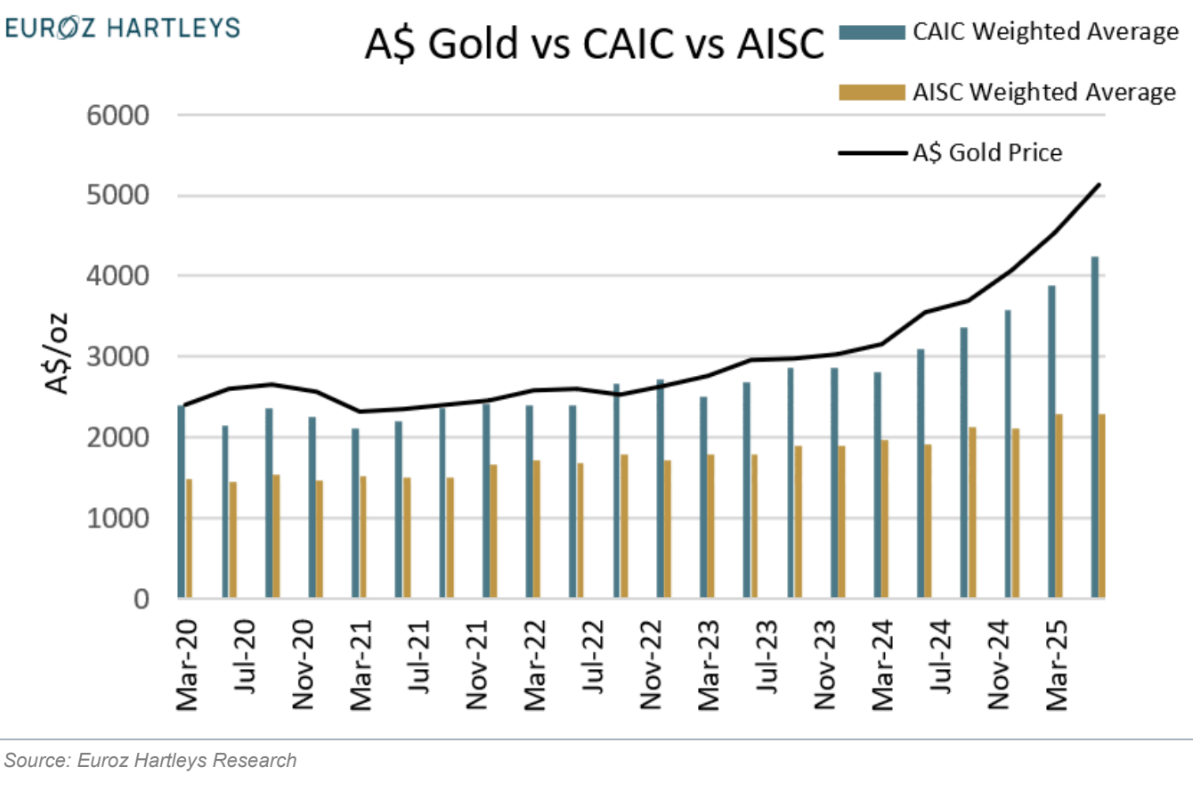

A note from Euroz analyst Michael Scantlebury showed the sectors cash build climbed from a previous record of $1.09bn in the March quarter to $1.59bn in the June quarter as gold lifted $580/oz on average (+13%) to $5132/oz.

The broker uses its own measure of analysing costs called CAIC, which includes capital and administrative costs hidden by miners in their official reporting.

While AISC are sitting above $2000/oz, weighted average CAIC is actually above $4000/oz.

Miners have also been impacted by hedges, with foregone revenue costing companies $720m on Scantlebury’s numbers in the June quarter, compared to $440m in March.

At the same time Scantlebury says the numbers show a “very healthy gold sector” when it comes to cash generation.

He also says looking at total costs can point to which gold miners hold value in the current market, with Scantlebury’s top pick King of the Hills gold mine owner Vault Minerals (ASX:VAU).

“VAU is the second cheapest gold producer on our CAIC cash flow multiple, yielding 5.4% for the June quarter and 13.2% for the FY25,” he said.

“Despite VAU’s hedge book costing A$85m in the quarter, if you add this back, then VAU’s cashflow yield would increase to 10.2% for the quarter or annualised 40.8%pa!

“Remember VAU’s hedge book rolls off over the next 12 months.”

The upside

While Tonkin remains confident the Super Pit expansion and Hemi will make the grade, there have been high-profile misses in recent times. Bellevue Gold (ASX:BGL) dumped plans to expand its WA mine of the same name to 250,000ozpa by 2029 earlier this year, resetting long-term targets to 190,000ozpa after running into geological challenges.

Greatland Resources (ASX:GGP) was dumped 24% in a day last week after lopping 11% off gold output plans for FY26 having set guidance only weeks earlier in a prospectus for its $490m ASX listing.

The best laid plans of mice and men …

That hasn’t gone unnoticed by investors.

Cam Judd, who runs Victor Smorgon Group’s gold fund, which netted a 54% gain in FY25, told Stockhead the June results season was a worrying one for many reasons.

“We’re seeing a lot of the miners starting to generate a lot of cash,” he said.

“But I’ll probably say I was a little bit disappointed with, on the whole, the quarterly season.

“Costs are definitely going up, whether that’s a function of input cost, or is it a function of mining more marginal ounces, which means the costs are also going up.

“It’s one that we’re watching very closely.”

Some of that capital spend is being put to good use, Judd noted.

If Northern Star hits its Super Pit targets post expansion, he says it should be an ‘amazing’ cash generator.

He thinks beyond the disappointments of the recent quarterly season, the outlook for gold remains bullish.

“I think the tailwinds behind the gold price at the moment are incredibly strong … the strongest we’ve seen them in some time and we’ve done a lot of work over history,” Judd said.

“I still think that the generalists haven’t come into the gold space or recognised the value that there.

“The gold miners are still trading on very low multiples or attractive multiples, I should say.

“If we see more quarters of cash generation and maybe some M&A activity, I think that will definitely attract the generalists, and I think there is a lot more upside.”

The reporter travelled as a guest of Northern Star Resources.