If you prefer to listen to Bass Bites, you can click the player below:

There are no charts in this week’s Bites due to travel commitments.

Global week in review

Global equities retreated last week reflecting disappointment over Fed signalling, US President Donald Trump’s reciprocal tariff update and a weaker than expected US payrolls report.

Fed caution and weak employment

The US Federal Reserve kept rates on hold as widely expected. But despite two dissenters voting for a rate cut, the market was ultimately disappointed that Fed chair Jerome Powell did not seem more open to a possible September rate cut – noting instead that inflation remained elevated. A solid Q2 US GDP report seems to justify the Fed’s caution, with economic growth bouncing back to a 3% annualised rate after a 0.5% annualised decline in Q1.

By Friday morning, however, the Fed’s reluctance to cut rates was old news, with a weaker-than-expected payrolls report raising markets’ expectations for a September rate cut to 80%. Employment rose only 73k in July (markets were expecting a +100k figure), although the bigger news was a downgrade to employment growth of 258k over the previous two months. The unemployment rate also edged higher to 4.2%. Adding to the concern, the ISM manufacturing index was also weaker than expected.

The jobs numbers were such a shock that President Trump – in yet another move markets are growing numb to – ‘shot the messenger’ by sacking the head of the Bureau of Labor Statistics for reporting (what he alleged were) “rigged” numbers. One can’t help imagine what he might do when and if the US economy actually enters a recession under his watch!

Trump’s tariff assault rolls on

Markets were also unnerved last week by Trump’s aggressive new set of tariffs. While Australia was affected relatively lightly with (only) a 10% tariff, many other countries faced much higher tariffs of around 20-40%. For unashamedly political reasons, many of Brazil’s exports will face a tariff of 50% even though it runs a trade surplus with the US. China is still facing a tariff of 30%, although both parties remain in talks.

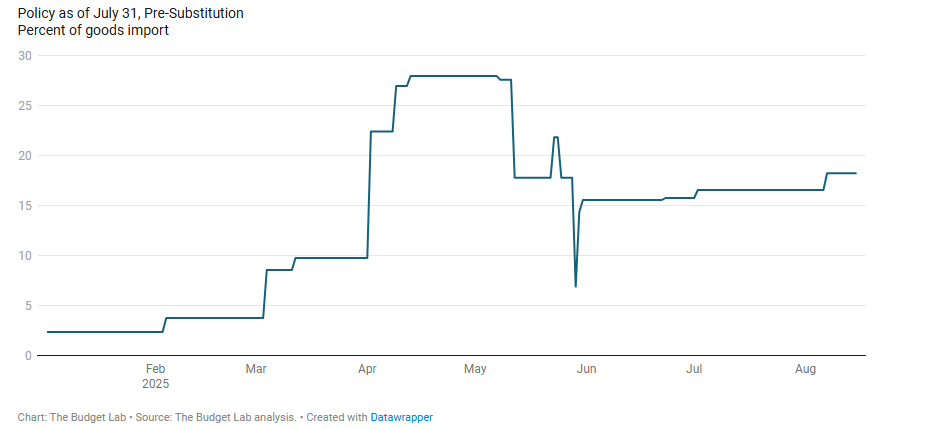

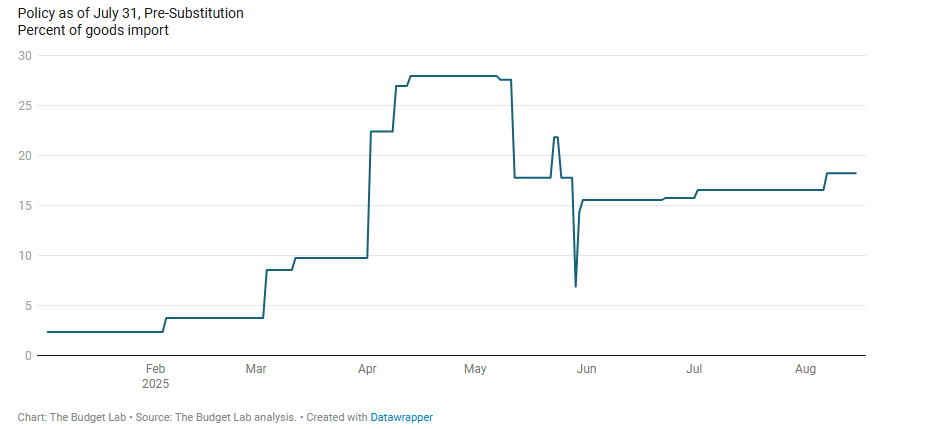

All up, the average US tariff rate is now around 18%, according to data collated by The Budget Lab at Yale. Little of this has yet to show up in either US inflation and/or corporate profits, but the hit can’t be too far away. In the past two months, US monthly customs revenue has tripled from an annual rate of around US$100 billion to US$300 billion – someone somewhere is paying these duties!

U.S Average Effective Tariff Rate Since January 1, 2025

Source: The Budget Lab at Yale

Some tariff effects are dribbling in. The core consumer price deflator (PCED), the Federal Reserve’s preferred inflation gauge, rose 0.3% in June, with the annual rate at 2.8%. This is still higher than the Fed would like.

AI winners and losers

Despite tariff concerns, the Q2 earnings season remains relatively encouraging, though there are growing signs of divergence among Magnificent Seven companies.

Meta and Microsoft reported good results and were rewarded with share market gains last week. Amazon, by contrast, also beat expectations though investors were unimpressed with its lower growth in cloud server revenue compared to its peers.

Global week ahead: ISM services

There’s little major global economic data this week although the US ISM services sector survey will face added scrutiny given renewed concerns over the US economic outlook.

Markets may not take kindly to a surprisingly weak result, though it would further boost prospects for a September Fed rate cut.

Australian week in review

The major local highlight last week was of course the Q2 CPI report. As expected, annual trimmed mean inflation was reassuringly benign at 2.7% – which makes an August RBA rate cut a virtual ‘done deal’. There were broad based signs of easing inflation across goods, services and housing.

Adding to the case for a rate cut was another fairly tepid retail sales report, with retail volumes growing only 0.3% in Q2 after a flat Q1 performance. After a welcome pick up late last year, consumer spending appears to have eased back again so far this year, despite the gradual recovery in real incomes and RBA rate cuts.

Australian week ahead

There’s little in the way of major local economic data this week.

That said, although not usually a market mover, there should be some interest in tomorrow’s ANZ-Indeed job ads report given the weaker than expected June labour market report a few weeks ago. Recall employment barely grew in June (+2k) and the unemployment rate leapt from 4.1% to 4.3%.

Having fallen from its peaks in late 2022, job ads have stabilised out over the past year at a still-relatively high level. Should they hold up tomorrow (as I expect), it should provide some comfort that the labour market is not unravelling too dramatically.