US graphite producers and near-term players poised to capitalise on Chinese tariffs. Pic: Getty Images.

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium.

Graphite pricing has been significantly impacted by Chinese production in recent months, and the US has just notched another arrow to fire in its trade war around the critical mineral.

Back in February, the US International Trade Commission (ITC) ruled that China harmed the American graphite industry by exporting graphite at unfairly low prices.

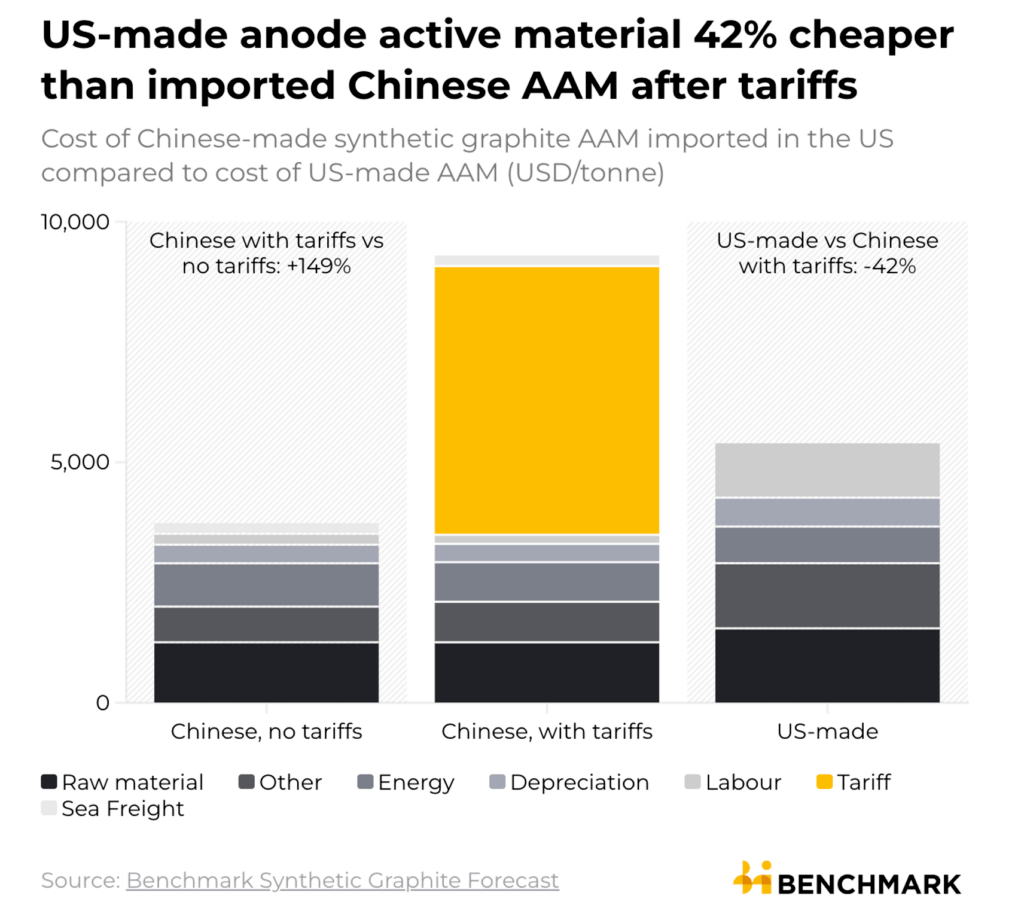

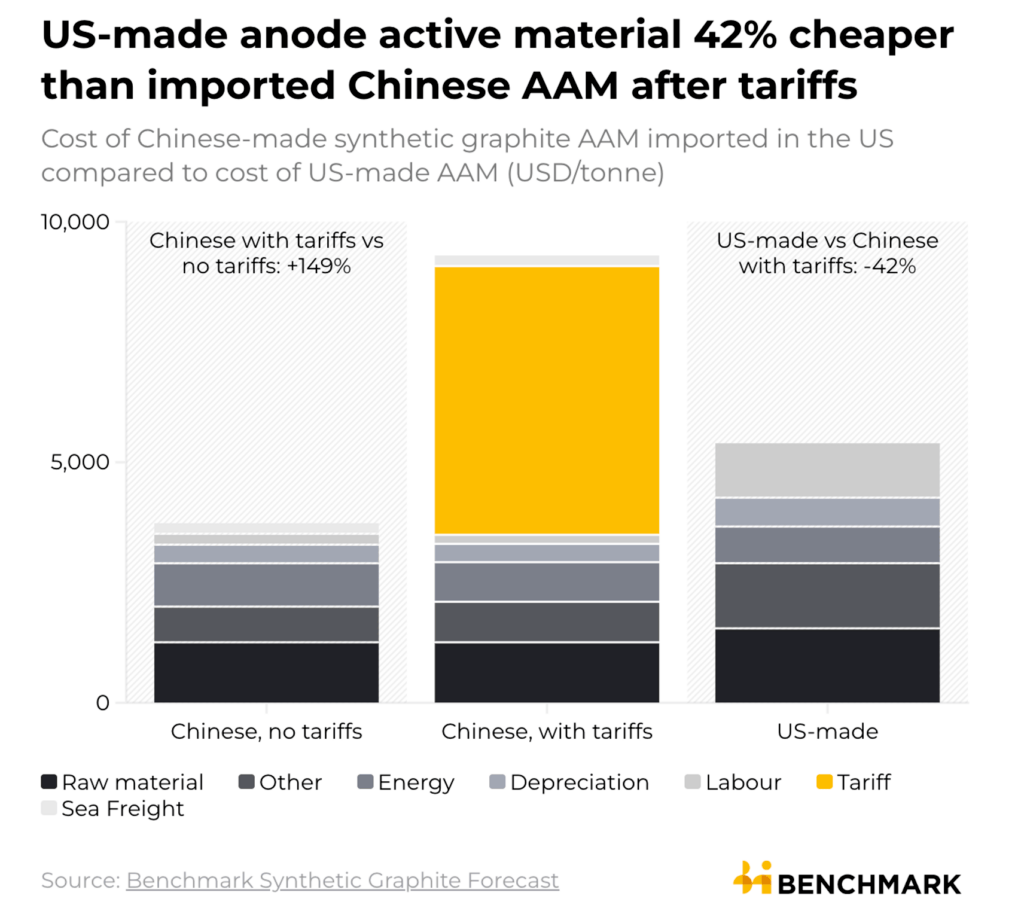

And last week, the Department of Commerce in the US applied 93.5% anti-dumping duties on active anode material (processed graphite). When combined with existing tariffs applied to Chinese imports into the US, the impost now totals 160% for active anode material.

Active anode material (AAM) is graphite refined into coated spherical purified graphite and is the final product used in batteries.

China has a stranglehold on global graphite supply, with 98% of graphite anode material (both natural and synthetic) coming from China.

The significant tariffs at a major import market like the US are expected to impact global prices of graphite and have highlighted the need for Western countries to shore up domestic supply chains – particularly around minerals critical to defence and tech applications.

Benchmark Minerals Intelligence (BMI) says the move will push the cost of Chinese AAM from ~US$3700/t to US$9300/t, making US-made AMM at ~US$5400/t over 40% cheaper.

“This marks an advantage for US anode aspirants looking to onshore production as they are likely to see greater interest from investors and cell makers, give the more balanced cost landscape,” BMI said.

“However, given the current limited availability of commercial-scale domestic AAM, cell makers will likely to absorb these higher associated costs in the near-term, which could dampen demand.”

Near-term US graphite producers

The tariff/trade war could present opportunities for ASX stocks with a near-term development project in the US – and even those further afield (but more on that later).

Syrah Resources’ (ASX:SYR) has its 11,250tpa Vidalia active anode materials plant, which is ramping up in the US and has the potential for expansion to 45,000tpa (targeted by 2028) and long term aspirations of >100ktpa.

Qualification by key customer Tesla has been extended from May this year to February 9, 2026.

There’s also Novonix (ASX:NVX), which owns the Riverside facility in Chattanooga, Tennessee, which is poised to become the first large-scale production site dedicated to high-performance synthetic graphite for the battery sector in North America. The project is targeting a 3000tpa start-up this year, growing to 15-20,000tpa by 2030, with long term aspirations to expand capacity to around 150,000tpa.

The initial 20,000tpa is already fully accounted for, with long-term offtake agreements with Panasonic Energy, Stellantis, and PowerCo.

Outside of the US, Renascor Resources (ASX:RNU) has the Siviour project in South Australia, the most advanced graphite development in Oz.

Siviour is expected to be one of the world’s lowest cost projects, with costs of US$405/t of graphite concentrate in the first 10 years. The upstream mine and concentrator has already nabbed a $185m loan under the Australian Government’s Critical Minerals Facility, signalling the nation-building value of the project.

RNU is looking downstream as well, planning to commission a purified spherical graphite (PSG) demonstration plant in Q4 this year.

In the Northern Territory, Kingsland Minerals’ (ASX:KNG) Leliyn project has an inferred resource of 180.2Mt at 7.2% total graphitic content and indicated resource of 12.3Mt at 7.9% TGC, making it one of the largest in situ graphite resource in Australia.

A scoping study is expected to be released this quarter, and will focus on just a fraction of the project’s 12km strike zone.

iTech Minerals (ASX:ITM) has the Lacroma, Sugarloaf and Campoona deposits north of Siviour on South Australia’s Eyre Peninsula.

It boasts a global mineral resource of 35.2Mt at 6% TGC, with test work already showing the project can produce a 94% graphite concentrate with material suitable for the key battery market.

Buxton Resources (ASX:BUX) owns the 20.7Mt at 10.8% TGC Graphite Bull project in WA where earlier this month the world’s largest anode manufacturer, BTR New Material Group, has qualified the ore for its entire ore-to-anode production process.

International Graphite (ASX:IG6) owns the Springdale deposit and proposed Collie plant, and Green Critical Minerals (ASX:GCM) owns 80% of the 1.1Mt McIntosh project, but has moved into the technology space, beginning production runs of its Very High Density (VHD) graphite block technology, with first revenue expected in H1 CY26.

The tech has thermal management applications in sectors from global electronics, semiconductor and microchip manufacturers, to data centre operators.

Battery Metals Winners and Losers

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese and vanadium is performing >>>

Battery metals stocks missing from our list? Shoot an email to [email protected]

| Code | Company | Price | % Week | % Month | % Six Month | % Year | Market Cap |

|---|---|---|---|---|---|---|---|

| XTC | XTC Lithium Limited | 0.2 | 19900% | 19900% | 19900% | 19900% | $17,528,272 |

| LMG | Latrobe Magnesium | 0.018 | 125% | 125% | 6% | -59% | $42,108,350 |

| AS2 | Askarimetalslimited | 0.016 | 100% | 167% | 45% | -64% | $6,466,731 |

| HLX | Helix Resources | 0.002 | 100% | 33% | -33% | -33% | $5,046,291 |

| VR8 | Vanadium Resources | 0.041 | 86% | 105% | 32% | -18% | $23,135,967 |

| GTE | Great Western Exp. | 0.019 | 58% | 111% | -21% | -37% | $11,355,159 |

| GRE | Greentechmetals | 0.078 | 56% | 81% | 16% | -35% | $7,824,264 |

| SLZ | Sultan Resources Ltd | 0.006 | 50% | 20% | -25% | -14% | $1,388,819 |

| PGD | Peregrine Gold | 0.265 | 47% | 71% | 77% | 83% | $22,060,413 |

| IG6 | Internationalgraphit | 0.072 | 47% | 41% | 20% | -17% | $13,936,200 |

| EVG | Evion Group NL | 0.033 | 43% | 106% | 32% | 65% | $13,917,439 |

| PMT | Patriotbatterymetals | 0.475 | 42% | 116% | 32% | -4% | $267,688,695 |

| IXR | Ionic Rare Earths | 0.0255 | 42% | 132% | 264% | 155% | $124,813,852 |

| IPT | Impact Minerals | 0.009 | 38% | 50% | -13% | -36% | $31,946,640 |

| LKE | Lake Resources | 0.044 | 38% | 57% | 7% | 22% | $84,748,040 |

| AR3 | Austrare | 0.12 | 36% | 140% | 43% | 38% | $24,378,547 |

| SYR | Syrah Resources | 0.395 | 34% | 58% | 72% | 32% | $432,531,598 |

| SYR | Syrah Resources | 0.395 | 34% | 58% | 72% | 32% | $432,531,598 |

| AGY | Argosy Minerals Ltd | 0.032 | 33% | 113% | 10% | -60% | $50,685,391 |

| RLC | Reedy Lagoon Corp. | 0.002 | 33% | 33% | -33% | -33% | $1,553,413 |

| SMX | Strata Minerals | 0.016 | 33% | 33% | -48% | -38% | $3,672,783 |

| EMT | Emetals Limited | 0.004 | 33% | 33% | -20% | -20% | $3,400,000 |

| TOR | Torque Met | 0.24 | 33% | 85% | 314% | 85% | $105,315,429 |

| FIN | FIN Resources Ltd | 0.004 | 33% | 0% | 0% | -33% | $2,779,554 |

| EG1 | Evergreenlithium | 0.033 | 32% | 6% | -60% | -44% | $7,058,030 |

| BKT | Black Rock Mining | 0.034 | 31% | 36% | 0% | -44% | $51,553,236 |

| EUR | European Lithium Ltd | 0.096 | 30% | 68% | 39% | 104% | $127,175,969 |

| PVW | PVW Res Ltd | 0.018 | 29% | 50% | 29% | -31% | $3,779,191 |

| FGR | First Graphene Ltd | 0.036 | 29% | 33% | -35% | -29% | $23,962,258 |

| KGD | Kula Gold Limited | 0.009 | 29% | 13% | 125% | -27% | $6,448,776 |

| INF | Infinity Lithium | 0.019 | 27% | 36% | -34% | -64% | $8,979,250 |

| INR | Ioneer Ltd | 0.1325 | 26% | 39% | -30% | -9% | $346,030,860 |

| QXR | Qx Resources Limited | 0.005 | 25% | 67% | 25% | -38% | $6,551,644 |

| CTN | Catalina Resources | 0.005 | 25% | 67% | 52% | 113% | $10,917,086 |

| GT1 | Greentechnology | 0.031 | 24% | 63% | -52% | -55% | $12,829,591 |

| TVN | Tivan Limited | 0.105 | 24% | 15% | -13% | 91% | $203,871,395 |

| MLS | Metals Australia | 0.021 | 24% | 24% | -5% | 11% | $14,574,390 |

| KOB | Kobaresourceslimited | 0.039 | 22% | 15% | -47% | -72% | $7,313,342 |

| SYA | Sayona Mining Ltd | 0.023 | 21% | 53% | 0% | -30% | $265,495,808 |

| PLL | Piedmont Lithium Inc | 0.1325 | 20% | 52% | 2% | -20% | $65,170,700 |

| TLG | Talga Group Ltd | 0.48 | 20% | 20% | 5% | 9% | $218,382,574 |

| ALY | Alchemy Resource Ltd | 0.006 | 20% | 20% | -14% | -14% | $7,068,458 |

| TON | Triton Min Ltd | 0.006 | 20% | 20% | -25% | -40% | $10,978,721 |

| PVT | Pivotal Metals Ltd | 0.012 | 20% | 33% | 50% | -45% | $9,979,485 |

| AKN | Auking Mining Ltd | 0.006 | 20% | -14% | 50% | -65% | $4,128,698 |

| WSR | Westar Resources | 0.006 | 20% | 20% | -25% | -25% | $2,392,349 |

| KZR | Kalamazoo Resources | 0.11 | 20% | 22% | 41% | 51% | $23,036,319 |

| VUL | Vulcan Energy | 4.23 | 19% | 21% | -21% | -2% | $984,602,560 |

| TMB | Tambourahmetals | 0.025 | 19% | 14% | 0% | -43% | $3,805,949 |

| RR1 | Reach Resources Ltd | 0.0095 | 19% | 19% | 36% | -21% | $7,869,882 |

| RR1 | Reach Resources Ltd | 0.0095 | 19% | 19% | 36% | -21% | $7,869,882 |

| FRB | Firebird Metals | 0.13 | 18% | 76% | 31% | 0% | $18,506,982 |

| KTA | Krakatoa Resources | 0.013 | 18% | 0% | 18% | 44% | $10,076,742 |

| TKM | Trek Metals Ltd | 0.099 | 18% | 8% | 313% | 209% | $56,670,152 |

| PLS | Pilbara Min Ltd | 1.815 | 17% | 51% | -22% | -37% | $5,888,919,118 |

| BCA | Black Canyon Limited | 0.27 | 17% | 170% | 303% | 225% | $35,800,202 |

| WMG | Western Mines | 0.28 | 17% | 115% | 87% | 14% | $27,100,736 |

| VHM | Vhmlimited | 0.22 | 16% | 13% | -35% | -62% | $55,785,389 |

| STK | Strickland Metals | 0.1675 | 16% | 20% | 112% | 73% | $361,977,568 |

| L1M | Lightning Minerals | 0.045 | 15% | -25% | -48% | -31% | $5,466,068 |

| IPX | Iperionx Limited | 5.925 | 15% | 38% | 44% | 165% | $1,762,802,476 |

| LPM | Lithium Plus | 0.069 | 15% | 13% | -14% | -37% | $11,689,920 |

| SGQ | St George Min Ltd | 0.039 | 15% | 22% | 50% | 26% | $104,240,075 |

| ASN | Anson Resources Ltd | 0.11 | 15% | 144% | 80% | -12% | $152,541,019 |

| AZL | Arizona Lithium Ltd | 0.008 | 14% | 33% | -27% | -58% | $37,662,201 |

| AM7 | Arcadia Minerals | 0.024 | 14% | 50% | 20% | -37% | $2,817,202 |

| CDT | Castle Minerals | 0.08 | 14% | 8% | 33% | -33% | $9,048,746 |

| MHC | Manhattan Corp Ltd | 0.024 | 14% | 20% | 0% | -4% | $5,637,574 |

| BMG | BMG Resources Ltd | 0.008 | 14% | 14% | -20% | 14% | $5,910,780 |

| TLM | Talisman Mining | 0.16 | 14% | 23% | -22% | -38% | $29,189,654 |

| LIN | Lindian Resources | 0.099 | 14% | -6% | -6% | -14% | $124,259,335 |

| MIN | Mineral Resources. | 31.17 | 14% | 52% | -12% | -43% | $6,025,260,399 |

| NVX | Novonix Limited | 0.54 | 14% | 44% | -8% | -20% | $372,320,697 |

| WCN | White Cliff Min Ltd | 0.025 | 14% | 25% | 25% | 56% | $60,334,654 |

| RBX | Resource B | 0.034 | 13% | 36% | 6% | -15% | $3,916,272 |

| RAS | Ragusa Minerals Ltd | 0.017 | 13% | 21% | 42% | 6% | $3,029,379 |

| RNU | Renascor Res Ltd | 0.069 | 13% | 23% | 21% | -22% | $180,563,960 |

| CTM | Centaurus Metals Ltd | 0.395 | 13% | 20% | -2% | 10% | $191,229,967 |

| NVA | Nova Minerals Ltd | 0.265 | 13% | -18% | -22% | 23% | $104,390,368 |

| VRC | Volt Resources Ltd | 0.0045 | 13% | 13% | 50% | -10% | $23,424,247 |

| GSM | Golden State Mining | 0.009 | 13% | 20% | 13% | -25% | $2,514,336 |

| RIE | Riedel Resources Ltd | 0.036 | 13% | 38% | 9% | -40% | $3,077,225 |

| PNN | Power Minerals Ltd | 0.065 | 12% | 12% | -29% | -38% | $9,239,642 |

| E25 | Element 25 Ltd | 0.2575 | 12% | 20% | -11% | 7% | $59,439,224 |

| LTR | Liontown Resources | 0.9225 | 12% | 41% | 40% | -6% | $2,259,346,631 |

| ZEU | Zeus Resources Ltd | 0.019 | 12% | 58% | 171% | 111% | $14,348,733 |

| LOT | Lotus Resources Ltd | 0.195 | 11% | 0% | -22% | -33% | $438,423,546 |

| IGO | IGO Limited | 5.265 | 11% | 36% | 1% | -6% | $3,945,365,306 |

| G88 | Golden Mile Res Ltd | 0.01 | 11% | -23% | 0% | -9% | $4,898,231 |

| NC1 | Nicoresourceslimited | 0.1 | 11% | 14% | 11% | -29% | $12,345,058 |

| WC1 | Westcobarmetals | 0.02 | 11% | 5% | -9% | -35% | $4,375,969 |

| CY5 | Cygnus Metals Ltd | 0.1 | 11% | 16% | -29% | 64% | $106,326,218 |

| GCM | Green Critical Min | 0.031 | 11% | 29% | 63% | 933% | $76,317,142 |

| SCN | Scorpion Minerals | 0.021 | 11% | 11% | 0% | 24% | $9,957,068 |

| ADD | Adavale Resource Ltd | 0.022 | 10% | 10% | -45% | -73% | $4,203,970 |

| GL1 | Globallith | 0.22 | 10% | 54% | 22% | -24% | $54,963,746 |

| STM | Sunstone Metals Ltd | 0.0165 | 10% | 10% | 136% | 83% | $92,353,480 |

| YAR | Yari Minerals Ltd | 0.011 | 10% | 0% | 267% | 267% | $6,894,638 |

| ITM | Itech Minerals Ltd | 0.033 | 10% | 3% | -40% | -59% | $5,637,568 |

| ARV | Artemis Resources | 0.0055 | 10% | 10% | -39% | -45% | $12,678,361 |

| OCN | Oceanalithiumlimited | 0.068 | 10% | 3% | 152% | 79% | $11,621,877 |

| ILU | Iluka Resources | 5.35 | 10% | 56% | 16% | -14% | $2,315,878,466 |

| VTM | Victory Metals Ltd | 1.26 | 10% | 52% | 245% | 260% | $136,381,295 |

| S32 | South32 Limited | 3.14 | 9% | 10% | -11% | 5% | $14,141,414,280 |

| MEK | Meeka Metals Limited | 0.1525 | 9% | 2% | 39% | 301% | $437,355,776 |

| RIO | Rio Tinto Limited | 120.02 | 9% | 18% | 2% | 5% | $44,349,201,087 |

| REC | Rechargemetals | 0.013 | 8% | -7% | -32% | -58% | $3,340,870 |

| HAV | Havilah Resources | 0.195 | 8% | 11% | -11% | -5% | $66,154,978 |

| PAT | Patriot Resourcesltd | 0.055 | 8% | 0% | 25% | 8% | $9,076,235 |

| GLN | Galan Lithium Ltd | 0.145 | 7% | 53% | 21% | -4% | $139,772,833 |

| JLL | Jindalee Lithium Ltd | 0.45 | 7% | 14% | 120% | 53% | $38,338,006 |

| LM1 | Leeuwin Metals Ltd | 0.15 | 7% | 15% | 25% | 83% | $15,120,958 |

| NIC | Nickel Industries | 0.7925 | 7% | 14% | -5% | 1% | $3,407,634,662 |

| BHP | BHP Group Limited | 41.87 | 7% | 17% | 7% | 1% | $212,430,275,035 |

| DLI | Delta Lithium | 0.165 | 6% | -8% | -3% | -23% | $121,812,105 |

| GAL | Galileo Mining Ltd | 0.17 | 6% | 62% | 10% | -6% | $33,596,238 |

| EMH | European Metals Hldg | 0.17 | 6% | -3% | 26% | -35% | $33,191,153 |

| LSR | Lodestar Minerals | 0.017 | 6% | 183% | 21% | -15% | $6,759,038 |

| A4N | Alpha Hpa Ltd | 0.94 | 6% | 18% | 7% | 18% | $1,074,467,171 |

| SRK | Strike Resources | 0.035 | 6% | 0% | 17% | 0% | $9,931,250 |

| EMN | Euromanganese | 0.185 | 6% | -3% | 12% | -45% | $9,413,767 |

| WC8 | Wildcat Resources | 0.185 | 6% | 42% | -21% | -27% | $260,630,845 |

| AVL | Aust Vanadium Ltd | 0.0095 | 6% | 19% | -32% | -41% | $86,346,581 |

| BM8 | Battery Age Minerals | 0.062 | 5% | 7% | -37% | -52% | $9,411,713 |

| MAN | Mandrake Res Ltd | 0.021 | 5% | 11% | -5% | -22% | $13,172,458 |

| LIT | Livium Ltd | 0.0105 | 5% | 17% | -38% | -50% | $16,909,071 |

| VML | Vital Metals Limited | 0.105 | 5% | 5% | -30% | -40% | $12,968,919 |

| RXL | Rox Resources | 0.315 | 5% | 15% | 43% | 117% | $238,911,961 |

| WIN | WIN Metals | 0.021 | 5% | 17% | 0% | -13% | $10,451,110 |

| LYC | Lynas Rare Earths | 10.505 | 5% | 15% | 58% | 75% | $9,485,431,282 |

| VRX | VRX Silica Ltd | 0.085 | 5% | 6% | 85% | 130% | $65,762,689 |

| GED | Golden Deeps | 0.022 | 5% | 5% | -8% | -35% | $4,073,891 |

| KM1 | Kalimetalslimited | 0.11 | 5% | 45% | -12% | -42% | $9,113,220 |

| BC8 | Black Cat Syndicate | 0.8525 | 5% | 5% | 24% | 154% | $608,543,633 |

| NTU | Northern Min Ltd | 0.0345 | 5% | 11% | 64% | 15% | $292,500,454 |

| CAE | Cannindah Resources | 0.024 | 4% | 0% | -38% | -56% | $16,745,839 |

| FML | Focus Minerals Ltd | 0.395 | 4% | 5% | 88% | 182% | $116,056,251 |

| PBL | Parabellumresources | 0.053 | 4% | 4% | -4% | 33% | $3,301,900 |

| FRS | Forrestaniaresources | 0.145 | 4% | 107% | 1350% | 326% | $37,322,691 |

| GW1 | Greenwing Resources | 0.029 | 4% | 21% | -17% | -40% | $8,564,078 |

| FTL | Firetail Resources | 0.088 | 4% | 17% | 22% | 47% | $32,682,406 |

| KNG | Kingsland Minerals | 0.15 | 3% | 92% | 15% | -25% | $10,521,332 |

| JMS | Jupiter Mines. | 0.2275 | 3% | 14% | 57% | -11% | $441,234,396 |

| ADV | Ardiden Ltd | 0.155 | 3% | 7% | 7% | 15% | $10,315,388 |

| NWC | New World Resources | 0.067 | 3% | 18% | 319% | 131% | $239,570,336 |

| CHN | Chalice Mining Ltd | 1.8575 | 3% | 20% | 55% | 71% | $729,425,228 |

| DM1 | Desert Metals | 0.0215 | 2% | 2% | -7% | -28% | $9,730,305 |

| SUM | Summitminerals | 0.044 | 2% | 29% | -66% | -78% | $4,517,380 |

| ALK | Alkane Resources Ltd | 0.69 | 2% | -5% | 31% | 37% | $417,823,905 |

| CWX | Carawine Resources | 0.097 | 2% | -1% | -8% | 13% | $22,904,169 |

| HAW | Hawthorn Resources | 0.055 | 2% | -5% | 20% | -20% | $18,425,859 |

| OMH | OM Holdings Limited | 0.325 | 2% | 12% | -7% | -25% | $241,370,892 |

| MEI | Meteoric Resources | 0.1625 | 2% | 30% | 93% | 35% | $362,291,231 |

| NMT | Neometals Ltd | 0.069 | 1% | 10% | -14% | -4% | $53,859,756 |

| BSX | Blackstone Ltd | 0.074 | 1% | -14% | 174% | 76% | $129,891,858 |

| SFR | Sandfire Resources | 11.17 | 1% | 1% | 13% | 33% | $5,173,739,862 |

| ASM | Ausstratmaterials | 0.72 | 1% | 35% | 47% | 5% | $130,565,291 |

| PTR | Petratherm Ltd | 0.3725 | 1% | 33% | -10% | 2091% | $131,713,613 |

| IDA | Indiana Resources | 0.086 | 1% | 10% | 32% | 85% | $56,560,456 |

| CXO | Core Lithium | 0.11 | 0% | 31% | 18% | 12% | $246,446,788 |

| RIL | Redivium Limited | 0.004 | 0% | 0% | 0% | 100% | $13,609,422 |

| COB | Cobalt Blue Ltd | 0.054 | 0% | -5% | -16% | -33% | $24,021,298 |

| LPD | Lepidico Ltd | 0.002 | 0% | 0% | 0% | 0% | $17,178,371 |

| MRD | Mount Ridley Mines | 0.0025 | 0% | 25% | -17% | -75% | $1,946,223 |

| CZN | Corazon Ltd | 0.002 | 0% | 0% | 0% | -60% | $2,369,145 |

| CLA | Celsius Resource Ltd | 0.007 | 0% | 0% | -30% | -46% | $20,380,675 |

| MNS | Magnis Energy Tech | 0.042 | 0% | 0% | 0% | 0% | $50,378,922 |

| AXN | Alliance Nickel Ltd | 0.034 | 0% | -3% | -8% | -11% | $24,678,547 |

| AAJ | Aruma Resources Ltd | 0.008 | 0% | -11% | -20% | -27% | $2,623,524 |

| TKL | Traka Resources | 0.001 | 0% | -50% | 0% | 0% | $2,125,790 |

| ATM | Aneka Tambang | 1.105 | 0% | 0% | 24% | 3% | $1,440,532 |

| LEL | Lithenergy | 0.37 | 0% | 0% | 0% | 1% | $41,440,581 |

| MRC | Mineral Commodities | 0.026 | 0% | 0% | 0% | 0% | $25,596,288 |

| PEK | Peak Rare Earths Ltd | 0.31 | 0% | 11% | 114% | 102% | $133,466,467 |

| WKT | Walkabout Resources | 0.095 | 0% | 0% | 0% | -10% | $63,769,838 |

| CNJ | Conico Ltd | 0.007 | 0% | 0% | -22% | -30% | $1,905,020 |

| BOA | BOA Resources Ltd | 0.018 | 0% | -10% | -18% | -10% | $2,220,351 |

| MQR | Marquee Resource Ltd | 0.009 | 0% | 0% | -18% | -18% | $5,024,723 |

| MRR | Minrex Resources Ltd | 0.008 | 0% | 0% | 0% | -11% | $8,678,940 |

| DTM | Dart Mining NL | 0.003 | 0% | 0% | -70% | -84% | $4,792,222 |

| EMS | Eastern Metals | 0.01 | 0% | 0% | -33% | -68% | $1,394,262 |

| IMI | Infinitymining | 0.009 | 0% | 0% | -10% | -44% | $3,807,142 |

| TEM | Tempest Minerals | 0.005 | 0% | 25% | 0% | -44% | $5,508,975 |

| EMC | Everest Metals Corp | 0.135 | 0% | 4% | -7% | 8% | $32,499,032 |

| OB1 | Orbminco Limited | 0.001 | 0% | 0% | -40% | -60% | $3,402,568 |

| KOR | Korab Resources | 0.008 | 0% | 0% | 0% | 0% | $2,936,400 |

| CMX | Chemxmaterials | 0.026 | 0% | 0% | 0% | -42% | $3,354,580 |

| ENV | Enova Mining Limited | 0.006 | 0% | -25% | 20% | -40% | $8,745,600 |

| AVW | Avira Resources Ltd | 0.007 | 0% | 0% | -65% | -65% | $1,610,000 |

| NWM | Norwest Minerals | 0.014 | 0% | 17% | 9% | -44% | $14,525,378 |

| RGL | Riversgold | 0.004 | 0% | 0% | 33% | -33% | $6,734,850 |

| THR | Thor Energy PLC | 0.009 | 0% | 0% | -22% | -44% | $6,397,109 |

| ODE | Odessa Minerals Ltd | 0.006 | 0% | -14% | -8% | 140% | $9,597,195 |

| AZI | Altamin Limited | 0.019 | 0% | -10% | -14% | -42% | $10,915,555 |

| LNR | Lanthanein Resources | 0.001 | 0% | 33% | -47% | -67% | $2,810,182 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | 0% | 0% | $3,017,699 |

| PEK | Peak Rare Earths Ltd | 0.31 | 0% | 11% | 114% | 102% | $133,466,467 |

| TAR | Taruga Minerals | 0.008 | 0% | 14% | -11% | -11% | $5,710,032 |

| DRE | Dreadnought Resources Ltd | 0.011 | 0% | 10% | -8% | -52% | $55,874,500 |

| KFM | Kingfisher Mining | 0.047 | 0% | -6% | 31% | -33% | $2,524,605 |

| GRL | Godolphin Resources | 0.011 | 0% | 22% | -21% | -21% | $5,386,480 |

| LNR | Lanthanein Resources | 0.001 | 0% | 33% | -47% | -67% | $2,810,182 |

| EV1 | Evolutionenergy | 0.016 | 0% | 33% | -16% | -48% | $5,802,408 |

| OM1 | Omnia Metals Group | 0.012 | 0% | 0% | -85% | -85% | $2,605,100 |

| LLL | Leolithiumlimited | 0.332997 | 0% | 0% | 0% | 0% | $401,204,047 |

| SRN | Surefire Rescs NL | 0.002 | 0% | 0% | -40% | -66% | $6,457,219 |

| LU7 | Lithium Universe Ltd | 0.007 | 0% | 17% | -30% | -55% | $6,551,857 |

| TMX | Terrain Minerals | 0.0025 | 0% | 25% | -38% | -17% | $6,329,536 |

| ANX | Anax Metals Ltd | 0.007 | 0% | 0% | -30% | -73% | $6,179,653 |

| RON | Roninresourcesltd | 0.15 | 0% | -9% | -23% | 25% | $6,056,252 |

| ASR | Asra Minerals Ltd | 0.002 | 0% | 0% | -33% | -67% | $8,000,396 |

| AEE | Aura Energy | 0.165 | 0% | 6% | 6% | 18% | $151,427,524 |

| AMD | Arrow Minerals | 0.02 | 0% | 0% | -55% | -67% | $17,555,332 |

| CUL | Cullen Resources | 0.005 | 0% | 67% | 0% | -33% | $3,467,009 |

| HWK | Hawk Resources. | 0.02 | 0% | 33% | -9% | -44% | $5,418,589 |

| ORN | Orion Minerals Ltd | 0.01 | 0% | 0% | -33% | -41% | $72,816,361 |

| SER | Strategic Energy | 0.006 | 0% | -8% | -25% | -60% | $4,697,233 |

| SVY | Stavely Minerals Ltd | 0.019 | 0% | 73% | 6% | -30% | $10,336,800 |

| SVM | Sovereign Metals | 0.74 | -1% | 13% | -2% | 13% | $488,438,721 |

| NST | Northern Star | 16.305 | -1% | -18% | -6% | 16% | $23,813,905,145 |

| QGL | Quantum Graphite | 0.49 | -1% | 2% | 5% | -15% | $165,594,537 |

| KNI | Kunikolimited | 0.093 | -1% | -19% | -44% | -54% | $8,083,957 |

| DEV | Devex Resources Ltd | 0.086 | -1% | 9% | -10% | -66% | $38,868,779 |

| ASL | Andean Silver | 1.365 | -1% | 31% | 41% | 80% | $221,489,388 |

| HAS | Hastings Tech Met | 0.29 | -2% | 9% | -5% | -15% | $59,073,040 |

| DVP | Develop Global Ltd | 4.6 | -2% | -4% | 107% | 145% | $1,530,301,137 |

| CHR | Charger Metals | 0.05 | -2% | 14% | -25% | -18% | $3,948,433 |

| SLM | Solismineralsltd | 0.081 | -2% | -8% | 21% | -40% | $11,427,494 |

| BUR | Burleyminerals | 0.04 | -2% | -13% | -49% | -61% | $7,366,692 |

| WA1 | Wa1Resourcesltd | 17.34 | -3% | 21% | 31% | 16% | $1,167,687,454 |

| ABX | ABX Group Limited | 0.038 | -3% | -5% | -16% | -31% | $9,571,497 |

| RVT | Richmond Vanadium | 0.073 | -3% | -26% | -56% | -76% | $15,772,687 |

| PSC | Prospect Res Ltd | 0.18 | -3% | 16% | 87% | 44% | $129,608,628 |

| PFE | Pantera Lithium | 0.018 | -3% | 50% | 6% | -39% | $8,764,998 |

| QPM | QPM Energy Limited | 0.035 | -3% | 0% | -50% | 0% | $102,523,345 |

| EFE | Eastern Resources | 0.031 | -3% | 0% | -3% | -38% | $3,908,788 |

| A11 | Atlantic Lithium | 0.155 | -3% | -3% | -38% | -59% | $103,972,097 |

| FG1 | Flynngold | 0.029 | -3% | -9% | 16% | 0% | $11,348,178 |

| HMX | Hammer Metals Ltd | 0.029 | -3% | -9% | -6% | -28% | $26,632,761 |

| SFM | Santa Fe Minerals | 0.27 | -4% | 671% | 694% | 744% | $21,117,449 |

| OD6 | Od6Metalsltd | 0.026 | -4% | 0% | -61% | -47% | $4,172,167 |

| 1AE | Auroraenergymetals | 0.049 | -4% | -11% | -18% | -25% | $8,774,123 |

| MLX | Metals X Limited | 0.655 | -4% | 24% | 44% | 49% | $571,722,542 |

| BMM | Bayanminingandmin | 0.063 | -5% | 80% | 26% | -7% | $6,879,941 |

| ARL | Ardea Resources Ltd | 0.41 | -5% | 3% | 15% | -15% | $85,217,231 |

| RAG | Ragnar Metals Ltd | 0.02 | -5% | 0% | 3% | 0% | $9,479,720 |

| AXE | Archer Materials | 0.285 | -5% | 24% | -35% | -8% | $72,631,399 |

| S2R | S2 Resources | 0.0665 | -5% | 2% | -11% | -40% | $32,996,123 |

| EVR | Ev Resources Ltd | 0.0095 | -5% | 36% | 280% | 88% | $20,047,530 |

| ARN | Aldoro Resources | 0.35 | -5% | 8% | 23% | 332% | $64,182,702 |

| SRZ | Stellar Resources | 0.017 | -6% | 13% | 21% | -15% | $35,355,760 |

| PUR | Pursuit Minerals | 0.067 | -6% | 81% | -18% | -55% | $6,682,176 |

| ICL | Iceni Gold | 0.066 | -6% | 12% | -6% | 0% | $22,657,892 |

| RMX | Red Mount Min Ltd | 0.008 | -6% | -11% | 0% | -20% | $4,658,367 |

| AX8 | Accelerate Resources | 0.008 | -6% | 33% | -27% | -33% | $6,537,510 |

| ZNC | Zenith Minerals Ltd | 0.032 | -6% | -14% | -29% | -40% | $16,942,576 |

| CRI | Critica ltd | 0.016 | -6% | -6% | -16% | -11% | $45,869,097 |

| 1MC | Morella Corporation | 0.015 | -6% | -12% | -38% | -65% | $5,526,435 |

| M24 | Mamba Exploration | 0.015 | -6% | 20% | -12% | 25% | $4,722,650 |

| AUZ | Australian Mines Ltd | 0.007 | -7% | -22% | -42% | -22% | $12,832,591 |

| ETM | Energy Transition | 0.0475 | -7% | 10% | -40% | 138% | $71,364,799 |

| MTC | Metalstech Ltd | 0.135 | -7% | -4% | 0% | -40% | $29,977,420 |

| EGR | Ecograf Limited | 0.335 | -7% | 20% | 264% | 191% | $154,438,818 |

| ESR | Estrella Res Ltd | 0.04 | -7% | -23% | 54% | 900% | $84,306,531 |

| LLM | Loyal Metals Ltd | 0.2 | -7% | 54% | 111% | 60% | $21,573,943 |

| FBM | Future Battery | 0.026 | -7% | 44% | 0% | 4% | $14,809,543 |

| LML | Lincoln Minerals | 0.0065 | -7% | 30% | 8% | 8% | $13,666,703 |

| A8G | Australasian Metals | 0.062 | -7% | -6% | -17% | -23% | $3,589,163 |

| FLG | Flagship Min Ltd | 0.055 | -8% | 22% | 28% | -32% | $13,196,926 |

| NH3 | Nh3Cleanenergyltd | 0.055 | -8% | 112% | 206% | 323% | $34,366,799 |

| PGM | Platina Resources | 0.021 | -9% | 5% | 11% | -16% | $13,086,787 |

| LRV | Larvottoresources | 0.725 | -9% | 33% | 8% | 504% | $299,001,368 |

| CNB | Carnaby Resource Ltd | 0.41 | -9% | 12% | 19% | -23% | $95,923,321 |

| SBR | Sabre Resources | 0.009 | -10% | 13% | 6% | -36% | $3,550,157 |

| SRI | Sipa Resources Ltd | 0.018 | -10% | 29% | 29% | 0% | $7,495,170 |

| WR1 | Winsome Resources | 0.18 | -10% | 44% | -63% | -70% | $47,573,848 |

| LCY | Legacy Iron Ore | 0.009 | -10% | 0% | 0% | -48% | $87,858,383 |

| MNB | Minbos Resources Ltd | 0.045 | -10% | 7% | -18% | -32% | $44,852,282 |

| GBR | Greatbould Resources | 0.06 | -10% | -5% | 28% | 11% | $58,927,864 |

| ARU | Arafura Rare Earths | 0.1925 | -10% | 17% | 54% | 1% | $492,865,738 |

| BUX | Buxton Resources Ltd | 0.042 | -11% | 8% | 5% | -48% | $13,744,236 |

| MHK | Metalhawk. | 0.37 | -11% | -20% | 12% | 612% | $46,272,211 |

| LEG | Legend Mining | 0.008 | -11% | 33% | -20% | -38% | $23,315,817 |

| M2R | Miramar | 0.004 | -11% | 33% | 0% | -64% | $2,990,470 |

| SRL | Sunrise | 1.32 | -12% | 103% | 313% | 207% | $147,101,074 |

| VMC | Venus Metals Cor Ltd | 0.105 | -13% | -5% | 62% | 21% | $21,574,155 |

| PNT | Panthermetalsltd | 0.0095 | -14% | -27% | 6% | -62% | $3,009,045 |

| QEM | QEM Limited | 0.029 | -15% | -24% | -59% | -78% | $6,855,610 |

| DYM | Dynamicmetalslimited | 0.23 | -15% | -10% | -15% | 35% | $9,816,868 |

| MTM | Metallium Ltd | 0.74 | -15% | 17% | 190% | 1847% | $380,883,366 |

| KAI | Kairos Minerals Ltd | 0.025 | -17% | -22% | 79% | 194% | $67,088,261 |

| HRE | Heavy Rare Earths | 0.046 | -18% | 35% | 53% | 60% | $9,361,525 |

| AQD | Ausquest Limited | 0.044 | -19% | -24% | 83% | 313% | $61,242,106 |

| MOH | Moho Resources | 0.004 | -20% | 0% | -20% | -20% | $3,727,070 |

| CRR | Critical Resources | 0.004 | -20% | 14% | -33% | -56% | $13,850,427 |

| ARR | American Rare Earths | 0.345 | -21% | 41% | 21% | 28% | $206,518,936 |

| CMO | Cosmometalslimited | 0.018 | -22% | 6% | 21% | -60% | $5,798,441 |

| REE | Rarex Limited | 0.0205 | -24% | 8% | 156% | 37% | $18,403,280 |

| BNR | Bulletin Res Ltd | 0.046 | -25% | -19% | 28% | -6% | $17,029,573 |

| BYH | Bryah Resources Ltd | 0.006 | -25% | -50% | 50% | 33% | $6,001,195 |

| AOA | Ausmon Resorces | 0.0015 | -25% | -25% | 0% | -50% | $2,622,427 |

| ENT | Enterprise Metals | 0.002 | -33% | -33% | -33% | -33% | $3,428,293 |

| AYM | Australia United Min | 0.002 | -33% | 0% | 0% | -33% | $3,685,155 |

WordPress Table

Weekly Small Cap Standouts

HLX is zeroing in on two distinct copper-gold systems at the White Hills project in Arizona, US, with a combination of geophysical, geological and geochemical results.

Two geological formations meet on the project’s tenure. Management reckons there’s evidence of copper at the northern end of the Arizona Arc formation, while a fault-style gold system sits at the southern end of the Walker Lane gold trend, both within the project area.

“With growing interest and policy support for domestic copper production in the U.S., the project is ideally positioned to benefit from this momentum,” executive chairman Mike Povey said.

While prices are not soaring the same as gold, the red metal is currently fetching between US$4.50-5.50/lb at the time of writing, reflecting a big arbitrage weighted to the US market, with tariffs on the horizon.

The company has signed an offtake agreement for the supply of 100,000 tonnes of vanadium-rich magnetite direct shipping ore (DSO) each month from the world-class Steelpoortdrift vanadium project in South Africa.

The offtake positions VR8 to transition from developer to producer and is a fillip as the company advances its near-term cash flow strategy aimed at unlocking value from Steelpoortdrift’s vast JORC resource, while preserving the flexibility to pursue full-scale development as market conditions improve.

Due to the absence of a standard spot price for the DSO product, the agreement, which is valid for two years, is also conditional on subsidiary VanRes finalising pricing terms with CPAL by August 30, 2025.

Executive chairman Jurie Wessels said alongside this negotiations with other potential offtakers are also progressing.

“These may lead to the staged or full-scale development of beneficiation through concentration capacity, enabling the production of higher-grade ore,” he said.

“Concurrently, we are assessing commercialisation opportunities with entities that possess downstream processing capabilities.”

This week the company confirmed that the Shaakichiuwaanaan project in Canada hosts the world’s largest pollucite-hosted caesium pegmatite deposit.

PMT declared a maiden Caesium Zone resource estimate of 163,000t at 10.25% caesium, 1.78% lithium, and 646 ppm tantalum (indicated) at the Rigel zone, and 530,000t at 2.61% caesium, 2.23% lithium, and 172 ppm tantalum (indicated) at the Vega zone.

President, CEO and managing director Ken Brinsden said what’s particularly existing for investors is that the addressable market for caesium appears to be at a key inflexion point, “with its ability to improve the efficiency and stability of next generation terrestrial solar technologies having the potential to drive a massive increase in global demand.”

“Shaakichiuwaanaan stands to play a driving role in the growth of this exciting new market,” he said.

“As we finalise the maiden lithium-only Feasibility Study for the CV5 Pegmatite, we are excited to start work on unlocking the enormous potential of the caesium resource.”

Shaakichiuwaanaan is already North America’s largest hard rock spodumene hosted lithium resource.

At Stockhead, we tell it like it is. While Renascor Resources, Kingsland Minerals, iTech Minerals, Buxton Resources and Green Critical Minerals are Stockhead advertisers, they did not sponsor this article.