I mentioned in previous posts that the best way to transfer money between two accounts you own at different institutions is by an ACH push. When you’re moving money from Bank A to Bank B, ask Bank A to send the money to Bank B. Don’t ask Bank B to grab the money from Bank A. Following this one simple approach avoids 99% of problems with money transfers.

Wire transfers are faster than an ACH push but there’s usually a fee for sending and/or receiving a wire. Most banks don’t charge a fee for an ACH push. The money from an ACH push is available immediately at the receiving end and you avoid getting your account flagged for fraud. See ACH Push or Pull: The Right Way to Transfer Money and Follow This Rule to Avoid Long Holds and Account Restrictions.

Bank of America is the second largest bank in the U.S. after JPMorgan Chase. It has a good credit card rewards program (see Bank of America Travel Rewards Card Pays 2.625% on Everything). However, some parts of its online banking interface are tricky to figure out. The way to set up auto pay on Bank of America credit cards is the most convoluted I have seen. Adding an external account for ACH push out of Bank of America isn’t as bad but it isn’t straightforward either. Here’s a walkthrough.

Enroll in Secured Transfer

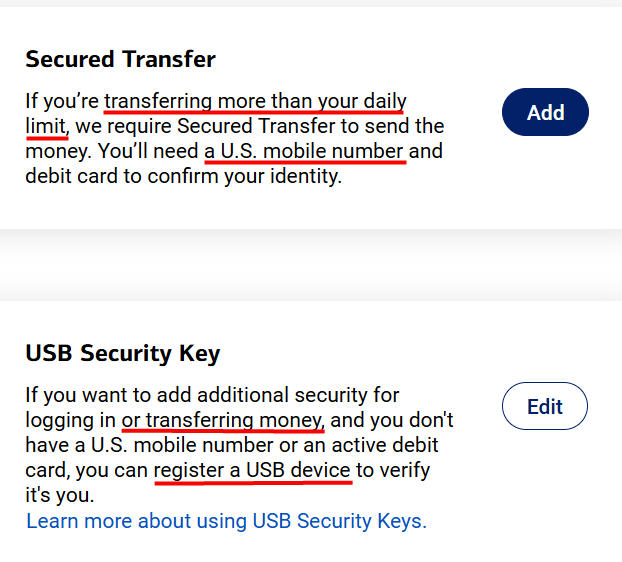

Secured Transfer at Bank of America means adding a mobile phone number or a hardware security key to authorize transfers. If you don’t enroll in Secured Transfer, your transfers may be limited to $1,000 per day. You can transfer $50,000 or more in one go after you enroll in Secured Transfer.

Click on “Security Center” on the top and then “Set up two-factor authentication.”

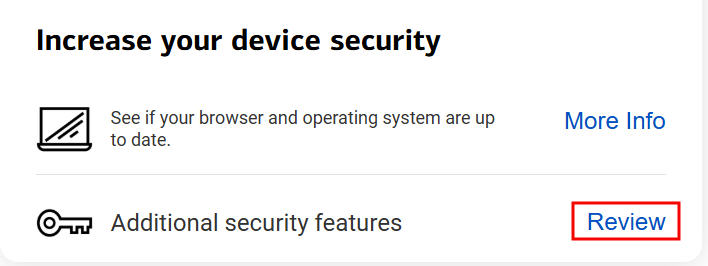

Scroll down to find “Additional security features” in the “Increase your device security” box. Click on the link next to it. Mine says “Review” because I already set it up. The link says something else when you don’t have it yet.

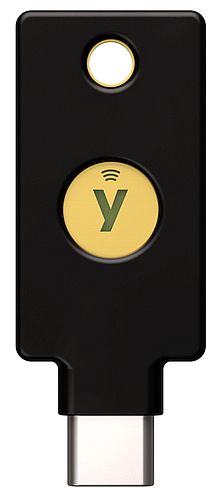

The first option uses a mobile phone number to receive security codes. The second option uses a hardware security key such as a Yubikey.

If you already have Yubikeys, it’s better to use your existing Yubikeys. You can register multiple Yubikeys. If you don’t have Yubikeys, it’s worth buying at least two Yubikeys and using them to secure your financial accounts and email accounts. See Security Hardware for Vanguard, Fidelity, and Schwab Accounts and Secure Your Email Account to Prevent Wire Fraud.

If you don’t want to use a Yubikey, a mobile phone number also works but it’s less secure.

Add External Account

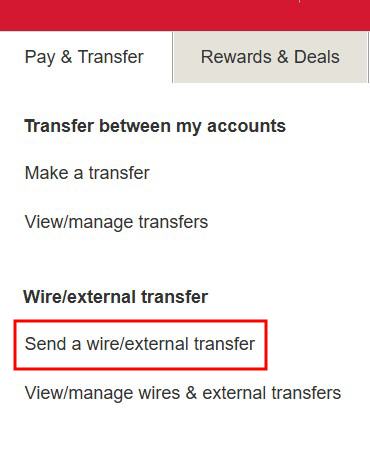

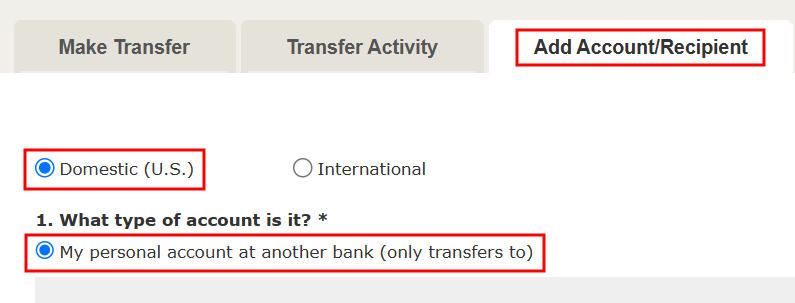

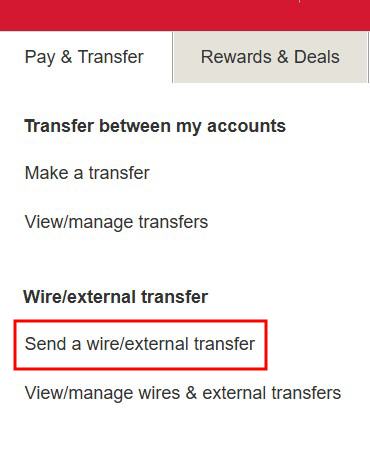

After enrolling in Secured Transfer, click on “Pay & Transfer” in the top menu and then “Send a wire/external transfer.”

Click on the “Add Account/Recipient” tab. Select “Domestic” and “My personal account at another bank (only transfers to).” Selecting “only transfers to” means you will use this link only to push money from Bank of America to the external account. To push money from your other account to Bank of America, you would add the Bank of America account as a linked account at your other bank.

Selecting “only transfers to” is important when you’re linking a brokerage account such as a Fidelity account. If you select “both transfers from and to” Bank of America will ask you to log in online to prove that you own the external account. You can’t pass this verification when your brokerage account isn’t with the bank that owns the routing number. The verification isn’t required if you select “only transfers to.”

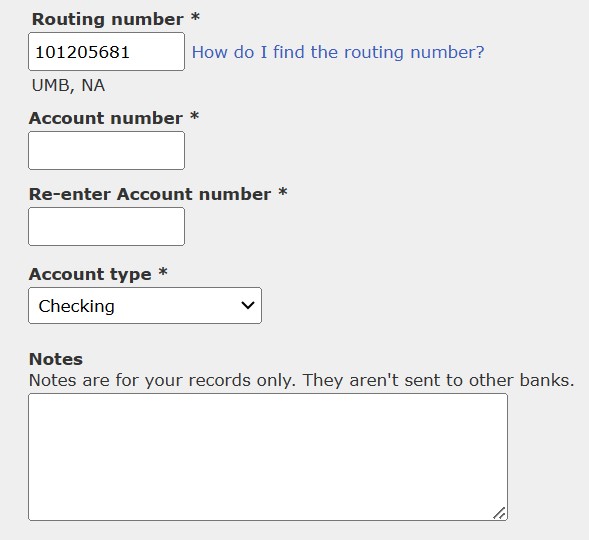

Enter the routing number and the account number of your other account. Adding an external account for “only transfers to” doesn’t require verification. You should make sure to enter the correct routing number and account number.

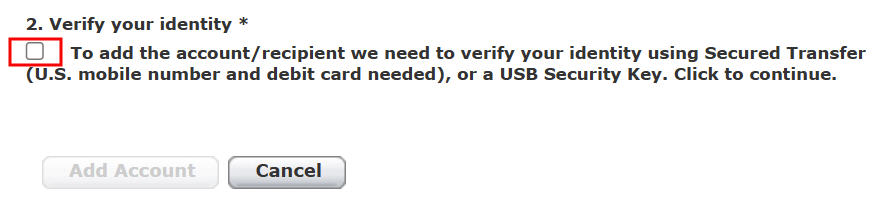

The “Add Account” button isn’t enabled until you check the box to verify your identity. Bank of America will ask for the Yubikey or the security code sent to the number you set up in Secured Transfer.

Send an ACH Push

Sending an ACH only works in online banking. Bank of America’s Android mobile app doesn’t support it.

Click on “Pay & Transfer” in the top menu and then “Send a wire/external transfer.”

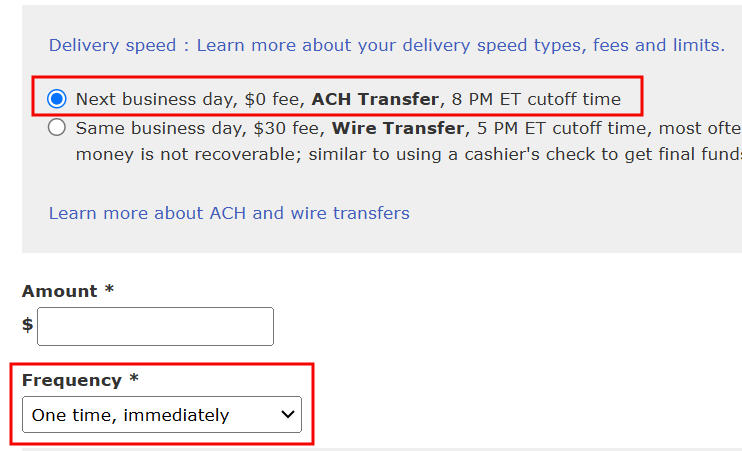

Choose the source and destination accounts. Bank of America used to charge $3 for slow ACH. Now it’s free and the transfer arrives on the next business day if you request it before 8 p.m. Eastern Time. Bank of America will ask you to use your Yubikey or the security code to confirm the transfer when you’re sending a large amount.

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.