New Zealand’s mining sector is becoming even more attractive. Pic: Getty Images

- New Zealand’s government led by the business-friendly National Party is keen to boost mining investment

- Mining friendly policies and the country’s prospectivity have increased its attractiveness

- Gold plays dominate with Uvre the newest company in the country

New Zealand may not be the first port of call for resource companies looking for the next big project, but this does not detract from the fact that the country has a rich mineral bounty.

The victory of the conservative and business friendly National Party during the November 2023 election has also led to a marked improvement in business sentiment.

This is best illustrated in the latest edition of the Fraser Institute’s Annual Survey of Mining Companies, which ranked New Zealand as the twelfth most attractive mining jurisdiction in the world, beating out previous power houses such as Western Australia at number 17.

Respondents to the survey expressed decreased concerns over uncertainty concerning what areas will be protected, uncertainty over regulation enforcement and uncertainty regarding environmental regulations.

New Zealand has flagged interest in doubling its mining exports to NZ$3bn by 2035 and has introduced measures such as the ‘Fast Track’ legislation, which accelerates permitting processes dramatically by introducing a one-stop shop for permitting.

A legend speaks

Mining legend Norm Seckold, who was recently appointed as a director of Uvre (ASX:UVA) following the acquisition of his company Octagold and its portfolio of gold projects in the country, believes New Zealand now has all the right ingredients that make it a tasty mining destination.

Speaking to Stockhead, he said one reason was the overtly pro-mining stance of the current government and Minister for Resources Shane Jones in particular with the other being its remarkable prospectivity.

“It’s relatively underexplored compared to, for example Western Australia where there are lots of new discoveries but it is a very active and competitive exploration market,” he added.

“You’ve got this highly efficient, very capable exploration industry in West Perth with lots of very smart guys and a whole lot of companies competing for projects.

“But that just hasn’t been applied to New Zealand and I just think the opportunity has been overlooked and it shouldn’t be because of projects such as the 8Moz Macraes mine in the South Island that has been in production for over 30 years.”

Along with the 10Moz endowment on the North Island, it points to the country having serious deposits.

“It’s not a little half-million-ounce thing that you hope you can grow a bit, they tend to have scale,” Seckold said.

All this matches up closely with his philosophy to exploration which ranks the project first, the location second and the politics in equal second or third place.

“The project, geology and prospectivity has to be number one. And New Zealand is extraordinarily prospective,” he added.

The same prospectivity also led Seckold to break one of the tenets of his (admittedly ad hoc) philosophy, which is to focus on the important part.

Octagold, which was originally formed by a couple of his former colleagues that then successfully enticed him to become the largest shareholder, had pegged out large tracts of ground over four granted projects, another that is under application and yet another that is being looked over.

“It’s a little bit against my religion. I’m a great believer in focus,” Seckold said jokingly about the large landholdings that Uvre now owns.

“I think the whole point is, I can see the rush coming, so despite my beliefs, here’s an opportunity and we don’t want to just sit there and watch other people pick up the good projects.”

Attractive projects

As for why he decided to get involved with Octagold, Seckold said the best indicator of where a gold mine could be found was where the old timers had been mining and pointed to Santana Minerals’ Rise and Shine discovery as a classic example.

“That’s the old Bendigo Goldfield, which was a high grade, low tonnage mine a hundred years ago, or less,” he noted.

“But what happens is you apply more modern geoscience and you find a multi-million ounce deposit.

He added that the rising gold price had meant that economically viable open pit mines could now extend to depths of 300m or more compared to between 60m and 70m in the early 1980s.

Lower grade finds are also viable and both factors create opportunities.

“The other thing is, there are very good public records in New Zealand and good ore libraries like there are here (in Australia), and you can just see the data,” Seckold added.

“You can see very high-grade assays in the Waitekauri project on the bottom level, they just didn’t keep drilling far enough.”

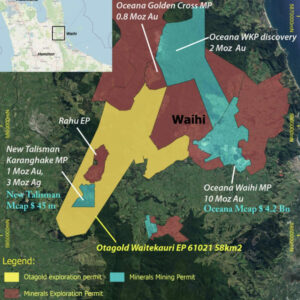

The brownfields Waitekauri project is the flagship asset that Uvre acquired and is just 8km west of OceanaGold Corporation’s 10Moz Waihi gold mine and along trend from three other +1Moz gold deposits in WKP, Golden Cross and New Talisman Gold’s Karangahake.

One of the three main prospects, Jubilee, has historical production of 260,000oz of gold and silver and is believed to be a potential extension of Karangahake,

Recent rock chip sampling has shown grades as high as 18.4g/t gold while early field mapping revealed a much broader area of post-mineral welded ignimbrite than previously recognised, something earlier explorers hadn’t fully understood.

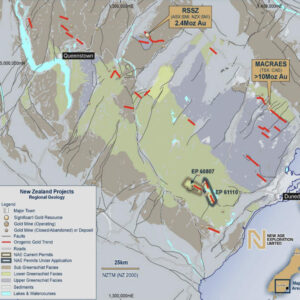

Other projects include the 1104 hectare Lottin project east of Rotorua on the North Island, a potential VMS system considered similar in style to Australia’s Golden Grove and Rosebery, along with the Roaring Meg, Oturehua and Invincible gold projects, all near Macraes and RAS on New Zealand’s South Island.

Invincible is also known to boast tungsten, which like gold sits on NZ’s critical minerals list.

Other ASX players

While Uvre is now a significant player in New Zealand, it is still a relative newcomer to the country.

New Age Exploration (ASX:NAE) operates the 265km2 Lammerlaw gold and antimony project in Otago that’s believed to host Macraes-style mineralisation with 1km gold anomalies, bearing similarities to the gold mine which has produced more than 5Moz since opening in 1990.

Lammerlaw also contains the historically mined Bella Lode, where gold was mined during the late 1800s with an average grade of 15g/t before the mine closed in 1901.

Previous antimony-targeted exploration has also revealed three mineralised trends with rock chip samples of >30% antimony.

The company’s belief in Lammerlaw having Macraes-style mineralisation received a shot in the arm after its phase 1 drilling intersected mineralisation textures, pathfinder geochemistry and host rock type that’s all consistent with early-stage Macraes-style mineralisation.

Of the five holes drilled, four returned gold mineralisation with a top result of 2m at 1.05g/t along with elevated tungsten of up to 1750ppm, up to 680ppm arsenic and antimony.

Company executive director Joshua Wellischs said the company would now seek to build on these results by targeting potential higher-grade shoots and drill towards a maiden resource.

Also engaged in the gold game on the South Island is Siren Gold (ASX:SNG) , which is advancing the Sams Creek project – a gold mineralised porphyry dyke that is up to 50m thick, extends for 7km along strike and has a vertical extent of at least 1km.

Sams Creek has a resource of 953,000oz at an average grade of 2.4g/t that is contained within the Main Zone fold, one of several gentle northeast plunging folds the Sams Creek Dyke has been folded into.

To date, 21,500m of drilling has been completed on the project with 90% focused on the Main Zone.

However, similar folds have been interpreted at Riordans, Western Outcrops, Anvil and Barrons Flat along with Doyles and Main Zone extensions.

These have the potential to significantly increase the current resource.

Additional resources discovered in the Main Zone, Doyles, Western Outcrops and Anvil folds could be accessed from the potential Main Zone underground mine and hauled to the proposed SE Traverse processing facility.

Siren expects a decision to be made on its mining permit application by the end of 2025.

It then plans to complete infill drilling on the SE Traverse, Carapace and Main Zone by the end of Q2 2026 so the majority of the inferred resource can be upgraded to the higher confidence indicated category.

This will be followed by updates to the resource and scoping study.

Santana Minerals (ASX:SMI) has been progressing the Rise and Shine deposit within its Bendigo-Ophir project in the Central Otago Goldfields on New Zealand’s South Island.

Recent drilling has extended the high-grade domain (HG1) beyond the March 2025 indicated resource boundary by confirming mineralised continuity to the north and strengthening the case for future reserve growth.

The drilling had targeted down-plunge extensions of Rise and Shine to improve definition of the inferred resource in the northern extent of the deposit with a view to upgrading it to the indicated category for potential inclusion in the mine plan.

Notable results include 31.9m at 5.3g/t gold from 303.1m and 11.1m at 9.6g/t from 296.9m.

Bendigo-Ophir has a contained resource of 2.34Moz at an average grade of 2.1g/t gold with Rise and Shine hosting the bulk of this at 2.08Moz grading 2.4g/t gold.

It benefits from proximity to Queenstown and existing infrastructure including transportation, clean water, green hydropower and low cost power.

At Stockhead, we tell it like it is. While Uvre and New Age Exploration are Stockhead advertisers, they did not sponsor this article.