In 2024, the Swiss crowdfunding market showed signs of stabilization after years of decline.

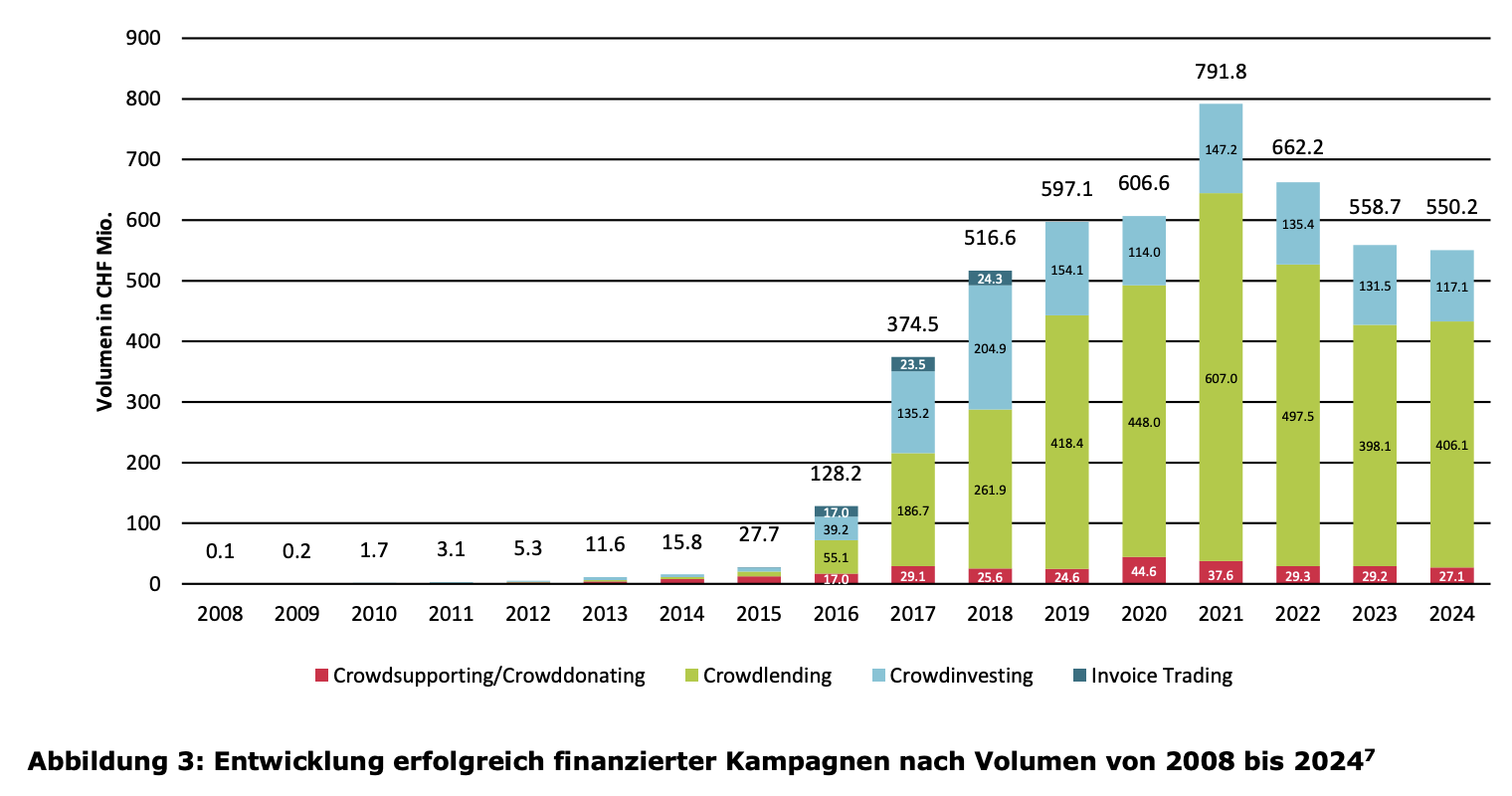

According to a new report by the Lucerne University of Applied Sciences and Arts, the volume of successful funded campaigns on Swiss crowdfunding platforms reached a financing volume of CHF 550.2 million, representing a slight year-over-year (YoY) decline of 1.5%.

This is a marked improvement compared to the sharper drops of 16.4% in 2022 and 15.6% in 2023. The number of successful funding campaigns also decreased slightly by 0.5% to 4,071.

This year’s Crowdfunding Monitor Schweiz report, released in June, reveals that Switzerland is now home to 38 crowdfunding platforms. However, only 23 reported financing activity in 2024. This is the same number as the previous year, further showcasing market stagnation. Last year, three platforms exited the market (GoBeyond, Neocredit, and Yeswefarm), while two new platforms launched (Imvesters, and Solarify).

Despite this stagnation, the report found that more Swiss consumers are participating in crowdfunding. In 2024, around 280,000 people supported at least one crowdfunding campaign, a significant increase fo 40% from 200,000 in 2023, and up 55% from 180,000 in 2019.

Crowdlending drives the market

In 2024, crowdlending remained the backbone of the Swiss crowdfunding market, making up for most of crowdfunding activity. Crowdlending was also the only segment to record YoY growth in lending volume.

Crowdlending campaigns, where numerous investors lend money to individuals or institutions, secured a total of CHF 406.1 million in 2024, a 2% YoY increase. These loans were issued through eight platforms, among which Swisspeers, Cashare, and Lend/Splendit. Crowdlending accounted for more than three-quarters of the total crowdfunding volume.

Within crowdlending, the business segment totaled CHF 133.6 million, growing only marginally by 0.6% compared to 2023. These loans were mainly used for project financing, debt restructuring, and short-term liquidity needs.

Consumer crowdlending grew more dynamically, with loans to private individuals rising 19.1% YoY to CHF 73.1 million. These loans were mainly used for debt consolidation, education, vehicle purchases, travel, or weddings.

In contrast, real estate crowdlending declined, falling 2.2% YoY to CHF 199.4 million.

Despite growth, crowdlending remains a niche market, accounting for only a tiny share of the overall lending market. In 2024, Swiss consumers took out 116,716 new loans totaling approximately CHF 4.2 billion. Of these, only 1,641 loans (or 1.4%) were done through crowdlending.

Similarly, the Swiss mortgage market sees CHF 150 to 180 billion in new or renewed loans annually. This makes the CHF 199.4 million financed through crowdlending platform negligible by comparison.

The same applies to business lending, where banks hold CHF 402.9 billion in business loans on their balance sheets, dwarfing the CHF 133.6 million facilitated through business crowdlending platforms in 2024.

Real estate dominates crowdinvesting

Equity-based crowdfunding, or crowdinvesting, where investors acquire company shares, remained prominent in the Swiss crowdfunding landscape. In 2024, a total of 78 successful crowdinvesting campaigns were completed, up from 55 in 2023. However, the total volume declined by 10.9% YoY to CHF 117.1 million.

Within the segment, real estate continued to lead, accounting for CHF 99.5 million, or a staggering 85% of the crowdinvesting market.

Most of this volume came from Crowdhouse, Conda, and Foxstone, the three prominent crowdinvesting platforms in Switzerland. Minimum investment amounts typically start at several tens of thousands of CHF, with the average investment per investor at about CHF 75,000 in 2024.

Globally, crowdfunding has become an established and reliable way for businesses and consumers to secure funding. North America currently leads that market, with digital capital raising volumes reaching US$36 billion in 2023, according to German data platform Statista. Europe follows with nearly US$10 billion, driven primarily by crowdlending activities.

Within Europe, the UK is the largest hub for digital capital raising, followed by Germany and Italy. The UK and Germany also lead in platform density, with each hosting over 100 active crowdfunding platforms in 2023.

However, as in Switzerland, many of these platforms hold only a small share of the overall lending market and operate with a relatively limited base of backers. Many reported fewer than 500 active investors in 2022.

Featured image: Edited by Fintech News Switzerland, based on image by smmedia.io via Freepik