Gold takes centre stage….again. Pic: Getty Images

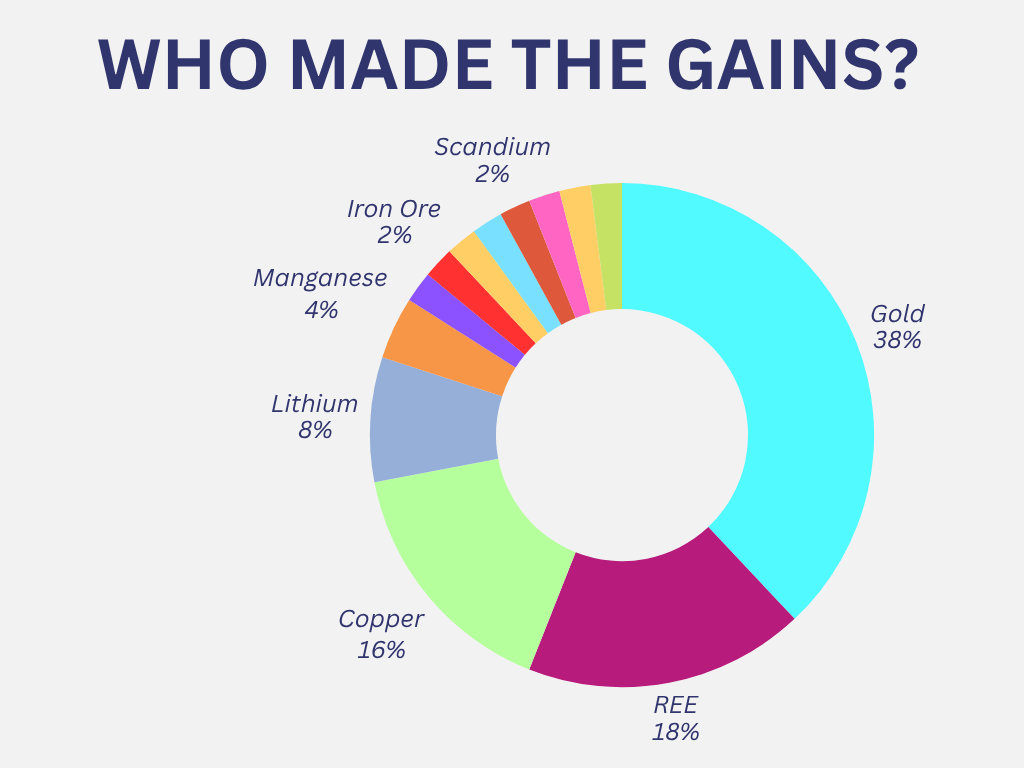

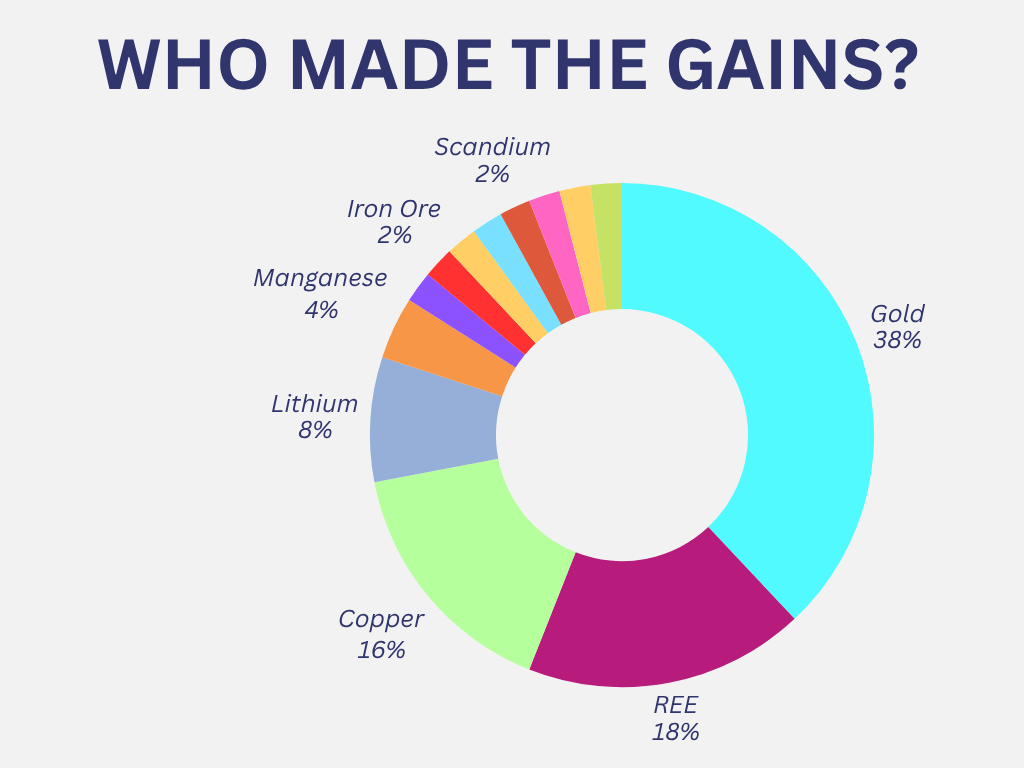

- Top commodities for July include gold and manganese

- Santa Fe Minerals takes top spot for the biggest monthly stock gain

- Falcon Metals and Black Canyon Resources also make the podium

Gold, copper and rare earths stocks stole the resources spotlight in June with the biggest individual gainer being Santa Fe Minerals (ASX:SFM), up a whopping 739%.

This is thanks to the precious metal player announcing it acquired the Eburnea gold project in Cote d’Ivoire from Turaco Gold (ASX:TCG) last month.

TCG is now a $520 million explorer thanks to its bet on the land of Didier Drogba and Yaya Toure (Kolo as well), which has emerged as the premier jurisdiction for new entrants into West Africa after military coups in Mali and Burkina Faso.

SFM will be itching to follow in the footsteps of Eburnea’s vendor Turaco, having plenty of work on its hands at the 3.55Moz Afema gold project.

Historic drilling includes 26m at 4.82g/t and 30m at 1.92g/t at different points along a 2km mineralised zone in the Satama permit.

SFM, which is raising $1.2m at 5c per share, is also picking up a 65% share in the Bouake North application, 35km from Endeavour Mining’s 3Moz Lafigue gold mine.

Stay tuned to see if the company could follow a similar trajectory to Many Peaks Minerals (ASX:MPK), which has had similar success at Ferke project.

Not to mention, gold is still sitting pretty high at US$3348.90 at the time of writing – giving explorers a nice confidence boost.

Plus gold prices are tipped to go even higher by Canadian global asset manager Fidelity who believe the precious metal could be testing the US$4000/oz mark by the end of this year.

This scenario could play out if the Federal Reserve begins to cut rates and the US dollar continues to decline.

For ASX gold players, though, what’s important is that gold soared in the first four months of this year and has remained elevated within a relatively narrow band since then, a point that has proven beneficial to the bottom lines of the producers while giving certainty to the explorers.

Gold in second, manganese in third

Precious metals explorer Falcon Metals (ASX:FAL) was up a respectable 216% for the month, after making a high-grade gold discovery late last week from the Blue Moon prospect on the outskirts of the Bendigo gold zone.

The Bendigo region has delivered 22Moz of gold since the gold rush, including 5.2Moz at 15g/t from the Garden Gully Anticline.

Mark Bennett chaired Falcon thinks Blue Moon is sitting to the north of that trend on the Eastern Limb of the anticline, with visual gold and a deep hit of 1m at 543g/t from 544.2m.

And finally, Black Canyon (ASX:BCA) saw a 169% jump last month after a high-grade manganese discovery at the Wandanya project piquing the interest of fund managers like Lowell Resources Fund (ASX:LRT) chief investment officer John Forwood.

Forwood says Wandanya has some similarities to Woodie Woodie, which sits just 80km to the north.

But it has some key differences. One of those is the high strip ratio the vintage Woodie Woodie mine now operates at.

“Whereas Wandanya in the grade could be similar, the strip ratio is almost definitely going to be very low. It could be less than five to one, so mining costs should be pretty attractive,” he told Stockhead.

Grades from drilling at Wandanya have clocked in at between 29-31% Mn, well above those seen in the Balfour field.

There’s also a high grade hematite iron ore zone sitting above the manganese horizon, with Hole WDRC057 from the most recent RC drill program there striking an intersection of 12m at 60.1% Fe from 5m including 7m at 64.2% Fe from 7m.

BCA said the results supported the logging of high-grade iron mineralisation over hundreds of metres of strike, remaining open to the north.

“It could have some pretty attractive economics, particularly as it looks like there is a high-grade iron ore zone which might fall partly within the same pit as the high-grade manganese zone,” Forwood said.

“Your waste-stripping ratio comes right down if some of that non-manganese material is actually high-grade iron ore and you might end up with an extremely low operating cost after byproduct credits.”

Most popular commodities in July:

Here are the top 50 ASX resources stocks for the month of July

| Code | Company | Price | % Month | Market Cap |

|---|---|---|---|---|

| SFM | Santa Fe Minerals | 0.26 | 739% | $18,932,885 |

| FAL | Falcon Metals | 0.49 | 216% | $87,003,080 |

| BCA | Black Canyon Limited | 0.3225 | 169% | $42,883,795 |

| ASN | Anson Resources Ltd | 0.12 | 161% | $166,408,385 |

| ALR | Altair Minerals | 0.005 | 150% | $21,483,721 |

| PLG | Pearl Gull Iron | 0.015 | 150% | $3,068,127 |

| DY6 | DY6 Metals | 0.26 | 136% | $23,759,499 |

| VMM | Viridis Mining | 1.11 | 136% | $95,704,572 |

| PEC | Perpetual Resources | 0.027 | 125% | $23,577,162 |

| CMG | Critical Mineral Group | 0.18 | 125% | $16,297,985 |

| CUF | Cufe Ltd | 0.011 | 120% | $14,812,324 |

| G50 | G50 Corp Ltd | 0.29 | 115% | $46,573,321 |

| I88 | Infini Resources Ltd | 0.17 | 105% | $8,902,903 |

| AS2 | Askari Metalsl | 0.011 | 100% | $4,445,878 |

| QXR | Qx Resources Limited | 0.004 | 100% | $5,241,315 |

| AOA | Ausmon Resorces | 0.002 | 100% | $2,622,427 |

| CR9 | Corellares | 0.004 | 100% | $4,029,079 |

| PUA | Peak Minerals Ltd | 0.063 | 97% | $183,161,241 |

| EVG | Evion Group NL | 0.033 | 94% | $14,352,359 |

| AUG | Augustus Minerals | 0.042 | 91% | $7,137,750 |

| BHM | Broken Hill Mines | 0.4 | 90% | $43,037,158 |

| BDG | Black Dragon Gold | 0.086 | 87% | $27,345,081 |

| LAT | Latitude 66 Limited | 0.043 | 87% | $6,166,230 |

| RRR | Revolver Resources | 0.057 | 84% | $15,747,633 |

| PGD | Peregrine Gold | 0.275 | 83% | $23,333,129 |

| PFE | Pantera Lithium | 0.02 | 82% | $9,475,674 |

| FRS | Forrestania Resources | 0.145 | 81% | $45,098,252 |

| AR3 | Austrare | 0.092 | 77% | $19,538,420 |

| LRD | Lord Resources | 0.03 | 76% | $4,650,061 |

| FRB | Firebird Metals | 0.13 | 73% | $18,506,982 |

| LSR | Lodestar Minerals | 0.019 | 73% | $7,554,219 |

| BMM | Bayan Mining and Minerals | 0.06 | 71% | $6,552,324 |

| SVY | Stavely Minerals Ltd | 0.017 | 70% | $9,248,716 |

| GBE | Globe Metals &Mining | 0.044 | 69% | $30,564,732 |

| KCC | Kincora Copper | 0.067 | 68% | $15,756,731 |

| ALB | Albion Resources | 0.092 | 67% | $12,137,867 |

| PXX | Polarx Limited | 0.01 | 67% | $23,755,010 |

| CRR | Critical Resources | 0.005 | 67% | $13,850,427 |

| CZN | Corazon Ltd | 0.0025 | 67% | $2,961,431 |

| ODY | Odyssey Gold Ltd | 0.03 | 67% | $33,125,801 |

| IXR | Ionic Rare Earths | 0.02 | 67% | $112,707,150 |

| LLM | Loyal Metals Ltd | 0.215 | 65% | $22,227,359 |

| MEG | Megado Minerals Ltd | 0.038 | 65% | $24,535,964 |

| JAL | Jameson Resources | 0.084 | 65% | $59,564,847 |

| AM7 | Arcadia Minerals | 0.028 | 65% | $3,286,736 |

| AGY | Argosy Minerals Ltd | 0.028 | 65% | $43,005,786 |

| LMG | Latrobe Magnesium | 0.014 | 65% | $36,844,806 |

| BPM | BPM Minerals | 0.041 | 64% | $3,579,313 |

| PVW | PVW Res Ltd | 0.018 | 64% | $3,580,286 |

| SRL | Sunrise | 1.31 | 63% | $153,199,733 |

WordPress Table

Small cap standouts

Last month the company shipped two tonnes of lithium-rich Green River brine to POSCO in South Korea as part of due diligence for a planned demonstration plant.

The brine, which is iron-free and processed using a non-chemical method, will be tested for lithium extraction efficiency to help shape initial engineering and cost estimates.

Results will be used by POSCO to prepare initial engineering design and cost estimates for the planned demonstration plant to be built at the Green River project in the US.

This testwork is a part of the due diligence process POSCO is undertaking to determine an investment into a demonstration plant at Green River which is expected to be completed by December 2025 as outlined in the non-binding MoU signed between the companies.

This bulk sample includes iron-free brine produced by Anson’s unique chemical-free process. The pretreatment process to reduce iron prior to being fed into the DLE processing was developed at Anson’s Lithium Innovation Center in the USA.

The planned demonstration plant is a scaled-up version of a pilot plant to validate a new industrial process at a larger, commercially relevant scale before full-scale construction.

This demonstration plant will operate on a continuous process basis to closely resemble that of the anticipated future commercial plant as well as generating significant quantities of lithium carbonate product.

The company has applied for three more exploration licences that would increase its landholding at the Central Rutile project in Cameroon to a massive 5901sqkm.

Notably, the Biyan licence is next to the Nganda and Bounde permits where DY6 recently reported both visible HM mineralisation as well as large (2-4cm) rutile nuggets within residual regolith samples.

The Nlong licence is immediately west of the Alamba and Nsimbo permits, which are seen as along trend from recently reported high-grade results from Peak Minerals’ Afanloum licence.

And the Ayene licence is to the southwest of the recently acquired Weaver group of licences.

“DY6 has been able to move quickly in securing additional ground in what we continue to see as an emerging globally significant rutile province,” CEO Cliff Fitzhenry said.

“The recently announced systematic soil sampling program will be expanded to include the new licence applications.

“We are keen to further expand our footprint at the Central Rutile project where we see the right ingredients for prospective residual natural rutile deposits, being correct underlying geology, a deep in-situ weathering profile and strategically located.”

Last month VMM signed a landmark binding Memorandum of Understanding (MOU) with two of Brazil’s foremost asset management firms, ORE Investments and Régia Capital, securing up to US$30 million (A$46m) in non-brokered private share placement funding for the rapid development of its flagship Colossus rare earth project in Brazil.

The partnership establishes a flexible, milestone-based funding structure to support the company through Final Investment Decision and into the initial phase of project execution.

MD Rafael Moreno said the MOU significantly de-risked the pathway to production, “while designed to provide funding flexibility to accelerate progress”.

“Importantly, the structure allows Viridis to retain full optionality around additional funding sources,” he said.

“The involvement of ORE and Régia brings more than just capital. Both firms are deeply embedded within the Brazilian investment and mining landscape and bring significant strategic value in navigating regulatory frameworks, managing local stakeholder engagement, and unlocking logistical and operational synergies.

“Their endorsement validates the technical and economic fundamentals of the Colossus project, and their local insight and financial networks will be instrumental in accelerating the permitting, project financing, infrastructure buildout, and development stages of the project.”

At Stockhead we tell it like it is. While Anson Resources and DY6 Metals are Stockhead advertisers, they did not sponsor this article.