Right now, lots of shares are beating these modest expectations. Hence why shares are jumping after their results come out. This is great. It means two things: There is likely more left in this bull run and there are lots of opportunities for stock picking How can we be sure (within reason)?

It was a big old green day on the ASX yesterday. Stocks leapt at the open…and stayed strong all day.

Suddenly we have a hot market on our hands.

Anyone who bought the dip back in April has had the chance to make some serious coin.

Let’s put this action in a broader context…

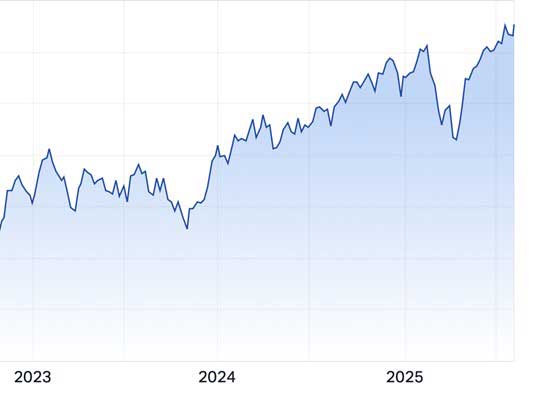

I stuck my stake in the ground in late 2023, calling for a new bull run on the ASX.

This is what the market has done since…

|

|

|

Source: Market Index. |

I described a regular bull market pattern that should break down into three stages over this likely time frame…

BULL MARKET STAGE 1: Reviving Confidence ← [2023-2024: Complete ✓]

BULL MARKET STAGE 2: Increasing Earnings ← [2025-2026: We Are Here]

BULL MARKET STAGE 3: Wild Speculation ← [2027-2028: Coming Next!]

Let’s narrow down to Stage 2: increasing earnings.

Is this what we’re seeing?

Here’s a few examples from the earnings announcement coming out so far…

ResMed ($RMD) said net profit rose 37%.

Pinnacle Investment Management ($PNI) said yesterday net profit is up 48%.

Credit Corp ($CCP) announced yesterday that profit is up over 80%.

All 3 share prices responded positively, too. The market is happy with the outlook on all of them.

Keep an eye on your daily news feed for more.

Remember, it was only back in May that I wrote here that ‘the vibe of market strategists is down and gloomy’.

I added…

“We can’t just ignore why they think like this right now. They think ASX companies are going to make less money in the upcoming 12 months.”

Right now, lots of shares are beating these modest expectations.

Hence why shares are jumping after their results come out.

This is great. It means two things:

- There is likely more left in this bull run

- There are lots of opportunities for stock picking

How can we be sure (within reason)?

Let’s look at the current market signals.

We have…

Advertisement:

REVEALED:

Australia’s 60-Cent

‘Secret Weapon’

It’s a tiny ASX stock that could hand the United States, NATO, and its allies a key advantage in case another major conflict breaks out.

That could make this stock very valuable and potentially profitable for investors over the coming months.

Get the full story here.

✓ Low Volatility: Market volatility is benign, creating a good environment for momentum strategies, and a high weighting to shares.

✓ Sector Rotation: Capital can and will move from richly valued large caps to undervalued small and mid caps

✓ Earnings Growth: Companies are starting to make money again after three tough years

✓ Rate Cut Cycle: Lower interest rates make it easier for companies to raise capital and grow

✓ Takeover Activity: Bigger companies and private equity are stepping in to take advantage of low valuations

✓ IPOs Returning: More companies come to market as confidence and risk taking return

✓ House Prices Strong: A strong residential property market gives investors confidence to act

All in all, the market is right where we want it to be.

Now, granted, as per yesterday, we have to be conscious that there are always risks lurking in the background.

Trump always does his best to throw us a bout of volatility from time to time.

Overall, though, keep this chart from Charlie Bilello in mind too…

This shows all the market scares since 1990. I’ve been at Fat Tail since 2012 and for a good chunk of these.

Look at what US stocks have done over the same time frame. Pretty darn impressive.

Of course, a general index will rise because it drops the losers and keeps the winners.

You or I might pick a few duds along the way too. That’s why the results period we’re in now is so instructive.

If a share price really tanks now, you’re probably holding a stinker, and can probably dump it for better prospects.

There are too many strong possibilities to waste time with something going nowhere.

Now’s the time to be making the best of what the market is offering.

As per our gameplan above, at some point a ‘Stage 3’ phase will go over the top, and it will be a time to harvest what you sow now.

Callum Newman,

Small-Cap Systems and Australian Small-Cap Investigator

***

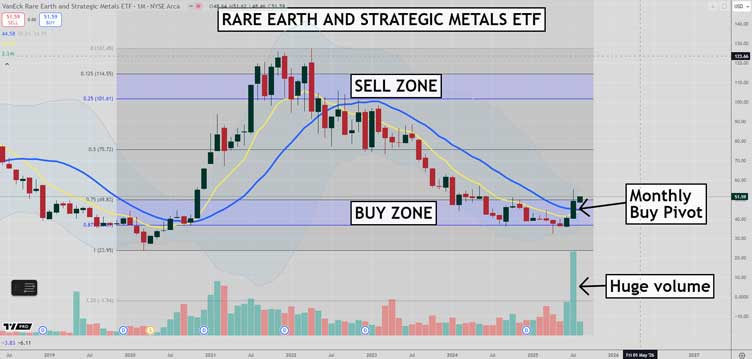

Source: Tradingview

[Click to open in a new window]

The strategic metals sector continues to heat up with the Australian government coming out with an announcement that they are willing to create a floor price for rare earths.

That is after the US announced the same policy recently after their investment in MP Materials Corp. [NYSE:MP].

The technical set up in the Rare Earth and Strategic Metals ETF [NYSE:REMX] is now complete and flashing green.

The chart of REMX above shows a monthly buy pivot confirmed in the buy zone of the huge rally that occurred between 2020-2022.

The uplift in volume on the buy pivot was immense as a result of the changes in government policy.

The future is always uncertain. But the notable changes in government policy combined with the strong technical set up is enough for me to put a stake in the ground and say the worst is over for rare earths and the upside is substantial.

Regards,

Murray Dawes,

Retirement Trader

All advice is general advice and has not taken into account your personal circumstances.

Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

Callum Newman is a real student of the markets. He’s been studying, writing about, and investing for more than 15 years. Between 2014 and 2016, he was mentored by the preeminent economist and author Phillip J Anderson. In 2015, he created The Newman Show Podcast, tapping into his network of contacts, including investing legend Jim Rogers, plus best-selling authors Jim Rickards, George Friedman, and Richard Maybury. He also launched Money Morning Trader, the popular service profiling the hottest stocks on the ASX each trading day.

Today, he helms the ultra-fast-paced stock trading service Small-Cap Systems and small-cap advisory Australian Small-Cap Investigator.